[ad_1]

A Guide to NetSuite Account Reconciliation

Accurate financial records are an important part of any business’ ability to make informed decisions and also adhere to legal regulations. Account reconciliation is a part of this process, helping businesses compare financial data across various sources to identify discrepancies and ensure accuracy.

In this guide, we’ll explore how NetSuite, a leading cloud-based ERP solution, streamlines account reconciliation processes, enhances efficiency, and improves financial visibility.

What Is Account Reconciliation?

Account reconciliation is the process of comparing different sets of financial records to ensure that figures are consistent and accurate across them. It involves matching transactions and balances between internal accounting records, such as general ledger accounts, and also external records, such as bank statements or vendor invoices.

By reconciling accounts regularly, businesses can detect errors, discrepancies, and fraudulent activities. This enables them to maintain accurate financial records, which is essential not only to conform to the laws of the land but also to make informed business decisions.

NetSuite Account Reconciliation Software Overview

NetSuite offers robust account reconciliation software as part of its comprehensive ERP suite. Designed to streamline financial operations and improve visibility, NetSuite’s account reconciliation module provides businesses with the tools they need to reconcile accounts efficiently and accurately. Some of its key features include:

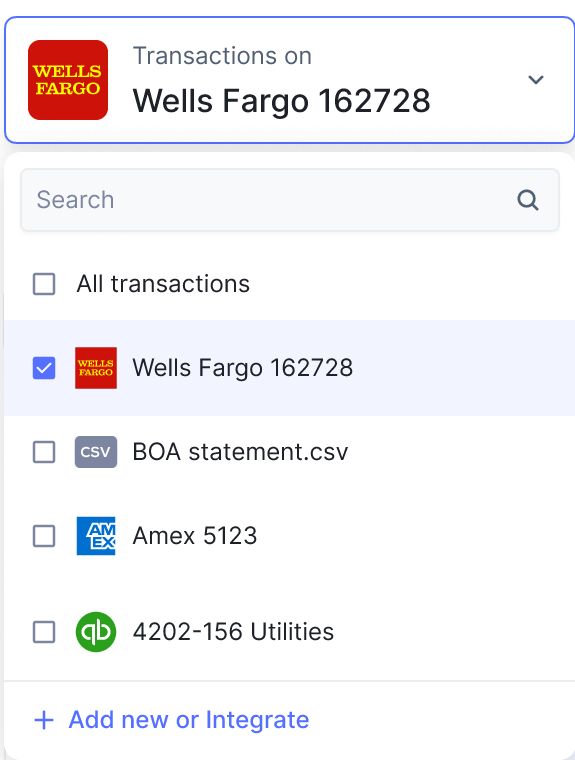

- Automated Reconciliation: NetSuite automates the reconciliation process by importing transaction data from various sources, including bank statements, credit card statements, and vendor invoices. This automation saves time and reduces manual effort, allowing finance teams to focus on higher-value activities.

- Bank Reconciliation: NetSuite’s bank reconciliation functionality allows users to reconcile bank statements with internal accounting records seamlessly. The system matches transactions, identifies discrepancies, and provides tools for resolving outstanding items, ensuring that bank balances align with accounting records.

- Multi-Currency Support: NetSuite supports multi-currency reconciliation, allowing businesses to reconcile accounts denominated in different currencies too. This feature is great for organisations operating in global markets, or dealing with international suppliers and customers.

- Real-Time Reporting: NetSuite provides real-time visibility into account reconciliation processes, allowing finance teams to monitor reconciliation status, track outstanding items, and generate comprehensive reports. Real-time reporting enables proactive decision-making and ensures financial transparency.

- Audit Trail: NetSuite’s account reconciliation module maintains a detailed audit trail of all reconciliation activities, including user actions, transaction changes, and approval history. This audit trail enhances accountability, facilitates compliance, and provides a transparent record of reconciliation activities for auditing purposes.

Pricing & Versions: NetSuite offers pricing plans and editions to cater to the diverse needs of companies of different sizes, from startups to large enterprises.

- Users subscribe to Netflix for an annual licence fee. The licence comprises three main parts: core platform, optional modules, and the number of users. There is also a one-time initial setup/implementation fee.

- As the business or number of users grows, it is easy to activate new modules or add users.

- Businesses can choose from different editions, including SuiteSuccess, SuiteCommerce, and SuiteAnalytics, each offering a unique set of features and capabilities tailored to specific industries and business requirements.

- Pricing for the account reconciliation module may vary depending on factors such as the number of users, the level of customization, and any additional features required.

How to Set Up Account Reconciliation in NetSuite

Setting up account reconciliation in NetSuite is straightforward. It involves configuring the system to import transaction data, defining reconciliation rules and criteria, and establishing workflows for review and approval.

Here’s a step-by-step guide to setting up account reconciliation in NetSuite:

- Configure Bank Feeds: Begin by configuring bank feeds to automatically import transaction data from your bank accounts into NetSuite. This ensures that your accounting records are always up-to-date and accurate.

- Define Reconciliation Rules: Next, define reconciliation rules and criteria based on your organisation’s accounting practices and policies. This includes specifying matching criteria, tolerance thresholds, and exceptions handling rules.

- Customise Workflows: Customise reconciliation workflows to align with your organisation’s approval processes and controls. Establish roles and permissions for users involved in the reconciliation process, such as reviewers, approvers, and auditors.

- Import Historical Data: If migrating from a legacy system or transitioning to NetSuite from another ERP solution, import historical reconciliation data into NetSuite to maintain continuity and historical accuracy.

- Train Users: Provide comprehensive training to finance team members and other users responsible for account reconciliation tasks. Ensure that they understand the system’s functionality, processes, and best practices for reconciliation.

- Test and Validate: Before fully implementing account reconciliation in NetSuite, conduct thorough testing and validation to ensure that the system functions correctly and meets your organisation’s requirements. Address any issues or discrepancies identified during testing before proceeding with live reconciliation activities.

Benefits of Using NetSuite for Account Reconciliation

Using NetSuite for account reconciliation offers numerous benefits to businesses, including:

- Enhanced Efficiency: NetSuite’s automated reconciliation processes reduce manual effort and streamline financial operations, enabling finance teams to reconcile accounts more quickly and accurately.

- Improved Accuracy: By automating data import, matching, and validation, NetSuite minimises the risk of errors and discrepancies, ensuring the accuracy and reliability of financial records.

- Greater Visibility: NetSuite provides real-time visibility into reconciliation status, outstanding items, and financial performance, empowering decision-makers with actionable insights and timely information.

- Easier Compliance: NetSuite’s audit trail functionality maintains a transparent record of reconciliation activities, which helps attain complicance with regulatory standards and internal controls.

- Scalability: As businesses grow and evolve, NetSuite’s platform can accommodate changing reconciliation needs, making it a future-proof solution for long-term use and success.

NetSuite Account Reconciliation Alternatives

While NetSuite offers robust account reconciliation capabilities and is trusted by diverse companies worldwide, businesses could explore alternatives based on specific requirements and preferences.

Some alternatives to NetSuite for account reconciliation include:

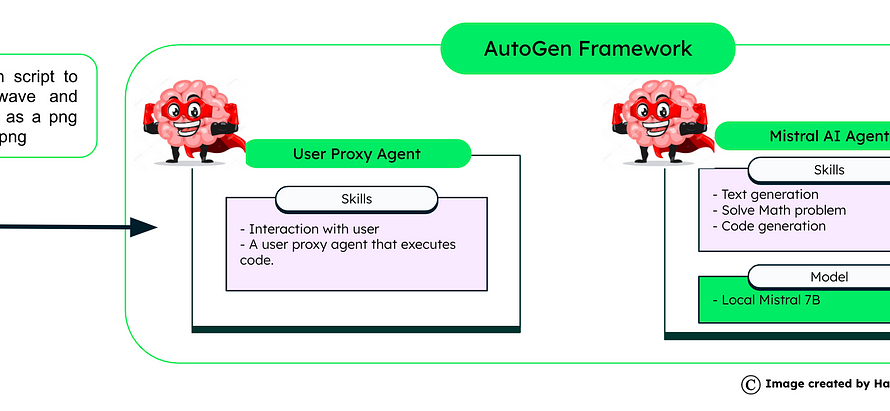

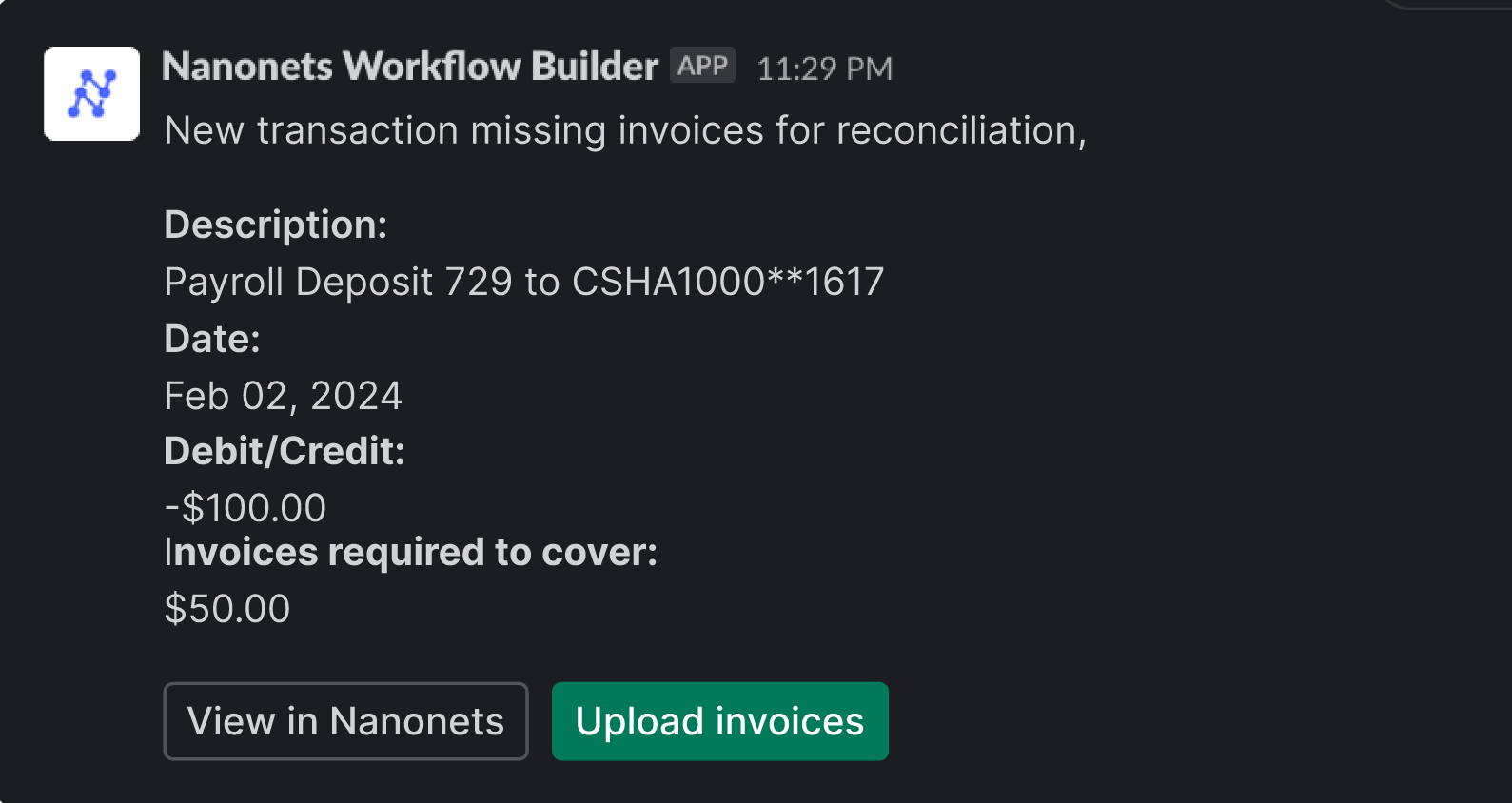

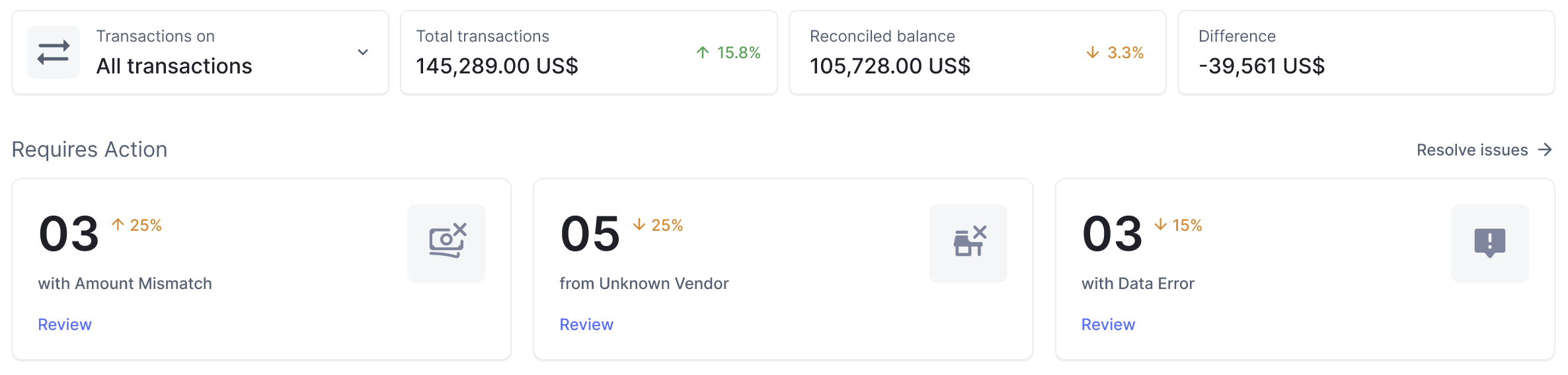

- Nanonets: Nanonets is an AI-powered solution that can greatly simplify and streamline the account reconciliation process. It automates various steps, reduces manual effort, and increases efficiency. Nanonets integrates data from multiple financial sources, extracts relevant data from documents, and matches data across different sources. It also facilitates automated review and approval workflows and provides a central repository for supporting documentation.

- QuickBooks Online: QuickBooks Online is a cloud-based accounting software that offers basic account reconciliation features, including bank reconciliation and transaction matching. It is suitable for small businesses and startups looking for a simple and affordable solution.

- Sage Intacct: Sage Intacct is a cloud-based ERP solution designed for mid-sized businesses and enterprises. It offers advanced financial management features, including account reconciliation, multi-entity consolidation, and revenue recognition. Sage Intacct provides scalability and customization options to meet the unique needs of growing organisations.

- BlackLine: BlackLine is a cloud-based finance and accounting platform that specialises in financial close automation, including account reconciliation, journal entry management, and variance analysis. It is suitable for larger enterprises and organisations with complex reconciliation requirements.

- ReconArt: ReconArt is a reconciliation software solution that offers comprehensive reconciliation functionality, including bank reconciliation, general ledger reconciliation, and transaction matching. It is suitable for businesses of all sizes and industries looking for a flexible and scalable reconciliation solution.

Why Use NetSuite ERP for Account Reconciliation?

NetSuite ERP offers several advantages for account reconciliation, including:

- Comprehensive Integration: NetSuite ERP seamlessly integrates with other modules and third-party applications, allowing businesses to streamline their entire financial management process from end to end.

- Advanced Automation: NetSuite’s advanced automation capabilities automate repetitive reconciliation tasks, reducing manual effort and improving efficiency.

- Real-Time Reporting: NetSuite provides real-time reporting and analytics capabilities, enabling businesses to monitor reconciliation status, track performance metrics, and make data-driven decisions.

- Scalability: NetSuite’s scalable platform can accommodate businesses of all sizes and industries, making it suitable for startups, SMBs, and large enterprises alike.

- Enhanced Security: NetSuite offers robust security features, including role-based access controls, data encryption, and audit trails, ensuring the confidentiality, integrity, and availability of financial data.

Automate Account Reconciliation with Netsuite and Nanonets

Nanonets (as mentioned above) offers AI-powered solutions for automating account reconciliation processes, enabling businesses to streamline operations, reduce manual effort, and improve accuracy. Additionally, Nanonets integrates seamlessly with NetSuite ERP, providing businesses with a comprehensive solution for financial management and account reconciliation.

Key benefits of Nanonets for automated account reconciliation:

- Automated Data Extraction: Nanonets leverages advanced Optical Character Recognition (OCR) technology to automatically extract relevant data from invoices, bank statements, receipts, and other financial documents. This eliminates the need for manual data entry and reduces the risk of errors, ensuring accurate reconciliation.

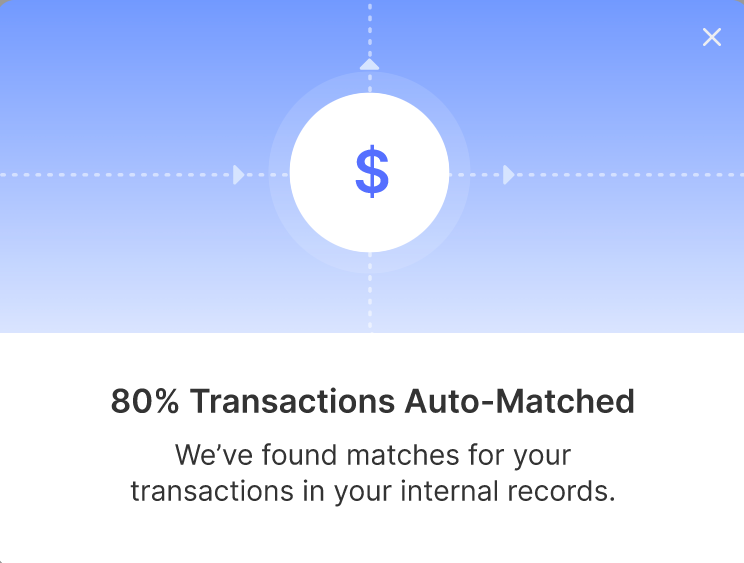

- Intelligent Data Matching: With Nanonets’ AI algorithms, you can match transactions across different systems and identify discrepancies with precision. The system intelligently analyses transaction data, identifies patterns, and reconciles accounts efficiently, saving valuable time and resources.

- Seamless Integration: Nanonets easily integrates with NetSuite and other accounting software, allowing for seamless data exchange and synchronisation. This integration streamlines the reconciliation process, enhances data accuracy, and ensures consistency across financial systems.

- Customizable Workflows: Nanonets offers customizable workflows that can be tailored to your specific reconciliation requirements. Whether you need to reconcile large volumes of transactions or manage complex accounts, Nanonets’ flexible workflow automation capabilities can adapt to your unique business needs.

- Real-Time Reporting: Nanonets provides real-time visibility into the reconciliation process, allowing you to monitor progress, track discrepancies, and generate comprehensive reports. This real-time insight enables proactive decision-making, improves financial transparency, and enhances compliance.

With Nanonets, businesses can achieve greater efficiency, accuracy, and compliance in their reconciliation processes.

Conclusion

In conclusion, effective account reconciliation is essential for maintaining accurate financial records, ensuring compliance, and making informed business decisions. NetSuite’s account reconciliation software offers a comprehensive solution for streamlining reconciliation processes, enhancing efficiency, and improving financial visibility. With its automated reconciliation capabilities, real-time reporting, and scalability, NetSuite empowers businesses of all sizes to reconcile accounts accurately and efficiently.

While NetSuite is a powerful solution for account reconciliation, businesses may also consider alternative options based on their specific needs and preferences. Whether it’s QuickBooks Online for small businesses or Sage Intacct for mid-sized enterprises, there are various alternatives available to meet diverse reconciliation requirements. Further integration with advanced OCR technologies like Nanonets can make the account reconciliation process more streamlined and efficient.

Ultimately, the key to successful account reconciliation lies in leveraging technology and automation to reduce manual effort and increase efficiency and accuracy. By embracing solutions like NetSuite, as well as advanced automation tools like Nanonets, businesses can optimise their reconciliation processes, drive operational efficiency, and achieve greater financial transparency and control.

[ad_2]

Source link