[ad_1]

In the rapidly evolving business landscape, the efficiency of Accounts Payable (AP) processes is no longer just a back-office concern but a strategic imperative. The complexity and resource-intensive nature of traditional AP work is becoming unsustainable, particularly in the face of growing demands for speed and accuracy.

Accounts Payable (AP) automation is the use of technology to streamline and improve the process of managing a company’s bills and payments owed to others. Instead of manually handling invoices, checking them, and making payments, AP automation uses software to do these tasks more quickly, accurately, and with less human effort. This can help companies pay their bills on time, avoid errors, and save time and money.

Our blog cuts through the complexity of AP processes, presenting a clear pathway to AP automation. This narrative is heavily driven by replacing the manual tasks associated with accounts payable using software; but it’s also a larger tale about how in the world of business, the most impactful revolutions often happen quietly, behind the scenes, changing the fabric of corporate life in profound ways.

Why is Accounts Payable so challenging?

This is a question that has long plagued the best of finance professionals. Accounts Payable is typically seen as a cost function within companies, and the reason is simple – no one wants to spend time paying bills and entering data about bill payments!

However, it’s still (very much) an essential business function.

The reason AP is challenging to optimise is really due to the nature of the beast.

The key activities in an AP process (Data extraction, invoice coding, ERP sync) are essentially data transformation activities. Automating those would be straightforward with today’s technology.

However, more importantly, AP work also involves human intervention – for review, approvals and financial controls.

It is this mix of data transformation and human input, that makes AP a notoriously complex and difficult process to optimize.

What exactly are these challenges?

Here’s a detailed look at each step of the AP process. By reading along, we can see where the inherent challenges lie within each part of the accounts payable workflow.

- Invoice Collection: Inefficiencies in managing a mix of digital and paper invoices, leading to misplaced documents and delayed processing.

- Data Entry: Manual data entry causes inaccuracies and delays in financial records and reporting.

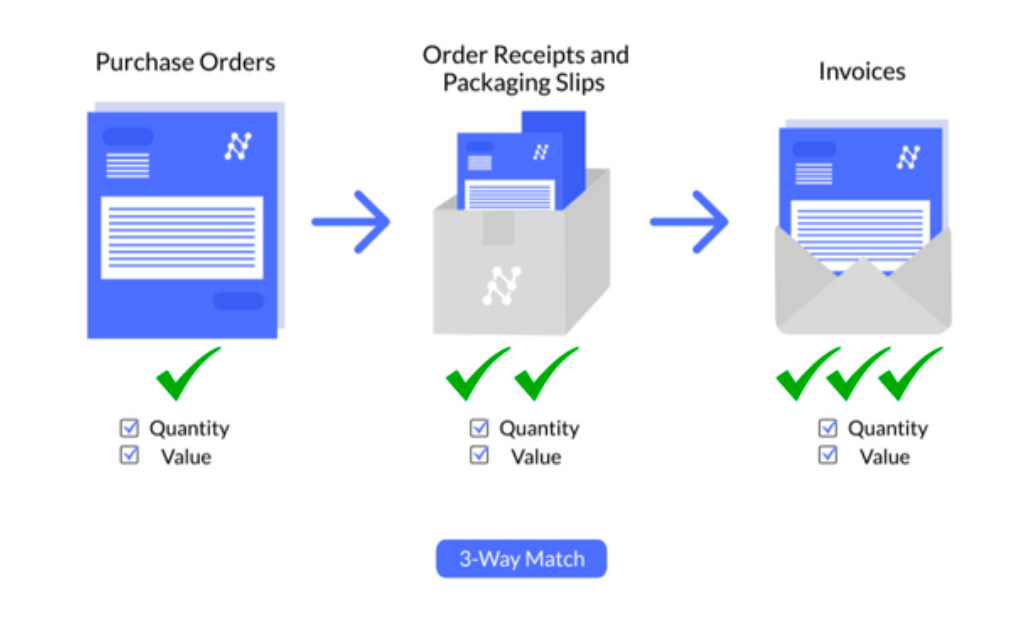

- Verification: Time-consuming process of cross-checking invoices against POs and delivery notes, often leading to delayed payments.

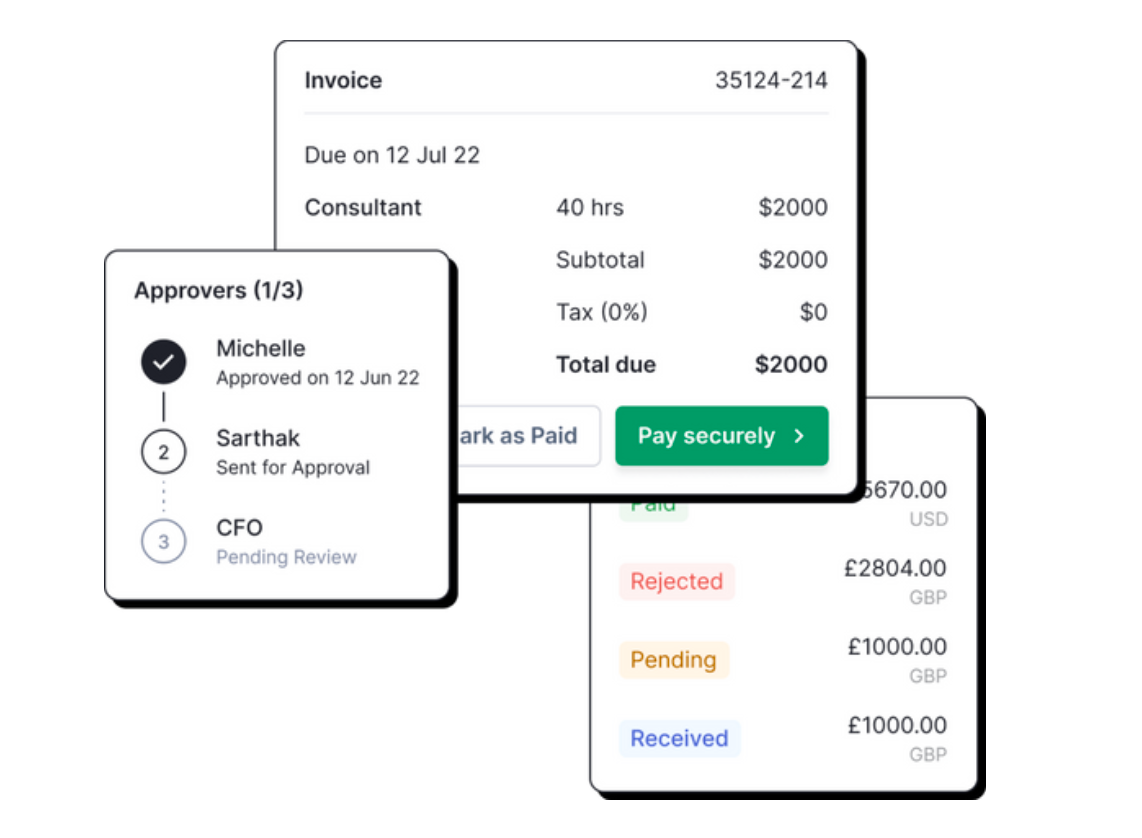

- Approval: Cumbersome approval process with challenges in providing context to approvers, tracking invoice status and ensuring timely authorizations.

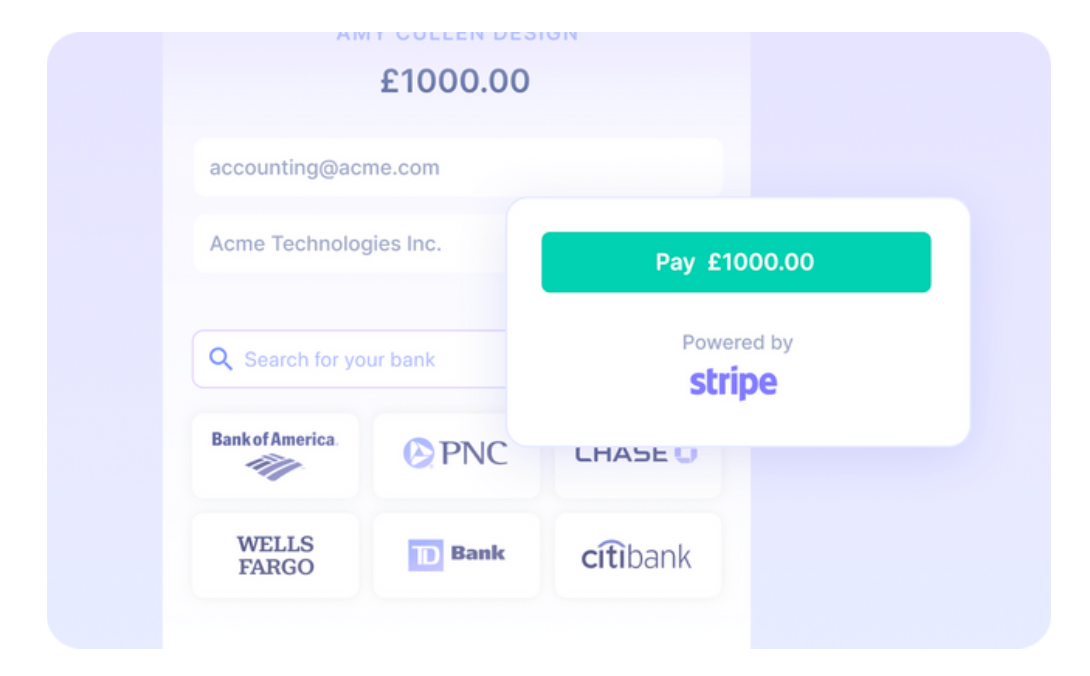

- Payments: Difficulty in managing multiple payment terms, schedules and currencies while ensuring timely payments.

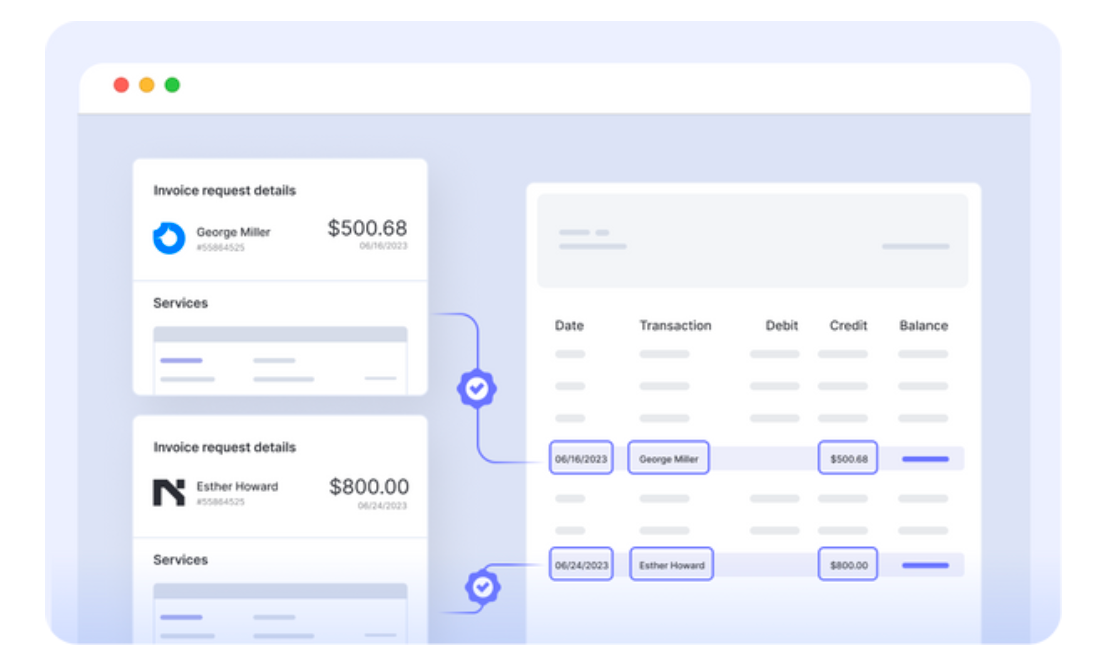

- Reconciliation: Labor-intensive process of matching bank transactions with ledger entries.

- Dispute Resolution: Time-consuming and complex resolution process for disputes, affecting vendor relationships and operational efficiency.

Inefficient Accounts Payable: A Proven Obstacle to Organizational Growth

Employing a manual accounts process for your business slows its growth by directly impacting the accuracy, efficiency and expenses associated with the AP process –

- Unnecessary Operational Costs: Manual invoice processing costs escalate from $13 to $50, prolonging accounts payable for up to three weeks.

- Penalties and Strained Supplier Relations: Nearly half of suppliers face late payments, straining vendor relations and incurring late fees or penalties.

- Cash Flow Chaos: 74% of mid-market and early-enterprise CFOs recognize that digitization of AP payment processes improves balance sheets.

- Fraud and Compliance Risk: A study by the ACFE found that 14% of fraud instances originated in accounting departments, with a median loss of $200,000 per instance.

- Lost Productivity: The average invoice processing time in a manual environment can reach as high as 45 days. This represents lost time and valuable human resources better spent on more impactful initiatives.

Looking to integrate AI into your AP function? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Now let’s see how AP Automation streamlines the accounts payable process and solves these problems.

What is Accounts Payable Automation?

Accounts Payable (AP) automation refers to the technological process of digitizing, streamlining, automating and optimizing the management of a company’s accounts payable operations – enhancing efficiency, accuracy, and compliance.

AP Automation looks at answering one particular question – how can each step of the accounts payable process be 10x better?

Let’s go through each step one by one and understand this.

Embracing Automated Invoice Collection

Imagine a world where all your invoice collection efforts converge harmoniously into one central hub. This is not a distant dream—it’s a reality with AP Automation. You’ll bid farewell to the days of sifting through emails, shared drives, vendor portals, and outdated databases. Instead, welcome a streamlined destination where every invoice, regardless of its origin, is collected automatically. Just think about the time you’ll save and the reduction in errors!

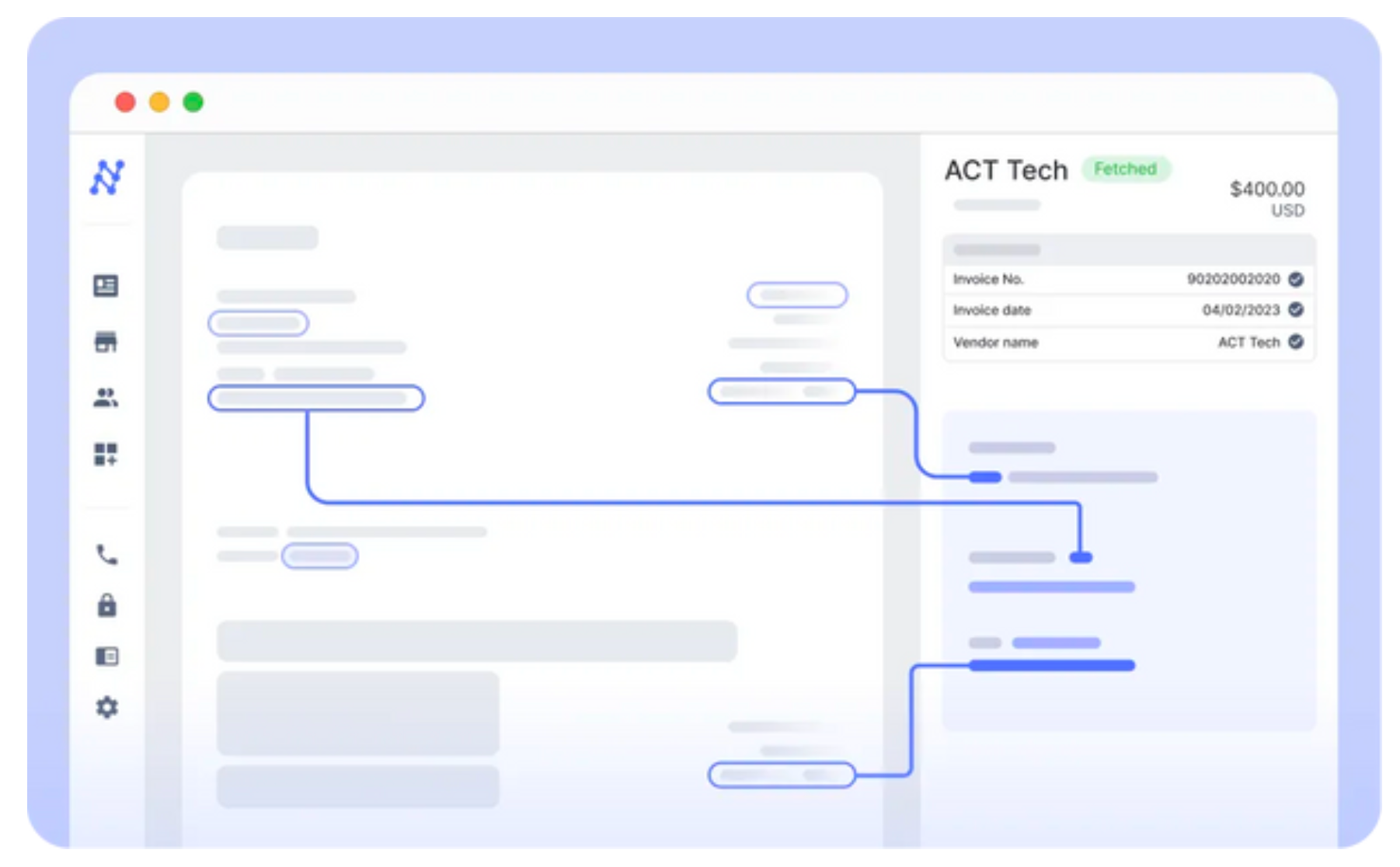

Perfecting the Art of Automated Data Entry

Data entry is often the bane of efficiency, but it doesn’t have to be. AP Automation brings to the table AI-powered Data Extraction that boasts an impressive 99%+ accuracy rate. This means your invoices and purchase orders are read and processed without the painstaking effort of manual entry. The hours or even days of labor this could save your team are invaluable. It’s the kind of change that makes your team want to come to work in the morning, knowing they can focus on tasks that truly need their expertise.

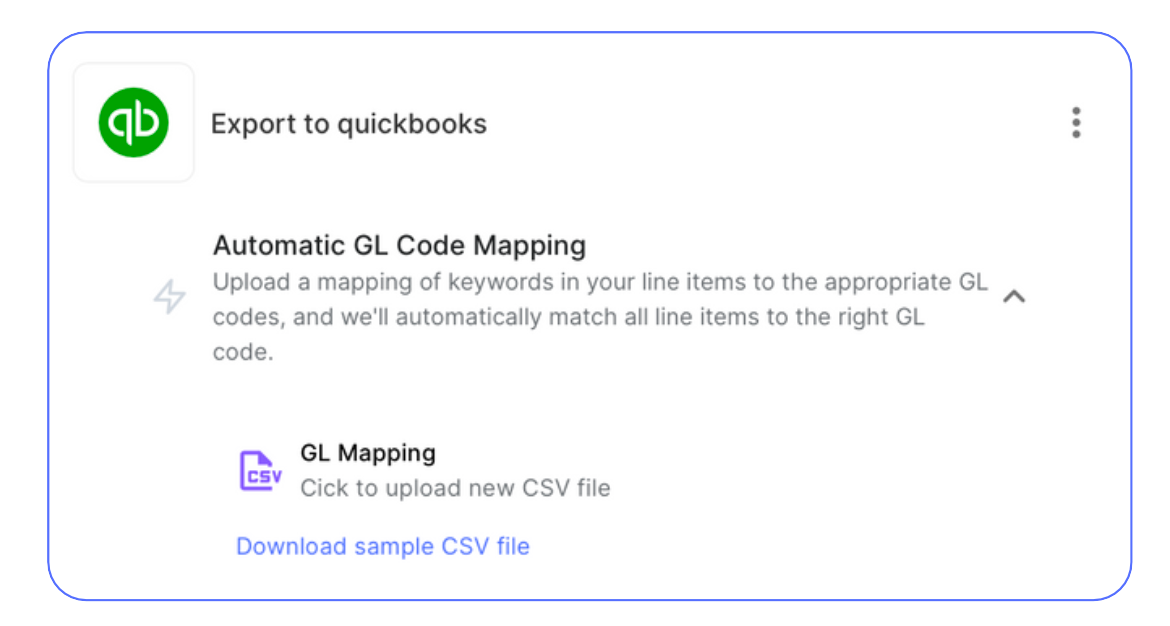

Streamlining with Automated GL Coding and Data Export

We all know how tedious and error-prone invoice coding can be. But with AP Automation, advanced AI techniques like NLP and LLM are here to tackle the grunt work. By automating GL coding and data export, your department can work smarter, not harder, and ensure the team’s efforts skills are used where they’re most needed.

Enhancing Accuracy with Automated Verification

The magic of Automated 3-way matching cannot be overstated. Integrating invoices, purchase orders, and delivery notes reduces both the time spent and the potential for errors—no more chasing down discrepancies or sending countless follow-up emails. This system handles the verification process with such precision that it feels like having an extra set of infallible eyes.

Simplifying Processes with Easy Approvals

Workflow automation means approvals are no longer a bottleneck. They become flexible and live where your organization does—whether that’s on email, Slack, or Teams. This eliminates the need for disruptive phone calls and the all-too-familiar barrage of reminders. Your approval process becomes as agile as your team, adapting to the flow of your daily operations seamlessly.

Achieving Fluidity with Seamless Payments

AP Automation isn’t just about handling invoices; it’s about facilitating the payment process too. This means making direct global payments becomes worry-free, as you can trust that the system will handle forex charges and avoid sudden chargebacks. This also means you can assure your suppliers of timely and accurate payments, fostering better relationships and a stronger supply chain.

Mastering Finances with Automatic Reconciliation

Finally, let’s talk about closing the books. Automatic reconciliation transforms this often arduous task, matching bank transactions with ledger entries in a fraction of the time it used to take. What once took days can now be done in minutes. Imagine closing your monthly books with such speed and precision that you can almost hear the collective sigh of relief from your team.

Looking to add AI to your Accounting process? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

AP Automation is the best ally your finance department will ever have. It’s about transforming your AP processes to be ten times better not just in efficiency but in job satisfaction and accuracy as well.

It induces a fundamental shift in your accounts payable department, moving from a task-oriented to a strategy-focused approach. Embrace these changes, and you’ll not only see a transformation in your workflows but in the morale of your team as they realize the potential of what they can achieve with adequate time and the right technology at their fingertips.

Numbers Speak

Various reported statistics underscore the impact of AP Automation. These numbers represent a narrative of the kind of success that you and your team can look forward to experiencing.

Dramatic Cost Reductions in Processing

Let’s start with the financial health of your department. AP Automation has been shown to slash processing costs by a staggering 70%. This isn’t just about saving pennies; it’s about reallocating your budget towards growth, training, and maybe even that office espresso machine everyone’s been eyeing. Think of this as an investment in both your team’s efficiency and their well-being.

Time is of the Essence

Now, imagine reducing your invoice processing time by 384%. It’s not a typo, it’s a revolution. This dramatic decrease means your team can process more invoices faster than ever before, freeing up time to focus on strategic initiatives that truly matter. With AP Automation, “I don’t have time for that” becomes “What’s next on the agenda?”

Error Reduction for Peace of Mind

We know errors can be more than just annoying—they can be costly. With a 37% reduction in invoice processing errors, AP Automation brings peace of mind to your operations. Fewer errors mean fewer hours spent in correction cycles and more confidence in your data integrity. This also translates into less friction with vendors and stakeholders, smoothing the way for smoother relationships and operations.

Cultivating Vendor Relationships

Speaking of relationships, let’s talk about the 76% of organizations reporting increased vendor satisfaction. This is key. Happy vendors mean a reliable supply chain and opportunities for negotiations and discounts down the road. Your vendors will notice and appreciate the punctuality and accuracy of your payments, thanks to AP Automation.

Cash Flow Optimization through Early Payment Discounts

A 3% savings through early payment discounts gives your organization a financial facelift, enhancing your cash flow, and providing you with more leverage and flexibility in your financial operations.

Compliance Without the Complications

Lastly, the crown jewel of AP Automation: 100% stress-free compliance. In an age where regulatory demands are ever-increasing, achieving complete compliance without the stress is nothing short of miraculous.

The Strategic Shift

It is important to talk about the profound shift Accounts Payable Automation brings to an AP department’s ethos and operations. This isn’t just a change in how tasks are done—it’s a renaissance in the very role of accounts payable within your organization. This is marked by transitioning from a task-oriented workflow to a strategy-focused approach.

- From Processing to Analyzing: Imagine your staff using the time saved from manual data entry to conduct thorough spend analysis, identifying trends and opportunities for cost savings. They could negotiate better terms with suppliers, leveraging volume discounts or exploring early payment benefits with the newfound financial flexibility.

- From Reacting to Planning: Instead of reacting to the endless cycle of invoices and approvals, your team can now plan proactively. With the efficiency gains from AP Automation, you have the bandwidth to develop robust budget forecasts and engage in strategic financial planning. This might involve crafting contingency plans to ensure financial stability during market fluctuations or allocating resources towards growth and expansion projects.

- From Resolving to Innovating: Instead of spending hours resolving errors and reconciling accounts, your team can now focus on innovating. This means they can implement new payment technologies, like virtual cards or blockchain for secure and efficient transactions. Or perhaps they could explore sustainability initiatives, such as transitioning to a completely paperless AP process, which not only reduces costs but also supports your company’s environmental goals.

- From Transactions to Relationships: AP Automation shifts the focus from transactional duties to building and nurturing relationships. Your team can spend more time working with vendors to improve the supply chain or with internal stakeholders to understand and meet their procurement needs better. They can initiate vendor performance reviews, create strategic partnerships, and collaborate on joint initiatives that bring mutual benefits.

- From Compliance to Leadership: Finally, moving away from the time-consuming compliance checks, your team can now lead the way in best practices for financial governance. They can establish internal control frameworks that set industry standards and contribute to thought leadership in financial operations. This proactive stance on compliance can also protect your organization from future regulatory changes, positioning you as a forward-thinking and resilient department.

AP Automation Essentials

In any evolving narrative, there are non-negotiables — factors that must be present for the story to advance. When it comes to AP automation, these 3 non-negotiables are the pillars that will ensure a solid efficient structure of your accounts payable process.

1. Integration: The Bridge to the Future

This involves seamless merging of new AP automation tools with existing ERP systems. Select an AP tool that blends easily with current ERP systems, providing a direct path to market and decreasing time-to-value.

2. AI-Powered: The Mind Behind the Machine

The second pillar is the intelligence of the system, an AI-powered core that shapes the workflow, ensuring that every manual process and data transformation is automated, and every human review is easier.

3. Scalability: The Growth Imperative

Lastly, scalability speaks to the ambition of growth. Choose software that meets current demands and scales seamlessly with your business growth, avoiding costly system overhauls and licenses.

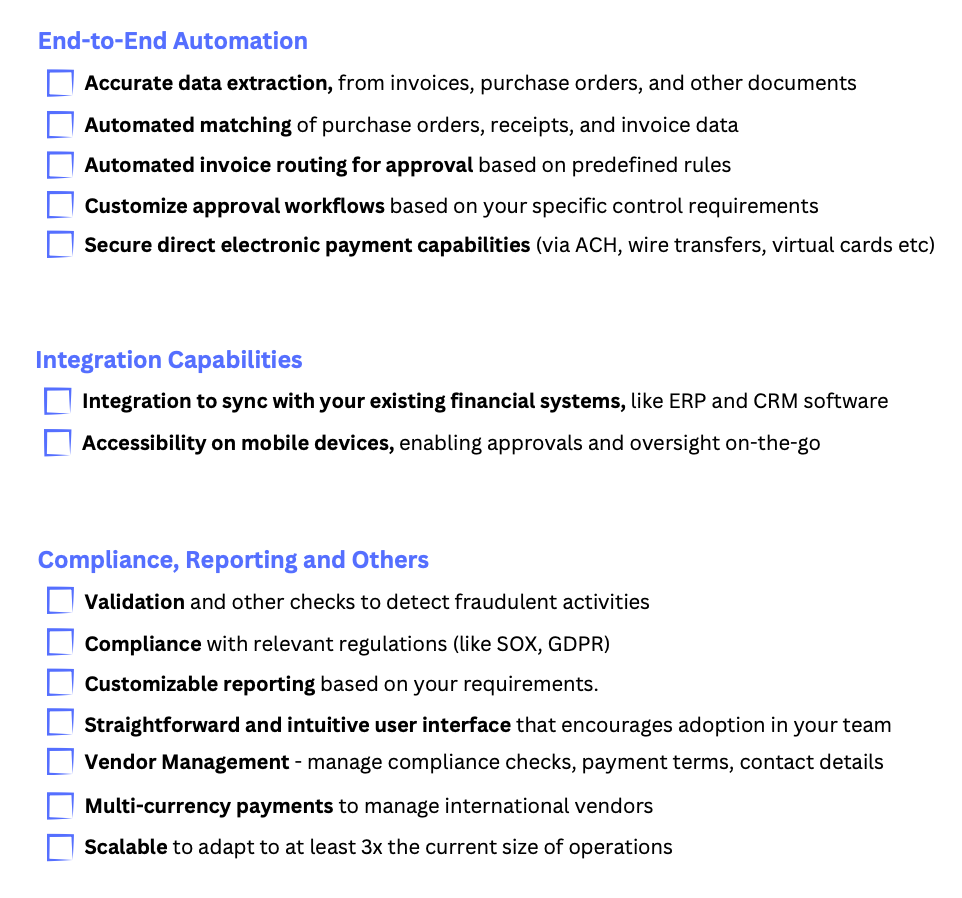

The AP Automation Checklist

Here’s a exhaustive list of functionalities that you should consider for prioritisation.

You can treat this as a tearaway to keep for reference.

Revolutionize Your Accounts Payable – Getting Started

Let’s explore how to get started with AP Automation & integrate it into your accounts payable process. Here are a few things to keep in mind.

1. Embrace the Automation Mindset: Start with the philosophy that automation is a core strategy, not an afterthought. This mindset ensures that every process and decision maximizes efficiency and accuracy.

2. Define Your Success Metrics: Determine clear, measurable goals to evaluate the success of the transition. This could be reducing processing time, cutting costs, or improving accuracy. Knowing what success looks like is crucial for tracking progress.

3. Partner with a ROI-Focused Vendor: Choose a vendor who asks about your success metrics and shows a genuine commitment to delivering value.

4. Secure Stakeholder Buy-In: Garner support from leadership by articulating the value proposition of AP automation – cost savings, improved efficiency, and stronger financial controls.

5. Assess Current AP Processes: Conduct a thorough review of your existing AP processes. Identify areas of inefficiency and potential for automation.

6. Clarify Requirements and Customizations: Clearly outline what you need from an AP automation tool, including any specific customizations.

7. Plan for Integration and Scalability: Ensure the chosen solution integrates well with your existing systems and is scalable to adapt to future business growth and changing needs.

8. Implement, Train, and Adapt: After implementation, focus on comprehensive training for your team. Be prepared to adapt processes as needed, based on feedback and evolving requirements.

What does your AP Automation journey with Nanonets look like?

Day 0: Start a Conversation

Schedule a call at your convenience to discuss your needs with our automation experts, and they’ll provide a personalized Nanonets demo.

Day 1: Assess your Needs

We will evaluate your current AP process, pinpoint how Nanonets can make the biggest impact, ensuring our solution aligns with your goals.

Day 2: Setup and Customization

We’ll guide you on using Nanonets. You’ll set up & automate your accounts payable workflow suited for you based on our discussion.

Day 3: Testing

After setup, test your workflow with real data during a standard 7-day trial (extendable on request). Our team will assist in fine-tuning your workflow.

Day 7: Purchase & Go Live

After successful testing, we’ll propose a tailored, cost-effective pricing plan. Once you’re happy with it, we’ll go live!

Forever: Empowering your Team

We provide resources, sessions, and continuous customer service to ensure your team’s adoption, proficiency and confidence.

AP Automation success stories with Nanonets

From small businesses grappling with AP workflow setup, to large corporations seeking to increase efficiency in their accounts payable processes, these narratives offer a panoramic view of the tangible benefits that AP automation can bring.

SaltPay Uses Nanonets to Integrate with SAP to Automate Accounts Payable

Based in London, England, SaltPay is a payment services and software provider for local European businesses. Founded in 2019, the company provides its services to 100,000+ small and mid-size businesses across Europe.

Challenge

- SaltPay needed to integrate SAP for efficient vendor management.

- Handling thousands of invoices manually was impractical.

Solution

- Nanonets provided an AI-powered tool for invoice data extraction.

- Seamless integration with SAP, enhancing data accuracy and process efficiency.

Results

- Drastic reduction in manual effort with 99% time savings.

- Successfully managing over 100,000 vendors.

- Significant increase in productivity and automation capabilities.

Tapi automates property maintenance invoices using nanonets

Tapi’s property maintenance software simplifies property maintenance. Based out of Wellington, New Zealand, Tapi helps maintain 110,000 properties and is expanding rapidly.

Challenge

- Manual processing of over 100,000 monthly invoices in property maintenance.

- Need for scalable, efficient invoice management.

Solution

- Nanonets AI tool for automated invoice data extraction.

- Quick integration with existing systems, maintained by non-technical staff.

Results

- Processing time reduced from 6 hours to 12 seconds.

- 70% cost savings in invoicing.

- 94% automation accuracy.

Pro Partners Wealth automates Accounting Data Entry with Nanonets

Pro Partners Wealth, based in Columbia, Missouri, specializes in wealth management and accounting services for veterinary owners.

Challenge

- Pro Partners Wealth needed accurate and efficient data entry for invoicing.

- Existing automation tools were insufficient, leading to high error rates.

Solution

- Nanonets offered a custom solution with accurate data extraction and integration with QuickBooks.

- Enabled streamlined invoicing and automated data validation.

Results

- Achieved over 95% accuracy in data extraction.

- Saved 40% time compared to traditional OCR tools.

- Over 80% Straight Through Processing rate, reducing manual intervention.

Augeo leverages Nanonets for Accounts Payable Automation on Salesforce

Augeō provides outsourced accounting and consulting services, and serves as a virtual accounting department for various clients across the United States. Their founder and CEO, Ken Christiansen (ex-Finance Director at Kaiser Permanente), has over 20 years of experience in Finance and Accounting.

Challenge

- Augeo needed an efficient accounts payable solution on Salesforce.

- Manual processing of thousands of invoices monthly.

Solution

- Nanonets provided an AI-driven platform for automated invoice processing.

- Integration with Salesforce for streamlined data handling.

Results

- Reduced invoice processing time from 4 hours to 30 minutes daily.

- 88% reduction in time spent on manual data entry.

- Processed 36,000 invoices yearly with higher accuracy and efficiency.

Frequently Asked Questions

What is accounts payable automation?

Accounts payable automation is like giving your finance team a superpower. It’s the use of software to transform the traditional, manual handling of accounts payable into a streamlined, digital process. By automating tasks like invoice processing, data entry, and payment scheduling, businesses can speed up their workflows, reduce errors, and gain real-time insights into their financials. Think of it as your financial operations running on autopilot, with improved efficiency and control.

How does automation impact the accuracy of accounts payable?

Imagine a world where misplaced invoices, typos, and miscalculations are things of the past. That’s the world of automated accounts payable. By minimizing human intervention, automation significantly reduces the chance of errors. It’s like having a meticulous, tireless virtual assistant who ensures every number is spot on, enhancing the overall accuracy of your financial operations.

Can automation integrate with existing financial systems?

Yes, and this is one of its greatest strengths! Accounts payable automation isn’t about replacing your existing systems; it’s about enhancing them. Most modern solutions are designed to seamlessly integrate with a wide range of financial systems and ERP platforms. It’s like adding a turbocharger to your car – boosting performance without changing what’s already working well for you.

What are the cost implications of implementing automation?

There’s no sugarcoating it – implementing automation requires an initial investment. This can include software costs, integration, and potential training. However, it’s like planting a seed that grows into a tree of savings. Over time, automation reduces labor costs, eliminates late payment fees, and improves cash flow management. The long-term financial benefits and ROI often far outweigh the initial costs.

Read this blog which discusses how much money accounts payable automation saves businesses. https://www.nextprocess.com/ap-software/much-money-will-accounts-payable-automation-actually-save- company-future/

How secure is accounts payable automation?

In today’s digital age, security isn’t just a feature; it’s a necessity. Accounts payable automation solutions are built with robust security measures like encryption, user authentication, and audit trails. They comply with various data protection regulations to ensure your financial data remains secure and confidential.

Is training required for staff to use automated systems?

While accounts payable automation tools are designed for ease of use, some training is usually required to get the most out of the system. However, this isn’t a months-long course; it’s more about familiarization and best practices. Most vendors provide comprehensive training resources and support to ensure a smooth transition. Think of it as a short learning curve which can be overcome within hours leading to a long road of efficiency.

How Does AP Software Function?

Accounts Payable software operates by digitizing and automating the entire invoice processing workflow. At its core, it uses technologies like Optical Character Recognition (OCR) to convert invoice data into digital format. Advanced algorithms then categorize and validate this data against purchase orders and delivery receipts. The software automatically routes invoices through a predefined approval workflow, and integrates with existing financial systems for seamless payment processing and record-keeping.

How Does Automation Software Facilitate AP Team Scaling?

AP automation software empowers teams to manage higher volumes of invoices without proportional increases in headcount or manual effort. By automating routine tasks, it frees up staff to focus on strategic activities. The software’s scalability ensures that as transaction volumes grow, the system can handle the increased workload without sacrificing efficiency or accuracy.

Will AP Automation Make Certain Accounting Jobs Redundant?

Rather than rendering jobs obsolete, AP automation transforms them. It shifts the focus from manual, repetitive tasks to more analytical and strategic roles. Professionals in accounting and bookkeeping will find their roles evolving to include managing the automation software, analyzing financial data, and contributing to strategic decision-making.

What is the Typical Cost of AP Software?

The cost of AP software varies based on factors like the size of the business, the volume of transactions, and the specific features required. It can range from a few hundred to several thousand dollars per month. Many providers offer customizable pricing models to fit different business needs and scales.

How Much Can a Business Save with AP Automation?

Businesses can realize substantial savings through AP automation. These savings come from reduced labor costs, elimination of late payment fees, early payment discounts, and decreased errors and fraud. Typically, companies can expect to save anywhere from 60% to 80% of their current processing costs after implementing AP automation.

How Can Automation Improve the Structure of an AP Department?

Automation transforms the AP department from a transaction-focused to a strategy-focused structure. With manual tasks automated, staff can focus on higher-value activities like vendor relationship management, spend analysis, and financial strategy. This shift not only improves the efficiency and effectiveness of the AP department but also elevates its role within the organization.

How Does AP Automation Aid the Invoice Approval Process?

AP automation streamlines the approval process by automatically routing invoices to the appropriate approvers based on pre-set rules. It provides approvers with all the necessary information and context, facilitating quicker decision-making. The system also tracks the progress of each invoice, sending reminders and updates to ensure timely approvals.

Can AP Automation Software Prevent Invoice Fraud and Duplicate Payments?

AP automation software plays a significant role in preventing invoice fraud. It does so by implementing controls like 3-way matching, which ensures that payments are made only for verified and approved purchases. Additionally, the use of digital audit trails and anomaly detection algorithms helps identify suspicious activities, reducing the risk of fraudulent transactions.

Can AP Automation handle Multi-Currency and International Payments?

AP automation software is typically equipped to handle multi-currency transactions and international payments. It can automatically convert currencies at current exchange rates, manage currency fluctuation risks, and comply with international payment protocols and tax regulations, ensuring efficient and compliant global payment processes.

[ad_2]

Source link