[ad_1]

Businesses of all sizes and types are increasingly looking for a one-stop shop for their ERP needs. Though hundreds of varied tools exist targeting specific business sub-requirements, the ideal remains a single portal through which companies can effectively manage their operations across the value chain.

Microsoft, the universally known leader across multiple software segments, is increasingly popular for small businesses and enterprise clients alike – though specific offerings targeting each segment vary somewhat. This article will look at which is best for your unique use case while providing a comprehensive overview of each.

Microsoft Dynamics 365 Overview

Microsoft Dynamics 365 (just D365 hereafter, for simplicity’s sake) is a wide-ranging suite of Microsoft-owned tools, features, and platforms for business owners and enterprise operations. A far cry from commonly used Microsoft tools like its Office suite, D365’s many products offer a soup-to-nuts series of solutions for businesses of all types and sizes.

Across its many business domains, D365 offers tools targeting use cases like:

- Sales

- Customer management, including customer service and analytics

- Human resources

- Supply chain management

- Operations

- Marketing

- Artificial intelligence and mixed reality

These are just a few of D365’s varied use cases. Still, two core products tend to capture the widest client attention, particularly for small and medium businesses (SMBs): Microsoft D365 Business Central and D365 Finance and Operations.

Though both act as an all-in-one ERP, they offer different benefits, and each works better within specific operational contexts. Understanding which is best for your operation is important to maximize their features.

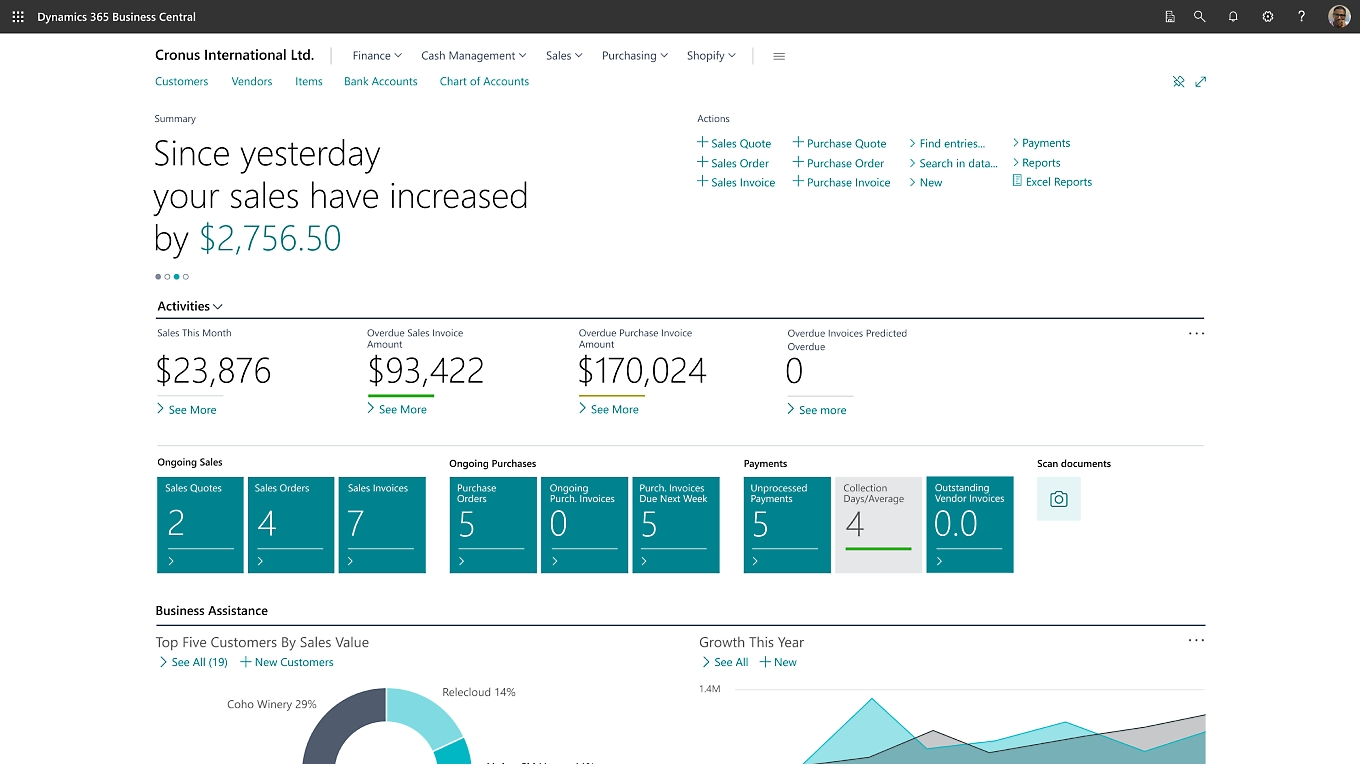

Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is generally best for smaller operations and SMBs. However, using the platform for most one-person operations, sole proprietorships, or freelancing businesses tends to be overkill (which applies to D365 Finance and Operations, which we’ll cover next).

SMBs, depending on their specific field and function, typically use D365 Business Central as a centralized platform (hence the name) to execute the most common administrative, financial, and operational business functions. Features commonly leveraged across SMB sectors include:

D365 Business Central Financial Management

D365 Business Central gives SMBs the same tools as many accounting and bookkeeping platforms; the benefit to D365 over other options like, say, QuickBooks is that it’s part-and-parcel within the larger ERP ecosystem rather than nesting within a third-party software. D365 Business Central’s finance management tools include:

- Basic bookkeeping and accounting and robust reporting tools to develop insights from financial data.

- Cash flow management and forecasting.

- Support for multiple currencies and languages and region-specific tax management to facilitate cross-border transactions and international dealings.

D365 Business Central Sales Management

D365 Business Central offers SMBs tools comparable to many high-end CRMs but natively nested within Microsoft’s ecosystem, simpler to use, and without unnecessary features many SMBs find themselves paying for but never using. As an example of D365 Business Central’s sales and customer management expediency, you can manage and track customer journeys across the sales chain and even manage the processes within Outlook rather than outsourcing to yet another third-party platform.

D365 Business Central Automation

Though we’re able to increasingly outsource major business functions to digital tools (rather than, say, analog ledger logs), we’re still often burdened by tedious manual data entry that both demands undue time and attention while increasing risk of error and, in the worst cases, outright fraud.

That’s where workflow automation come in – by automating the tedious, repetitive, and simple (but time-consuming) tasks, D365 Business Central helps business owners unlock one of their most valuable assets: time capital.

D3654 leverages one of Microsoft’s emerging AI-powered tools, dubbed Copilot, to execute those automations. While its automations range the operational spectrum, one of the most useful to company financial teams is streamlined bank reconciliation, accomplished by leveraging Copilot AI to analyze bank statements, match them to existing transactions, and create entry proposals for any unmatched transactions.

Combine D365 Business Central’s workflow automations with enhanced accounts payable tools, like Nanonets, and you can create a virtual flywheel that needs little-to-no human intervention or oversight – just periodic review to ensure all remains on track.

D365 Business Central Pricing

Though you can try it for free, D365 Business Central starts at $70 per user per month for the Essentials plan. The platform’s Premium tier costs $100 monthly.

D365 Business Central Limitations

As with any off-the-shelf solution, some will find drawbacks and limitations to D365 Business Solutions. Assuming that you’re part of the target audience (SMBs) and not a large or complex operation, common limitations include:

- Fewer customization options than fully scaled ERPs.

- It is a somewhat high cost, particularly if you intend for all staff and employees to use the system.

- While the tools nest perfectly within Microsoft’s ecosystem, you may have trouble synchronizing unrelated third-party platforms and applications.

Microsoft Dynamics 365 Finance and Operations

Microsoft Dynamics 365 Finance and Operations (D365 F&O) is a scaled ERP offering many of the same core upstream functions as D365 Business Central with two differences: it’s targeted at larger, more robust, and complex operations, and it has a greater level of tool granularity and customization to fit those large organizations’ unique needs.

Note that Finance and Operations technically refers to two discrete services – D365 Project Operations and D365 Finance. But, since they’re complementary and typically used in tandem, it’s simplest to look at both from a single-unit perspective.

D365 Finance and Operations Analytics and Insights

On the financial side, D365 F&O’s key strength for large organizations lies in its robust suite of analytics opportunities to help companies optimize their financial landscape and accurately forecast different contingencies and courses of action to drive strategic decision-making. These tools include:

- Cash flow monitoring and trend projections.

- AI-powered customer payment predictive tools to mitigate write-offs.

- Budget optimization using historical data analysis.

- A range of reporting and operational workflow analytics suits nearly every imaginable need.

D365 Finance and Operations Process Management

Far too often, we find ourselves mired in the administrative minutia, diving too deeply into systems and processes that may optimize our operations but at the cost of hundreds of work hours (or more) dedicated to developing, fine-tuning, and tweaking those systems. D365 F&O relieves some of this burden by simplifying common workflows and processes, such as:

- Remote and mobile time and expense submission.

- Effective compliance oversight, whether aligned with internal controls or regulatory requirements.

- Accurate reporting and insights to see which workflows work, which need tweaking, and which don’t add value.

D365 Finance and Operations Automation

With automation a hot topic across businesses with AI’s advent, it’s little surprise that D365 F&O also gives users a range of automation tools to streamline processes, which, coupled with its process management features, can cut down on time spent executing manual processes while minimizing human error. These automation workflows include:

- Digitized invoicing for both accounts payable and receivable.

- Rules-based and predictive credit management to assess client non-payment risk and manage cash flow.

- Centralized business intelligence integrations to aggregate data into an easy-to-read and understandable dashboard.

D365 F&O also synchronizes with Nanonets to turbocharge your accounts payable automation by streamlining the entire Microsoft Dynamics system processes, starting from import and proceeding through GL coding and vendor creation, then finishing with bill synchronization in D365.

D365 Finance and Operations Pricing

D365 Finance and Operations is an enterprise-level platform; as such, it’s priced at an enterprise-level price point. Expect to pay $120 per user per month for D365 Operations, while D365 Finance costs $180 per user per month for the basic platform and $300 monthly for advanced features.

D365 Finance and Operations Limitations

If you’re an SMB, you’ll likely find D365 F&O well beyond your personal price point. If you’re an enterprise-sized client seeking solutions, though, note that common D365 F&O complaints include:

- A lengthy and somewhat complex integration, implementation, and onboarding process; complexity scaled the larger your organization.

- A point related to the previous bullet is user training – expect an extensive onboarding process for existing and new employees; this is compounded if your organization is used to working with other providers.

- As you saw in the previous paragraph, costs are high even for large companies.

Last Look: D365 Business Central vs. D365 Finance and Operations

Microsoft Dynamics 365 Business Central and Microsoft Dynamics 365 Operations and Finance offer similar core features, but their implementation and scope are quite different. Smaller organizations will benefit from D365 Business Central’s key features and can likely replace a range of platforms for a similar total price. Likewise, enterprise-level clients will likely find all they need in D365 F&O – though at a steep cost.

Still, if you’re interested in pulling the trigger on either Microsoft D365 platform but are either 1) worried about synching your existing software ecosystem or 2) find a few features missing, don’t worry – both Business Central and D365 F&O offer third-party integrations to help integrate your operational landscape and cover any gaps in the platforms you may uncover.

For example, Nanonets integrates with Microsoft D365 to offer improved AP automation tools that build upon Microsoft’s sturdy foundation. For example, Nanonets’ integration lets users kickstart accounts payable processes and workflows simply by forwarding an invoice – Nanonets takes it from there, using AI to extract customer data, vendor, chart of accounts, payment info, and more before ensuring the info is accurately and rapidly migrated into Microsoft Dynamics 365.

[ad_2]

Source link