[ad_1]

Remember the time when a single misplaced receipt could derail the entire expense reporting process in a company? Well, those days are long gone. In today’s lightning-fast business world, the efficiency of expense management isn’t just a nice-to-have, it’s a must-have for a thriving company. Streamlined expense approvals are not just about speed; they’re about smart business.

In this blog, we’ll dive deep into the world of expense approvals. We’ll take you through the knotty challenges of traditional expense approval processes and unfold how embracing efficiency can be a game-changer for your financial management. We will ultimately explore strategies to streamline your expense approvals and drive your company’s growth.

The Importance of Efficient Expense Approvals

Imagine a typical expense approval process: piles of receipts, endless back-and-forth emails, and a whole lot of waiting.

The traditional methods are often riddled with inefficiencies:

- lost documents

- delayed approvals

- lack of visibility into spending

This sluggish process isn’t just frustrating; it’s costing businesses more than just time. It leads to delayed reimbursements, unhappy employees, and worst of all, a lack of control over company spending.

Streamlining for Success

Now, let’s switch gears to a streamlined expense approval process. Here, efficiency is king. Fast and efficient expense approvals mean real-time tracking, quick reimbursements, and happy employees. But it’s more than just happy faces; it’s about the bottom line. Efficient expense approvals give you a clear view of your company’s spending patterns, helping you make informed decisions. You know where every dollar is going, enabling better budget management and financial planning. In turn, this contributes to the overall growth of the company, turning the cogs of the business wheel faster and more effectively.

Case Study on Expense Approval Automation

Let’s explore a real life example.

A case study on the benefits of automating expense reporting comes from the auto retail store and workshop chain, ATU. They faced significant challenges in their financial workflows due to reliance on cash payments and manual reconciliation processes. This system was inefficient, especially given ATU’s large scale, with over 500 branches and numerous external purchases requiring extensive paperwork.

ATU’s CFO, Sebastian Jarankowski, highlighted the inefficiencies in their old system, where they had to transport paper invoices across Germany, causing massive paperwork and management difficulties. The turning point for ATU was the adoption of Payhawk’s expense management software, which revolutionized their financial operations.

The implementation of Payhawk’s solution provided ATU with complete visibility of company spending and allowed the firm to leverage built-in spend controls and automated multi-step approvals. This transformation enabled ATU to make more informed spending decisions, reduce the resources allocated to manual tasks significantly, and achieve substantial savings through VAT reclaims.

A notable outcome of this digital transformation was the elimination of the need to chase paper receipts. As stated by Mathias Goetz, Senior Project Manager at ATU, the new process required managers to simply take a picture of their receipts and upload them into the automated finance system. This change led to an impressive recovery of €2 million from the tax office in the first year alone, a significant financial benefit that would have been lost under their previous system.

Read the full case study report below.

ATU improves payment reconciliation and saves +2m | Payhawk

From driving trucks full of paper invoices to going fully digital. Learn how Germany’s number one auto retail company went cashless and saved +2m in payment reconciliations.

Key Strategies for Streamlining Expense Approvals

We’ll now explore on how to set up and automate your expense approval prcoess from scratch. Let’s get started now.

1. Prioritizing Transparency and Accountability

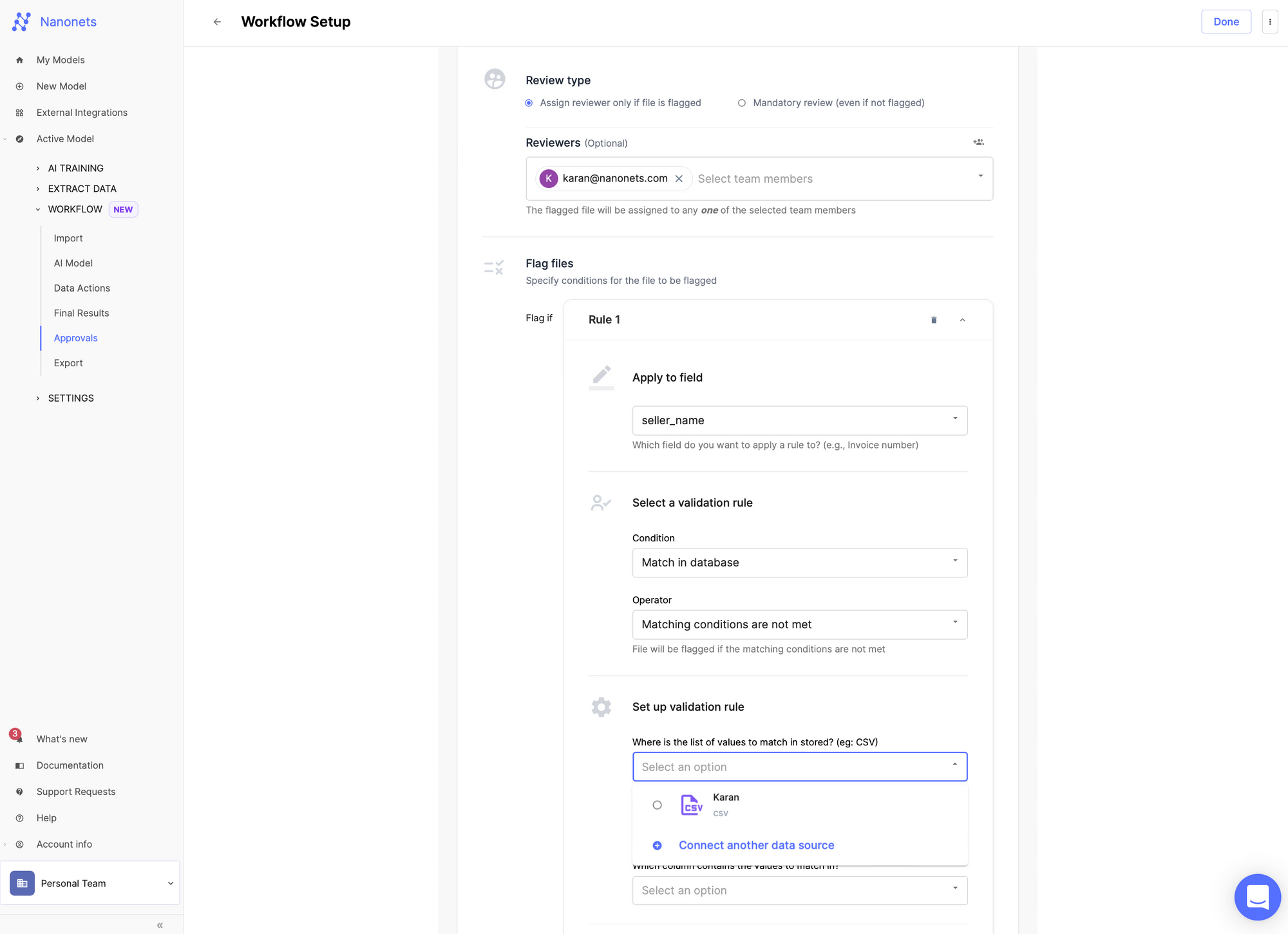

Every transaction, every approval, should be clear as day. To achieve this, establish a system where approvals and denials are not just communicated but explained. Encourage a culture where questioning expenses isn’t taboo but a sign of good governance. Choose a platform where approvals are tracked and visible to relevant parties, so there’s a clear audit trail. This level of transparency ultimately fosters accountability.

2. Creating the Expense Policy

Think of your company’s expense policy like the rulebook of a sport. If the rules aren’t clear, the game turns into chaos. A well-drafted, comprehensive expense policy is your first line of defense against misuse and confusion. Start by defining what’s reimbursable and what’s not. Be as clear as crystal – if a pair of sneakers doesn’t count as a business expense, say it. Use plain language, not legalese, so everyone from your tech team to your sales force understands it. And communication? Don’t just email it and forget it. Have regular discussions, workshops, and reminders about these policies. Make understanding the expense policy as common as morning coffee in your office.

You can browse through the article below to get started with creating a expense policy suited for your needs.

Crafting an effective company expense policy

Crafting an effective company expense policy is crucial for the growth of any business. Learn how to create a policy today.

3. Choose Software for Expense Approval Automation

Let’s dive into the world of expense automation and explore available solutions. Imagine each of these potential solutions as a superhero in the universe of finance management, each with its unique powers to transform your expense reporting from a headache into a breeze.

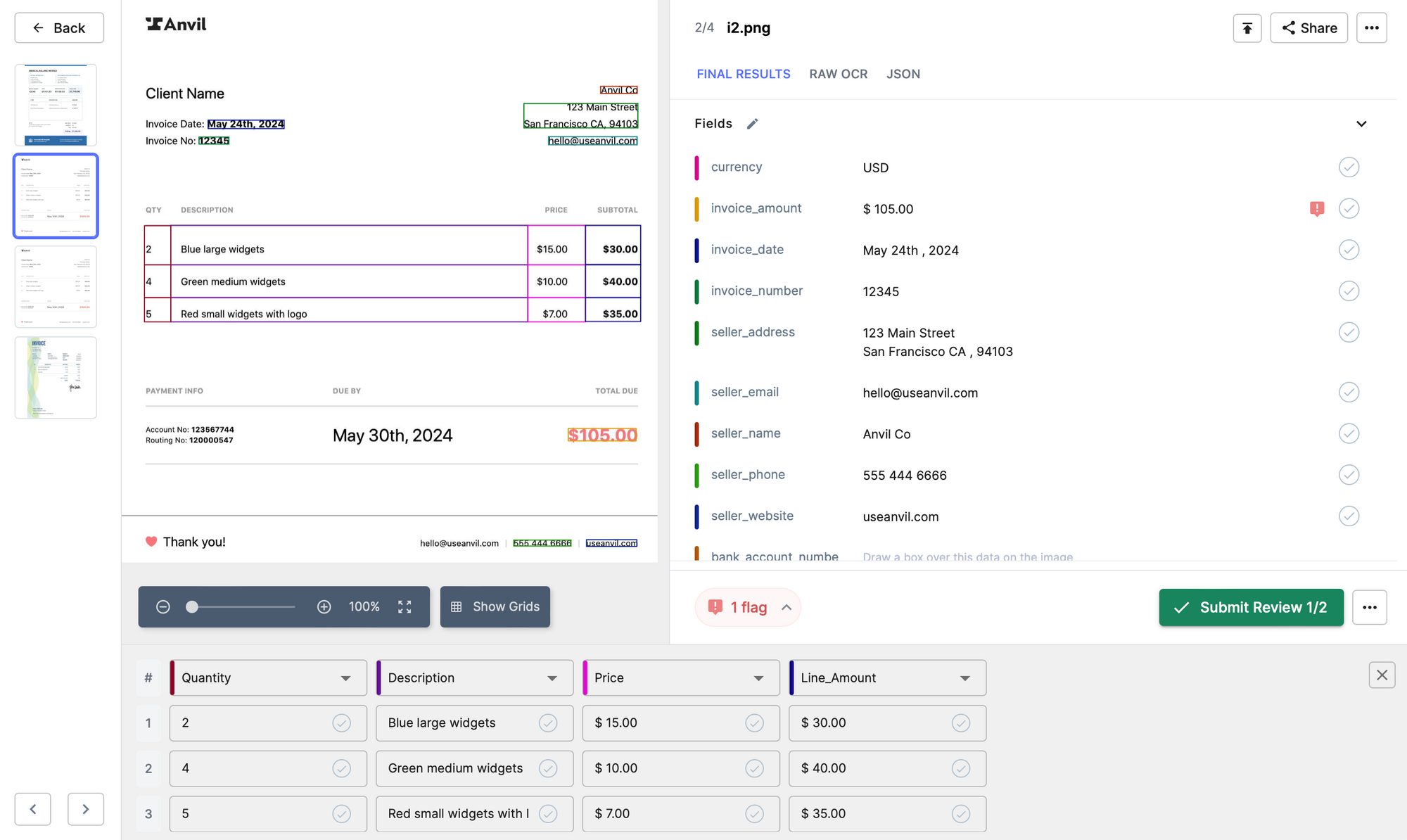

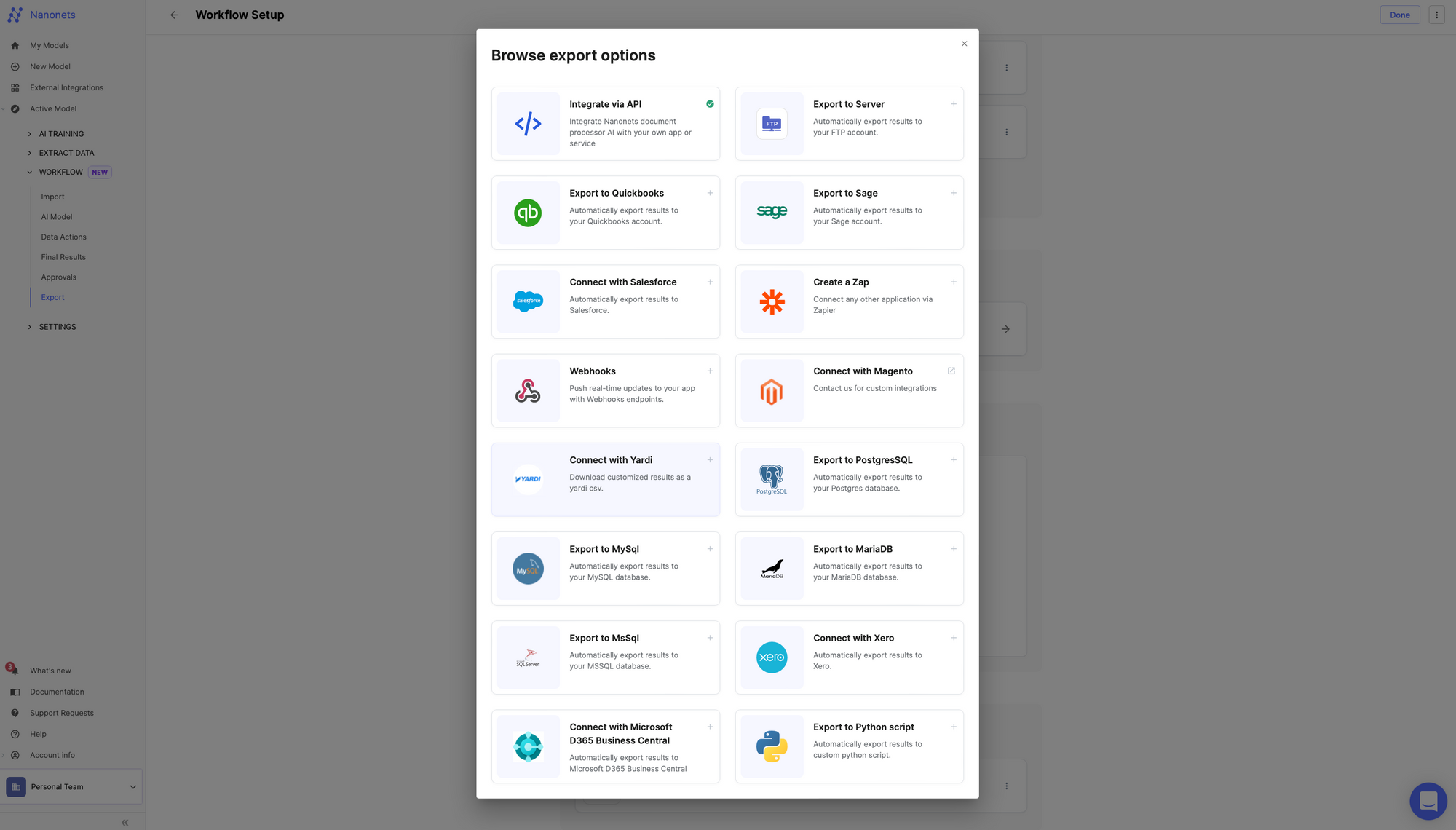

- Nanonets: Nanonets is the tech-savvy whiz kid on the block. With its cutting-edge OCR technology and AI-driven processes, Nanonets takes the pain out of expense management. With its intuitive user interface, seamless integration with various accounting software, and policy compliance monitoring, Nanonets stands out as a holistic solution. It’s like having a dedicated financial assistant who’s mastered every trick in the book – from receipt tracking to sophisticated spend analysis.

- Expensify: Think of Expensify as the cool, intuitive friend who knows exactly what you need. Its user-friendly interface makes tracking receipts and managing reimbursements feel like a walk in the park. With compatibility with various accounting software, Expensify doesn’t just play well with others; it enhances the whole team’s game.

- Zoho Expense: Zoho Expense is like the multitasking genius of the group. As part of Zoho’s extensive suite, it brings automated expense recording to the table, ensuring policy compliance is a breeze. Its seamless integration with accounting software is like having a translator who speaks every financial language fluently.

- QuickBooks Online: Imagine QuickBooks Online as the seasoned all-rounder. It’s not just about robust accounting; it’s about bringing expense tracking into the fold. With QuickBooks, you’re not just managing expenses; you’re consolidating your entire financial universe in one place. It’s like having your cake and eating it too.

- Spendesk: Spendesk is the modern, control-freak (in a good way) of expense management. It offers a comprehensive spending solution that puts control, visibility, and automation right in the palm of your hand. From company cards to unexpected payments, Spendesk has it covered. It’s like having a financial Swiss Army knife at your disposal.

Each of these solutions brings something unique to the table, transforming the daunting task of expense management into something more manageable, more streamlined, and dare I say, more enjoyable. It’s not just about keeping track of expenses; it’s about embracing a smarter way of working based on choosing a solution which aptly caters to your needs.

Expense Approval Workflow

Let’s roll back the clock and look at the traditional, manual expense approval workflow, reminiscent of the days when everything was done by hand.

- Gathering Receipts: Employees collect paper receipts for every expense – from taxi rides to client dinners. It’s like keeping a scrapbook, but less fun and more tedious.

- Filling Out Expense Reports: Next, they fill out expense reports by hand or in a spreadsheet. It’s time-consuming, like doing your taxes every month.

- Submission for Approval: These reports, stacked with receipts, are then submitted to the manager or finance team – often in a physical folder that gets passed around like a hot potato.

- Manager Review: The manager reviews each report, scrutinizing every line item. It’s like detective work, but with more numbers and less excitement.

- Queries and Clarifications: If there are queries, it’s back to the employee for clarifications. This back-and-forth can feel like a never-ending game of ping-pong.

- Final Approval and Reimbursement: Once approved, the report goes to the finance team for reimbursement processing. This could take days or weeks, depending on the queue.

- Archiving and Record-Keeping: Finally, all these documents are filed away for record-keeping, taking up physical space and making retrieval a hassle.

Streamlined Workflow with Nanonets: The Modern Approach

Now, let’s fast-forward to today and reimagine this workflow with Nanonets, turning a cumbersome process into a streamlined, efficient operation.

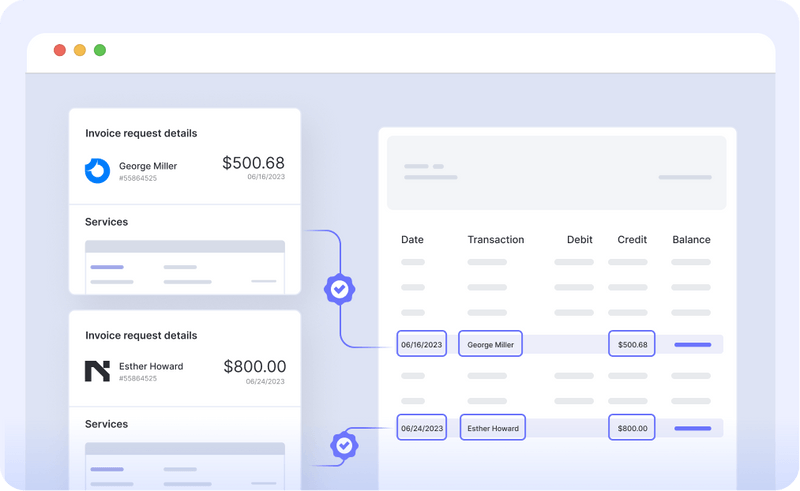

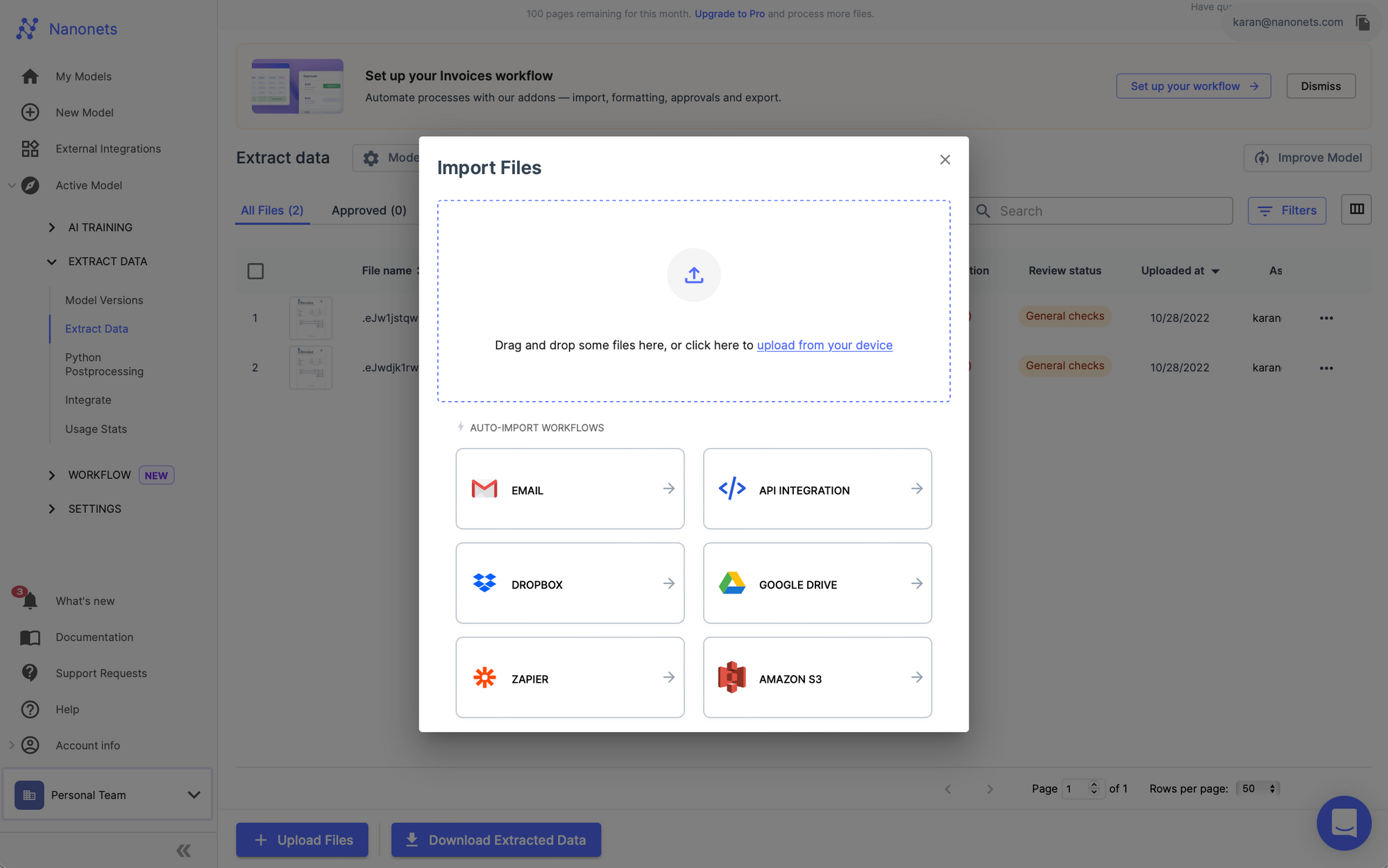

- Automated Receipt Capture: Employees snap photos of their receipts. Nanonets’ OCR technology instantly captures and digitizes the data. No more hoarding paper!

- Effortless Expense Report Generation: The system automatically populates expense reports using the captured data, and exports it into your software of choice. It’s like magic, with the numbers appearing where they should, all neat and tidy.

- Electronic Submission and Notification: Employees submit reports electronically from their medium of choice. Managers receive instant notifications, moving the process along at the speed of an email.

- Quick Manager Review with AI Assistance: Managers review reports more efficiently, aided by AI that flags anomalies or policy violations. It’s less of a treasure hunt and more of a quick scan.

- Reduced Queries and Real-Time Clarifications: With clearer data and digital records, queries are reduced. Any needed clarifications are handled swiftly through the system, cutting down the back-and-forth dramatically.

- Speedy Approval and Automated Reimbursement: Once approved, the system interfaces with payment systems for rapid reimbursement. Employees get their money back faster, and everyone’s happier for it.

- Digital Archiving and Easy Retrieval: All records are stored digitally, making archiving a breeze and retrieval as easy as a Google search. No more digging through filing cabinets!

By implementing Nanonets, companies transform their expense approval workflow from a slow, manual process into a fast, automated, and nearly effortless system. It’s not just about keeping up with the times; it’s about propelling your business into a future where efficiency is the norm and productivity soars.

Overcoming Common Challenges

Breaking the Ice

Change, especially in an established organization, can be as challenging as teaching an old dog new tricks. But it’s not impossible. When introducing new expense approval processes or technologies, expect resistance. To ease this, involve your team in the selection and implementation process. Make them feel like they’re part of the change, not victims of it. Provide ample training and show them the benefits – not just for the company, but for them as well. A little empathy and a lot of communication go a long way in transforming skeptics into advocates.

Speed vs. Compliance

In the race to streamline expense approvals, compliance is the track you must stick to. Balancing speed with compliance is like walking a tightrope. On one hand, you want to make the process faster; on the other, you can’t afford to cut corners legally. The key is to set up systems that are not only efficient but also inherently compliant. Use technology that keeps an eye on regulatory updates and integrates them into the process. Conduct regular audits and keep your team trained on compliance matters. It’s not just about going fast; it’s about going far, without tripping over regulations.

Implementing these strategies will not only streamline your expense approval process but also build a culture of efficiency and accountability. It’s a journey, but with the right approach, it’s a journey that can transform the financial backbone of your company.

Conclusion

So there we have it, a whirlwind tour through the dynamic world of expense management. We’ve seen the clunky, time-consuming methods of yesterday and how they stack up against the sleek, efficient processes of today. It’s like comparing a horse-drawn carriage to a sports car – both get you where you need to go, but one does it with so much more style and speed.

We delved into real-life transformations, like ATU’s journey from a paper-laden past to a digitized, streamlined future, recovering a staggering €2 million in the process. It’s stories like these that show us the tangible impact of embracing modern expense management solutions.

Our exploration of top solutions in the market, from the tech-savvy Nanonets to the intuitive Expensify, the versatile Zoho Expense, the all-encompassing QuickBooks Online, and the control-centric Spendesk, highlighted the varied flavors of innovation available to us. Each solution brings its unique flair to the table, but it’s hard to ignore the comprehensive charm of Nanonets, subtly combining the best of all worlds.

As we’ve journeyed from the labyrinth of traditional methods to the streamlined pathways carved out by modern technology, it’s clear that the future of expense management is not just about doing things faster. It’s about doing them smarter, with more transparency, accountability, and efficiency. It’s about empowering our teams, freeing them from the drudgery of manual processes, and giving them the tools to drive our businesses forward.

So, as we wrap up, I invite you to reflect on your current expense management process. Is it a relic of the past, or is it poised to propel you into a productive future? Remember, in the world of business, standing still is not an option. Embrace the change, ride the wave of technological advancement, and let’s steer our companies towards a horizon of efficiency and growth. The future is now, and it’s exhilarating!

[ad_2]

Source link