[ad_1]

Are you concerned about how much money your business spends during the month or the whole year?

Let me start by defining the expense report.

An expense report is made for recording and reporting all the expenses made by the company during the month, quarter, or year. However, this report also includes all the purchases and taxes paid during the period. The expense report helps keep your mind at peace, and you feel relaxed from the expense side by keeping track of all the expenses.

In this short guide, we will inform you of all the expense reports you can make to record all your business expenditures and solve your expense management. Also, we will describe the steps of creating an expense report, types of expense reports, categories of expense reports, and finally see how we can automate expense report generation using automation and artificial intelligence.

What is an expense report?

An expense report contains a categorized and detailed list of costs incurred on behalf of the company.

Expense reports and additional analysis aid the supervisor or financial team in determining what portion of the expense authorizes for repayment, how money is being spent, and what items the company purchases.

An expense report, made on paper or electronically, lists all business costs an employee paid for out of pocket and claimed compensation. These costs are often broken down into mileage, food, and office supplies. Additionally, they itemize to disclose different vendors and their separate charges. The expense report enables more thorough auditing throughout the permitting process than just showing the total expenditures incurred.

What should you include in your expense report?

Being a business report, the expense report consists of various information and inquiries. The details and information are as under:

Information about the Employee

The first to be written in an expense report is the basic information of the employee maintaining the report, like name, contact number, department, etc.

Information about the Client

The next thing to be written is the details of the client who has purchased the product/service and from whom the company buys the item.

Date

Then the date of each expense is to be written. Also, the date of the receipt and expense report should be identical.

Type and Other Details

Another thing an expense report needs is a type of expense and other details about the expenses.

Total and Subtotal Amount

The next thing included in the expense report is the total of every expense and the total expense (including tax that the company pays).

Create professional expense reports with our expense report template!

Benefits of using an Expense Report

An expense report is a fundamental part of every organization as you can easily record the transactions and expenses that happened during the month, quarter, or year. Moreover, generating an expense report can benefit you in the following ways.

Control and Tracking of Expenses

Making an expense report is vital in a business as it helps control costs and track expenses. With the help of expense reports, you can easily track how much you have spent in your company.

Keeps your Budget Accurate

The more accurate your budget is, the easier it will be for you to run your business. The expense report is the most fundamental strategy for preparing your business’s budget. The expense report aids you in preparing an accurate budget for the organization that helps you stay relaxed and run your business promptly.

You can see which departments might benefit from larger budgetary allocations. To keep your company’s finances on track, you may also use the expense report to see if the departments are following their assigned budgets.

Start keeping track of employee expenses with an expense report template.

Standardize the Employee Reimbursement process

Employees are conscious of whether costs are eligible or non-eligible for reimbursement as expenditure report has become a standardized practice of managing expense. However, the expense report facilitates the timely submission of expenditure reports with accuracy in reimbursement.

Additionally, because employees document every aspect of their spending along with the invoices, it is simpler for finance managers to determine whether or not the expenses are accurate. So, we can say that expense reports always help maintain reimbursement.

Tax Maintenance

The central part of running a business is maintaining tax deductions and fillings. However, making a separate report for taxes can be hectic.

Companies generate expense reports because it helps in retaining the report and expanses of tax appropriately. Similarly, with solid proof of tax expenses done during the whole period, the managers write it in the expense report, which is advantageous for a business.

Types of Expense Reports

There are different kinds of expenditure reports like T&E, Monthly expenses, etc. All cost reports, generally, are intended to aid the business in better tracking and analyzing spending. T&E expenditure reports, some of which are crucial for taxation purposes, can assist in locating areas where organizations could be overpaying.

Workers often produce weekly expenditure statements for T&E that include information about their own money spent on things like client dinners or travel to customer premises. Businesses may create reports using the appropriate expenditure management system that evaluate the combined data from worker expenditure to keep track of costs and support creating a travel management strategy.

Different forms of expenditure reports are used by businesses to monitor other areas of expenditure, particularly overhead expenses like wages and rent. Let us look at the following types of costs;

Monthly Expenses Report

A corporation may monitor and evaluate all operating costs using monthly expenditure reports. The monthly report aids the business in tracking expenditure patterns, assessing whether total expenditure is in line with projections, and identifying cost-cutting opportunities.

Long-Term Expenses Reports

Long-term expenditure reports, which often include a quarter or a year, offer another perspective on how much money a company spends. Annual cost reports can be used by businesses to locate tax deductions for inclusion in their yearly tax returns.

Recurring Expenses Report

Regular expenditures that the business must pay monthly, such as rent, salary, and utilities, are often examined in recurring expenditure reports. Any significant rises in this expenditure that can covertly harm the bottom line can be more easily detected with their help.

Want to automate repetitive manual tasks?

Check out Nanonets workflow-based document processing software. Extract data from employee reimbursement forms, contracts, receipts, and more on autopilot!

What does an Expense Report Look Like?

An expense report is like a form containing all the spending done by the business. An expenditure report can range in complexity from a straightforward spreadsheet with a few key fields to several documents with several sections. It includes a date, vendor name, client name, account details, total amount, subtracted amount, etc.

Here is a sample expense report:

Download our free expense report template now. Create professional expert report templates now.

How to fill out an expense report?

There are about two ways of filling an expense report

- Manual expense report

- Electronic expense report

How to fill expense reports manually?

Many organizations have adopted the outdated manual process of making expense reports, using customized expense report templates for preparing reports in PDF or sheet form.

Here’s how you can fill out expense report manually:

- Use an expense report template in excel.

- Every employee is required to fill all their expenses from their receipts, bills, and invoices into the excel template.

- Employees must fill in their employment details, subtotals, totals, and other comments for their manager’s review.

- The employee then attaches the expense report in an email and all the proof of payment to the manager for review.

- The manager receives the report and checks it for accuracy and any policy breaches or false claims.

- The report is sent to the accounts department for reimbursement after getting their permission.

How to fill expense reports automatically?

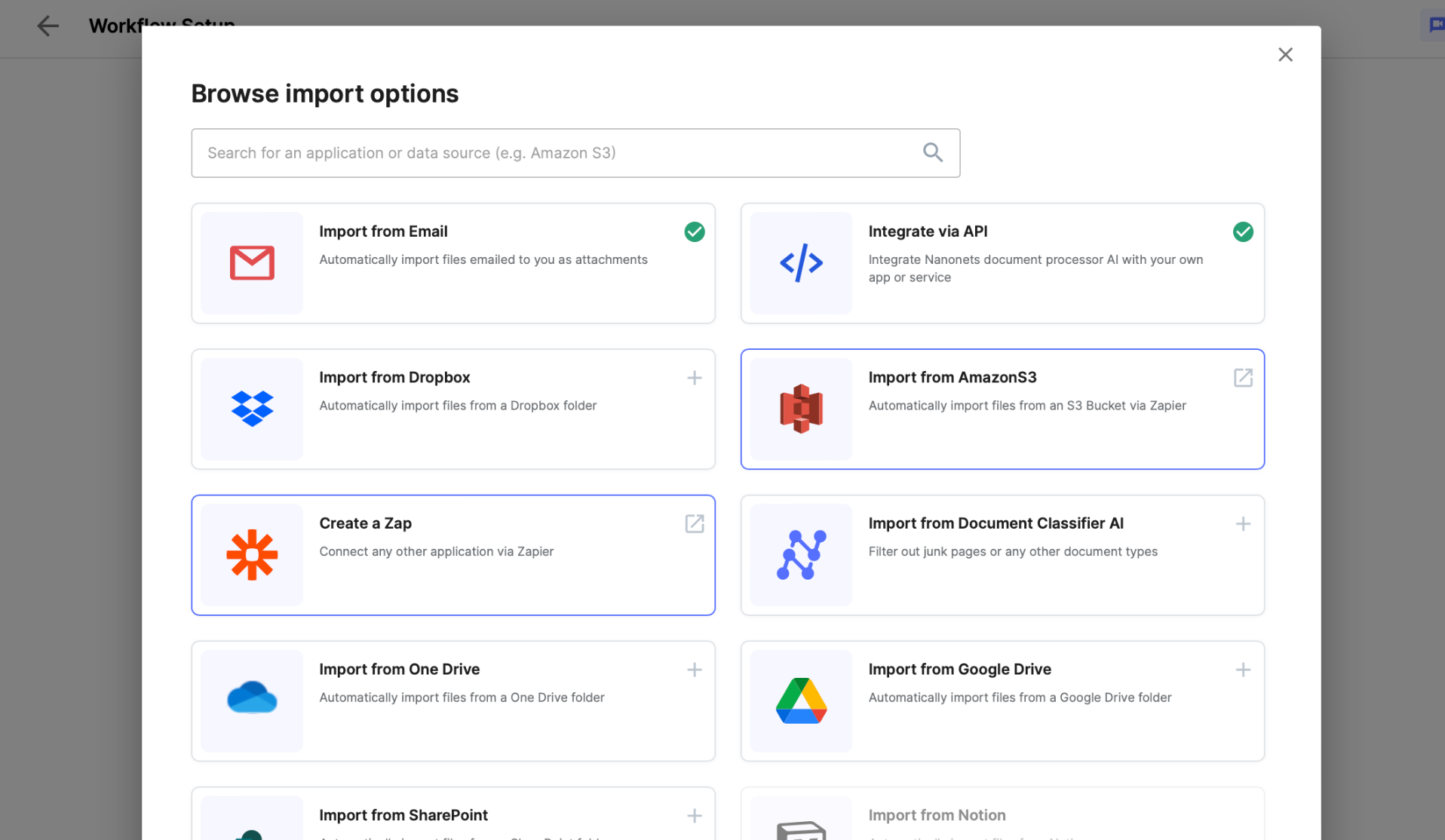

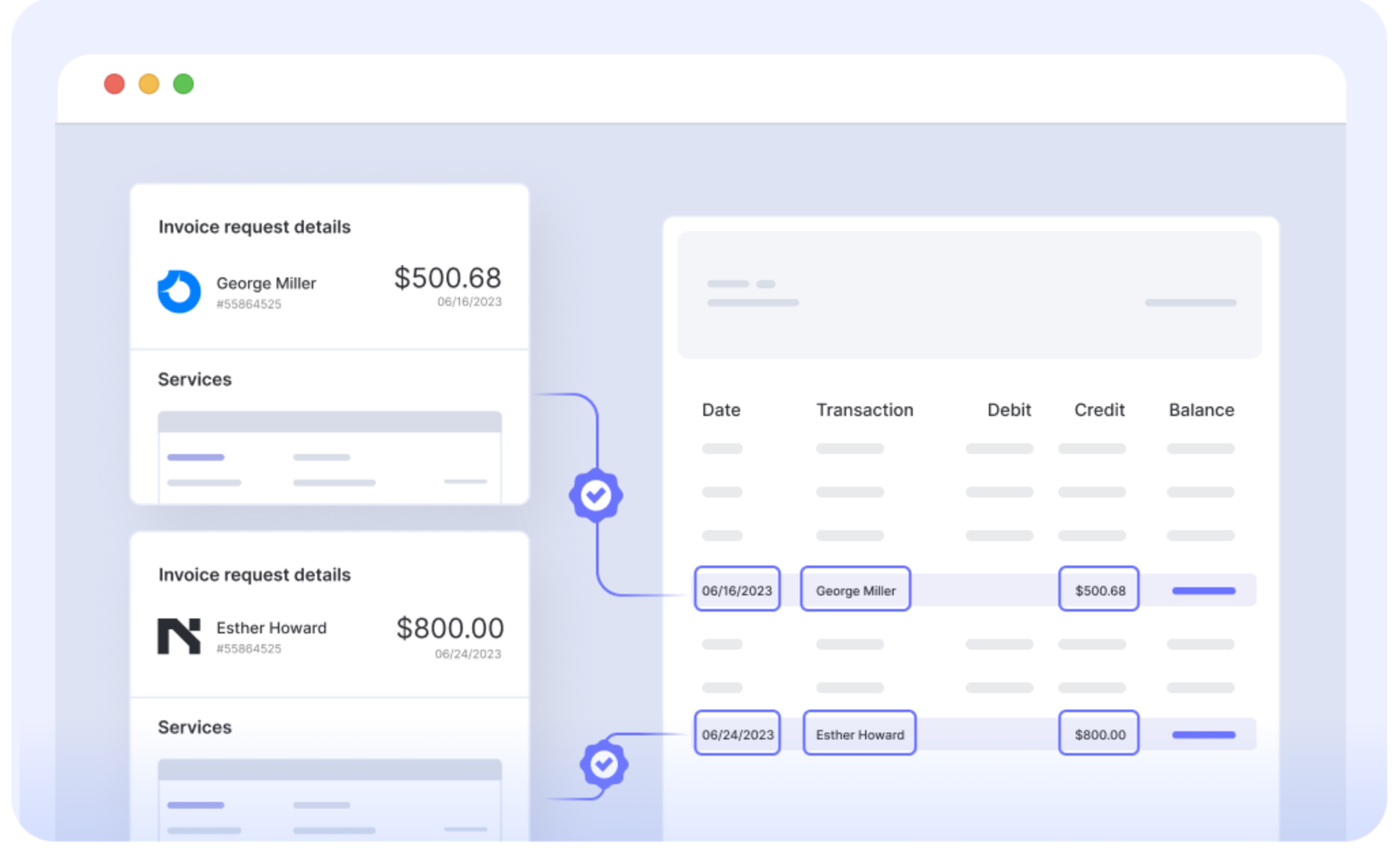

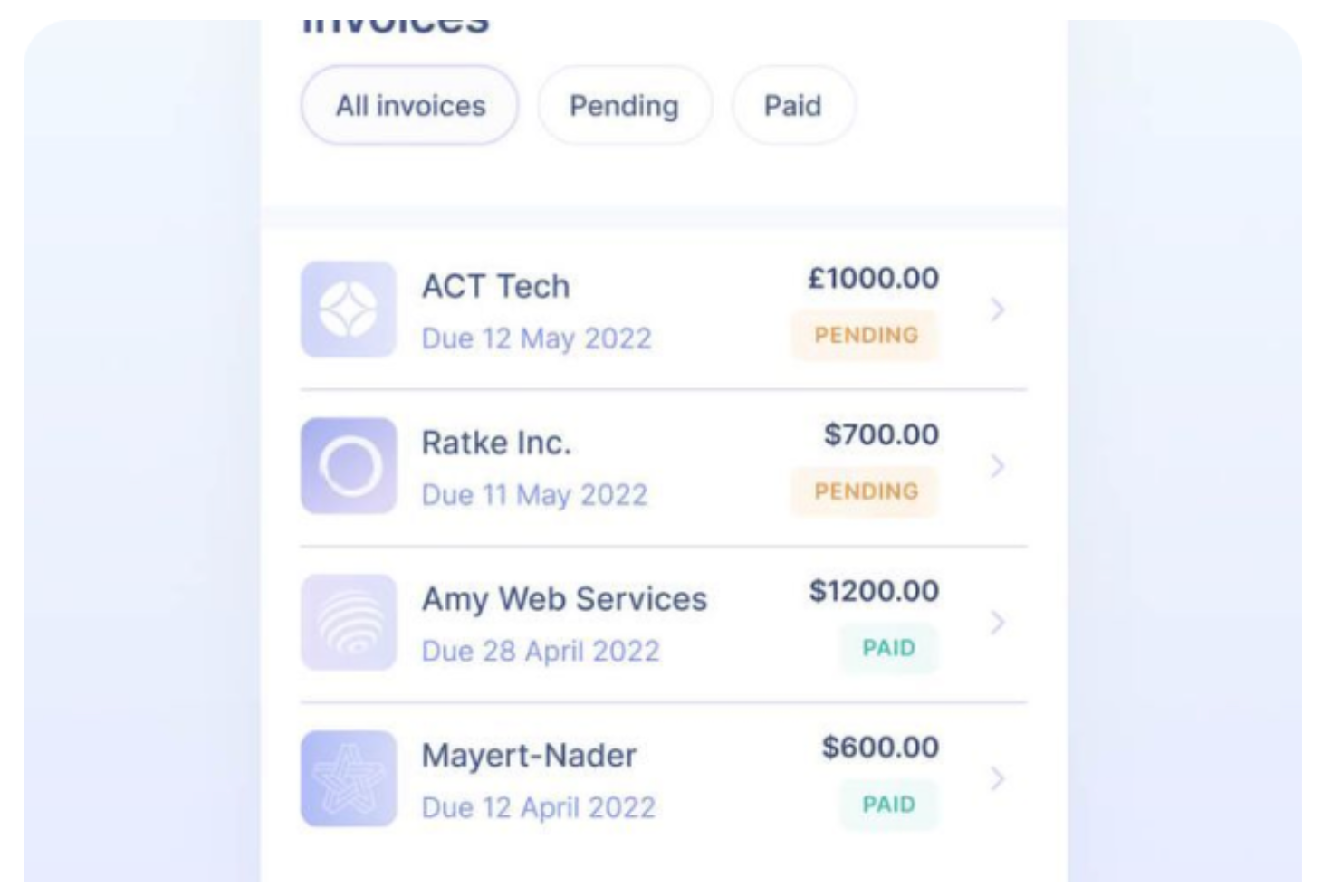

Instead of manually filling expense reports, you can automate it all for your employees using expense management software like Nanonets. Here’s just one example of what an automated expense reports and expense reimbursements process looks like with Nanonets:

- Your employees forward all the invoices, receipts, and bills to a specific email address.

- Nanonets parses the email inbox and ingests data from your mail contents and attachments. It automatically sorts all the documents and extracts information like date, total amount, employee name, expense details, and more.

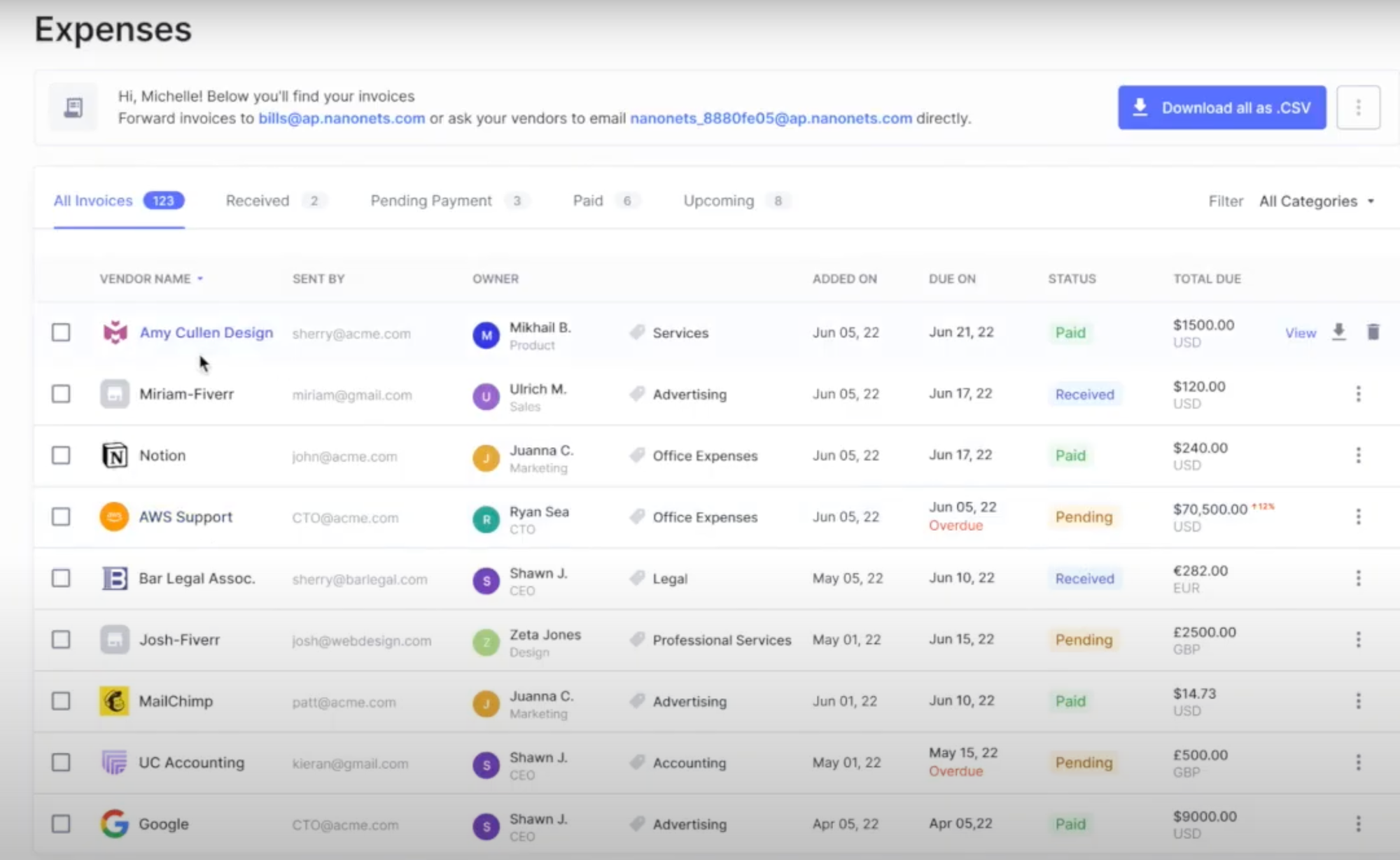

- Based on expense details, Nanonets can automatically categorize the expenses based on existing policies and populates an expense report template in Google Sheets, Excel, or other software of your choice.

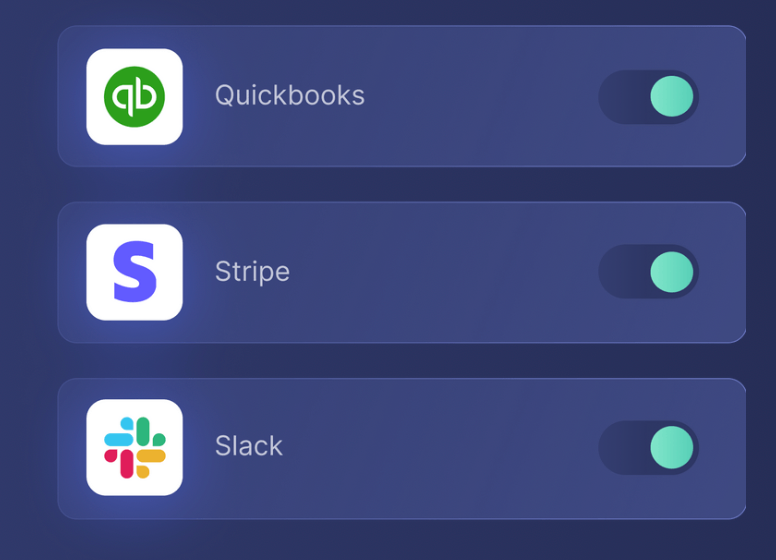

- The compiled data goes to the relevant manager for approval. Once the expense is completely approved, the data is exported to the system of choice like Xero, NetSuite, Google Sheets, or other databases. Check out integrations.

- In case of any flags, a set of stakeholders receive notification to either approve the expense, or review the expense & provide needed modifications.

- After this, you can also send the payments directly via Nanonets using Nanonets Flow. With multiple ACH payment and wire transfer options, send the amount to employees or adjust it in their pay slips.

Automate expense reimbursement with Nanonets’ expense management software. Try it for free. Start your free trial.

Nanonets for expense automation

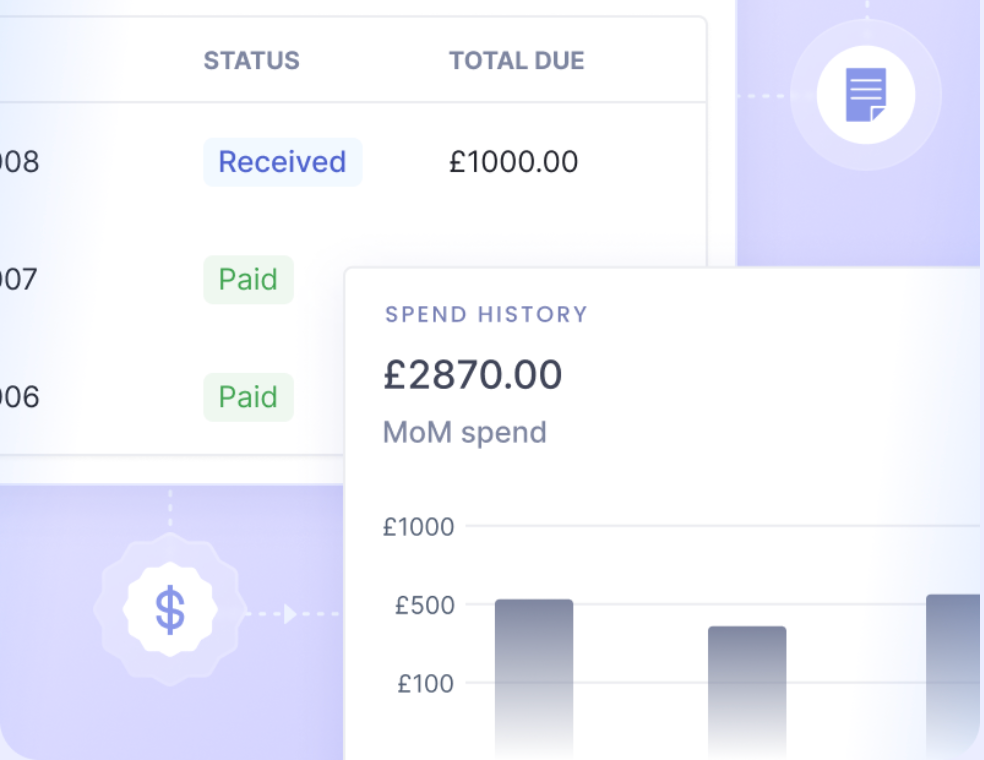

Automation and Artificial Intelligence has transformed this gloomy landscape, and made expense report automation a breeze. Let’s take a look at how a modern expense management software like Nanonets employs these technological advancements to make expense automation seamless, efficient and error-free.

1. Expense Incurrence: Same old expenses, but here’s where the magic happens. Receipts are captured faster than a speeding bullet, thanks to the wonders of mobile technology and seamless integrations to import receipts from your apps and databases.

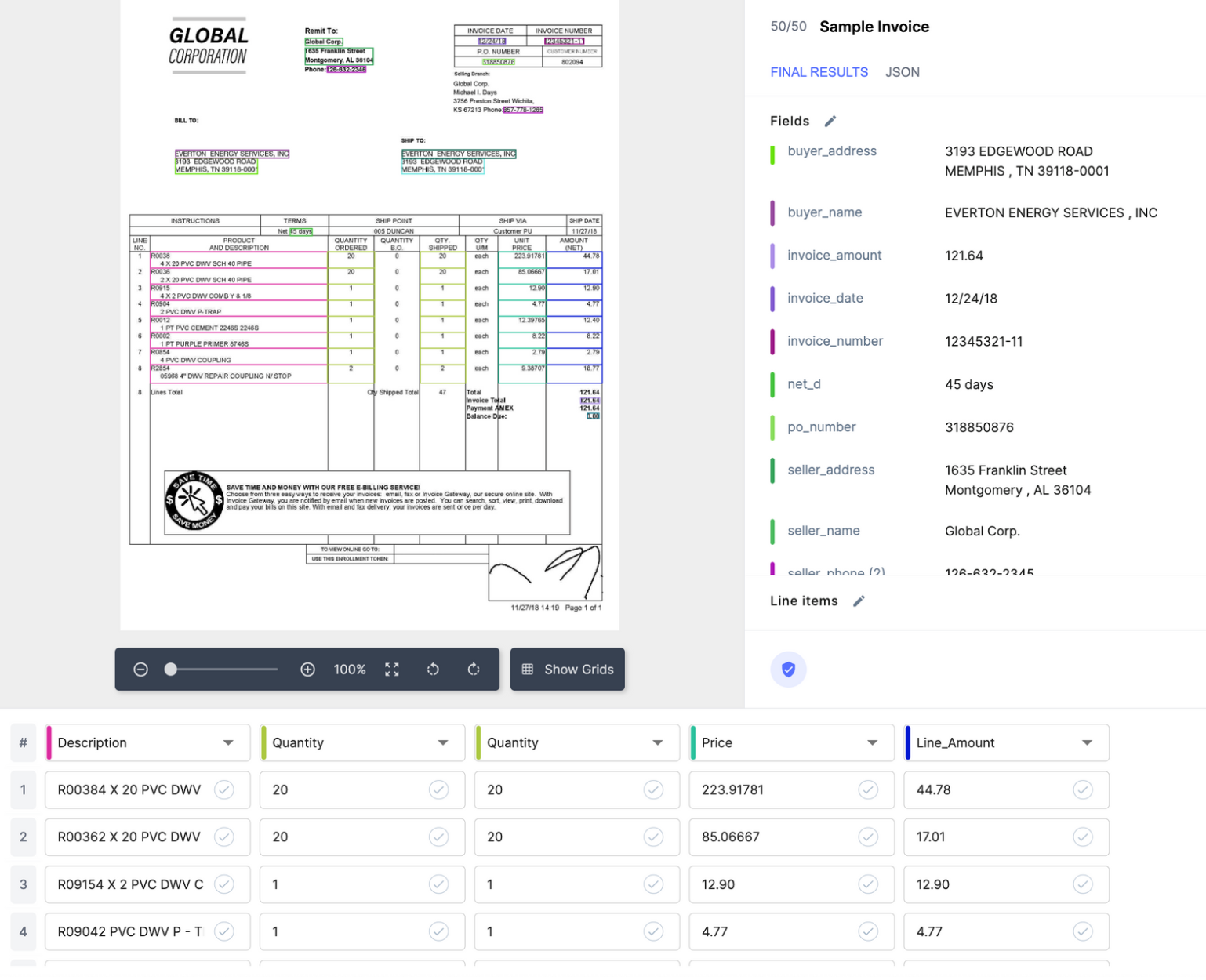

2. Auto-Magic Recording: Optical Character Recognition (OCR) technology steps in, extracting structured data from receipts into digital data faster than you can say “expensed.”

3. Real-Time Reporting: Reports are generated with the click of a button – it’s like having your own personal assistant, minus the coffee runs.

4. Easy Approvals: System-driven compliance checks kick in first, flagging only the outliers. Managers get to focus on real issues instead of playing Whack-a-Mole with every report. You can then add humans-in-the-loop to ensure invoices are sent to approval to the right person at the right time. Furthermore, you can enforce your approval policy and custom validation checks.

5. The Compliance Cruise Control: Continuous, automated audits make life easier. Anomalies stick out like a sore thumb, and policy enforcement is tighter than a drum.

6. The Speed of Light Reimbursements: Reimbursements happen at warp speed, boosting employee morale to the stratosphere.

7. The Sync Symphony: Seamless integration with your accounting software and other apps turns data entry and reconciliation into a harmonious symphony rather than a chaotic cacophony.

8. Analytics at the Speed of Thought: Real-time insights are at your fingertips, offering a crystal ball into spending patterns and saving opportunities.

In conclusion, while the jump from implementing manual to automated expense management might seem like a giant leap, in reality, it’s a series of small, practical steps towards efficiency, clarity, and ultimately increased profitability.

Here are a few cases studies of businesses that have successfully implemented expense management and automation –

- SaltPay Uses Nanonets to Integrate with SAP to Manage Vendor Invoices.

- In2 Project Management helps Water Supply Corporation save 700,000 AUD with Nanonets AI.

- How Happy Jewellers, a SMB, benefitted from NanoNets.

- Nanonets AI helps ACM Services automate extraction from expense documents, saving 90% time for the Accounts Payable team.

- Tapi automates property maintenance invoices using Nanonets.

- Puma automates their expense management process with Zoho Expense.

- SWISS improved expense processing efficiency by 80% with Rydoo.

- Suncommon manages their company spend and saves company time by leveraging the the Expensify Card.

Conclusion

Expense reports provide a bird’s eye view of employee expenses for a given period of time. They’re an effective tool for keeping employee expenses in a tab. Businesses should adopt expense reports as part of their reimbursement processes and work towards automating these reimbursement processes to make them error-free.

FAQs

What Is an Expense Report Used For?

The expense report is used for listing all the expenses that the company makes, all the items the company purchases, and the recording of taxes.

What are different Business Expense Categories?

The expense report falls into the following categories;

Fees and commission, Advertisement, Expenses of vehicle, Expenses of interest, Expense of mortgage, Expense of insurance, Professional and legal services, Office expenses, Profit-sharing plans and pensions, Rent, Repairs and maintenance, and many more.

What Is a Monthly Expense Report?

The monthly expense/cost report lists every purchase and expense of a firm that the manager writes during the month, which is essential for business operations.

What Is Considered an Expense?

An expense is the amount of money spent and the expenses experienced by a business to generate revenue. For example, purchasing new equipment, the expense of the company’s vehicle, bad debts, and employees’ salaries, etc.

Why do you Need an Expense Report?

We need to generate the expense report because every expenditure report generally aims to assist the business in tracking, analyzing, and monitoring the spending and purchases of the company.

Who is Eligible to Submit an Expenditure Report?

Based on corporate policy and the way the records are being used, different people can submit expenditure reports based on the need of organizations.

Most of the time, only supervisors may file expense reports, but occasionally, anybody who incurs expenses for authorized business expenses and requests reimbursement may do so.

Anyone can occasionally file a report, but it needs to have the manager’s approval.

Read more Accounting Articles:

Automate Accounting with free accounting templates

Find the best software for your business

[ad_2]

Source link