[ad_1]

What is Balance Sheet Reconciliation?

What is a Balance Sheet?

A balance sheet is a financial statement that provides a snapshot of a company”s financial position at a specific point in time. Balance sheet reconciliation is a critical financial process that aligns the financial statements with external documentation such as bank statements, invoices, and general ledger entries.

What is Balance Sheet Reconciliation?

Balance sheet reconciliation resolves any discrepancies in the financial statements with external documentation so that companies adhere to accounting standards and reflect their actual financial position.

By doing regular balance sheet reconciliations, financial teams can address fraudulent activity, detect errors, and resolve discrepancies promptly. Accurate and timely financial reporting is important in maintaining trust with stakeholders and making informed business decisions.

Challenges of Balance Sheet Financial Close

The reconciliation process during the financial close can be challenging for finance teams due to disconnected data sources, a lack of automation, and the sheer volume of transactions. When faced with issues like complex data, finance teams can make human errors and inconsistencies since manual data entry increases errors, transposition errors, and missing transactions. This might lead to potential financial losses and incorrect reporting. It is estimated that manual reconciliation can lead to an extra 5-7 business work days of error rectification and bookkeeping, problems that can be solved via automated reconciliation software like Nanonets.

Manual reconciliation processes are more complex when balance sheet transactions require reconciliation across multiple general ledgers, ERPs, invoices, and bank accounts. These involve a tremendous amount of work to be managed on spreadsheets. There are specific checklists that you can, however, follow to do manual reconciliations across your balance sheets.

Finance teams can also follow specific templates designed to reconcile their balance sheets manually. These involve check-marking, the ability to adjust balances, and documenting any findings during the balance sheet reconciliation process.

How to Reconcile Balance Sheet Accounts

During balance sheet reconciliation there are several steps that we need to ensure from your end in order to successfully reconcile your entries:

- Identify the accounts that need to be reconciled:

First, we need to identify which accounts need to be reconciled. These could be balance sheet accounts like cash, accounts payable, accounts receivables, credit cards, etc. - Gather Supporting Documentation:

Gathering necessary documents like bank statements, sub-ledger entries, vendor invoices, payment schedules, and other financial records. - Compare Balances:

Compare the balances in the balance sheet with the supporting financial document. These mean matching each amount line by line, noting down the exact date and time of the transactions. - Categorize Variances:

Note any differences between the balance sheet amounts and the supporting documentation. These differences are variances that need to be investigated further. There can 3 major types of variances:- Timing Differences:

These occur when transactions are recorded in different periods in the balance sheet and supporting documents. For example, a bank deposit recorded in the company’s books at the end of the month might not appear on the bank statement until the next month. - Errors:

These can include data entry mistakes, incorrect amounts, or misclassifications. - Unrecorded Transactions:

Transactions that have occurred but have not yet been recorded in the balance sheet.

- Timing Differences:

- Resolve Issues:

Once you have identified the root cause of a discrepancy, take the necessary steps to resolve it. This may involve adjusting the general ledger, journal entries, or other accounting records. - Document Findings:

Document your findings and any changes made to the general ledger or journal entries. This helps controllers, auditors, and other professionals track down any changes and accelerates future reconciliations by identifying and documenting recurring issues

Balance Sheet Account Reconciliation Example

We have added an example of what reconciliation might look like for reconciliation between a company’s bank statement and its internal documentation or company books:

Month Ended May 31, 2024

| Item | Amount |

|---|---|

| Cash balance as per bank statement, 5/31/2024 | $20,000 |

| Add: Deposit in transit | $3,000 |

| Adjusted cash balance | $23,000 |

| Deduct: Outstanding checks | $1,500 |

| Adjusted cash balance | $21,500 |

| Cash Balance per books, 5/31/2024 | $21,500 |

| Add: Interest | $50 |

| Adjusted cash balance | $21,550 |

| Deduction: Monthly service fee | $50 |

| Adjusted cash balance | $21,500 |

The starting point for the reconciliation statement is the cash balance as per the bank statement for the period (here 5/31/2024) – this marks the amount that the bank reports at the end of the period. The amount that we note over here is $20,000.

Note the balance as per the books recorded by your company at the end of the period. Successful reconciliation means that your company’s books and the bank statement report the same amount. We note this to be $21,500 as of 5/31/2024.

Deposits in transit record entries that have been marked as received by the company but haven’t been recorded in the bank yet. Since these deposits are typically made near the end of the period, they are typically reflected in the next period. The adjusted bank balance here becomes $23,000.

Outstanding checks are entries issued by your company but have not been deducted by the bank yet. Since the bank has not yet recorded them, we must subtract these entries. $23,000 – $1,500 = $21,500.

Any interest that your company earns inside the bank will not be recorded by your books. We will need to add the interest to the balance as per the books, which comes out to $22,000.

The bank charges Monthly service fees for maintaining the account, which may not have been recorded by the company yet. The service fee needs to be deducted from the balance per the books. So final adjusted cash balance is $21,500, which means a successful reconciliation!

Challenges with Manual Balance Sheet Reconciliations

Finance teams are faced with a lot of challenges when they choose to manually reconcile their balance sheets. These lead to inaccuracies and hinder the efficiency of the over reconciliation process and poor financial reporting. Specifically these are the issues that you can come across:

- Human Error:

Manual reconciliations are error prone due to to high data volumes, time constraints and unintentional mistakes. - Scalability Issues:

As your organisation grows, the volumes and complexities which involve manual resolution increases rapidly. This might lead to greater potential issues. - Time Consumption:

Manual reconciliation involves compiling, validating and processing data across spreadsheets which can delay immediate and timely reconciliations. - Disconnected Data sources:

When faced with multiple data sources like ERPs, bank statements, vendor invoices and sub-ledger entries, consolidating all the data at one place can also prove to be major hindrance. - Insufficient Documentation:

If the reconciliation process lacks comprehensive and well-documented explanations, auditors may struggle to grasp the intricacies of the process, potentially raising doubts about the accuracy of reported figures - Time Consumption:

Manual reconciliation involves extensive time spent on compiling, validating, and processing data through spreadsheets, which can delay immediate tasks and hinder forward-looking business planning - Spreadsheets across stakeholders:

While your finance team might involve top tier spreadsheet wizards, they are error prone and can lead to inaccurate financial data. According to a study by IBM, 88% of all spreadsheets contain at least one error.

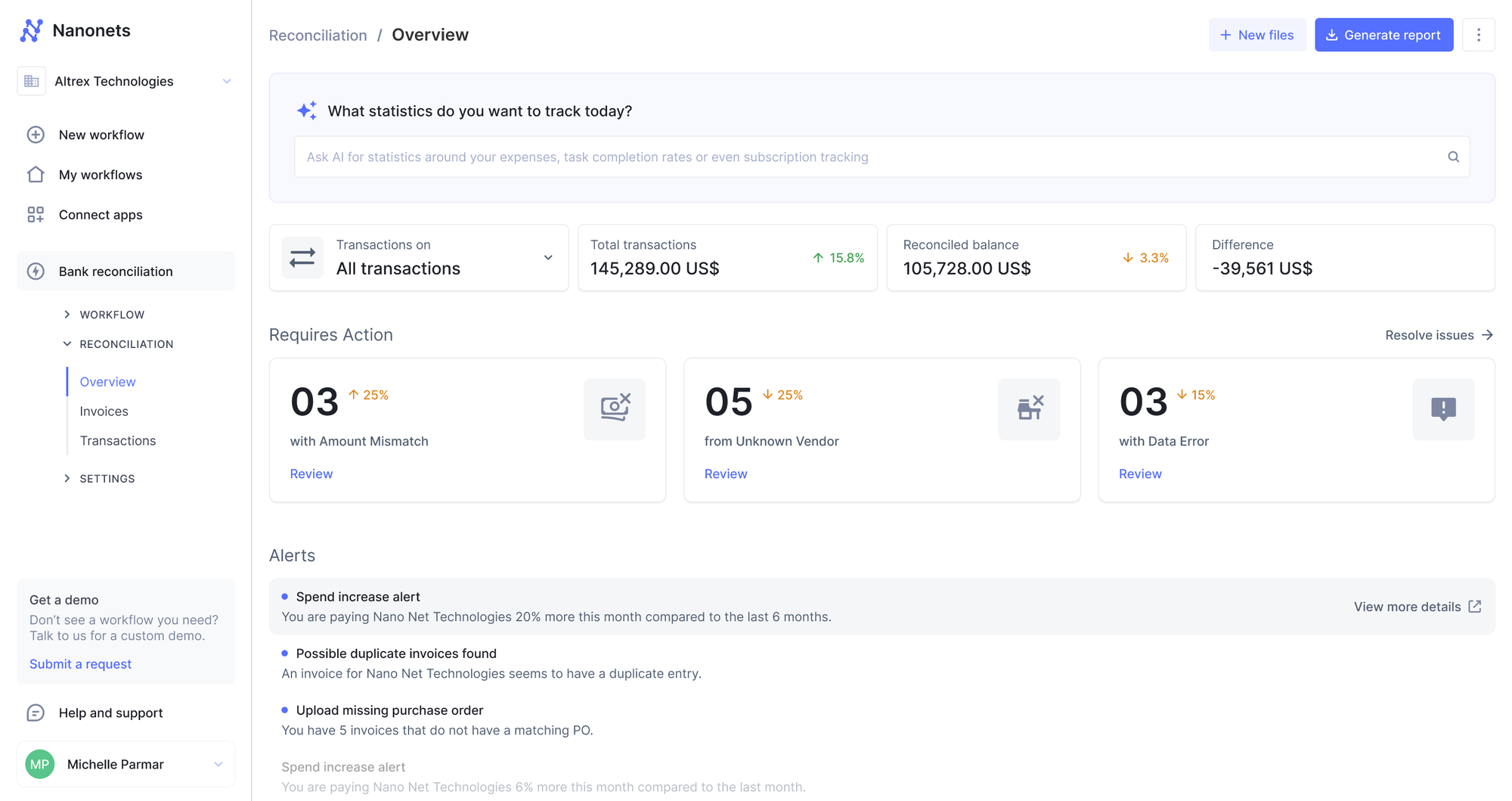

Automated Balance Sheet Reconciliation with Nanonets

Automated Reconciliation software like Nanonets can help seamlessly solve the account reconciliation problem involving balance sheets. Nanonets offers numerous benefits for balance sheet reconciliation, making the process more efficient, accurate, and streamlined. Here are some key advantages:

Increased Efficiency and Speed

Nanonets can process large volumes of transactions quickly, significantly reducing the time spent on manually reconciling each transaction entry individually.

Organizations have reported that AI data entry can automate up to 95% of repetitive data tasks. This frees up employee time for higher-value work.

So even if your transaction records are not imported into spreadsheets, you can directly upload them on Nanonets for data extraction and consolidation.

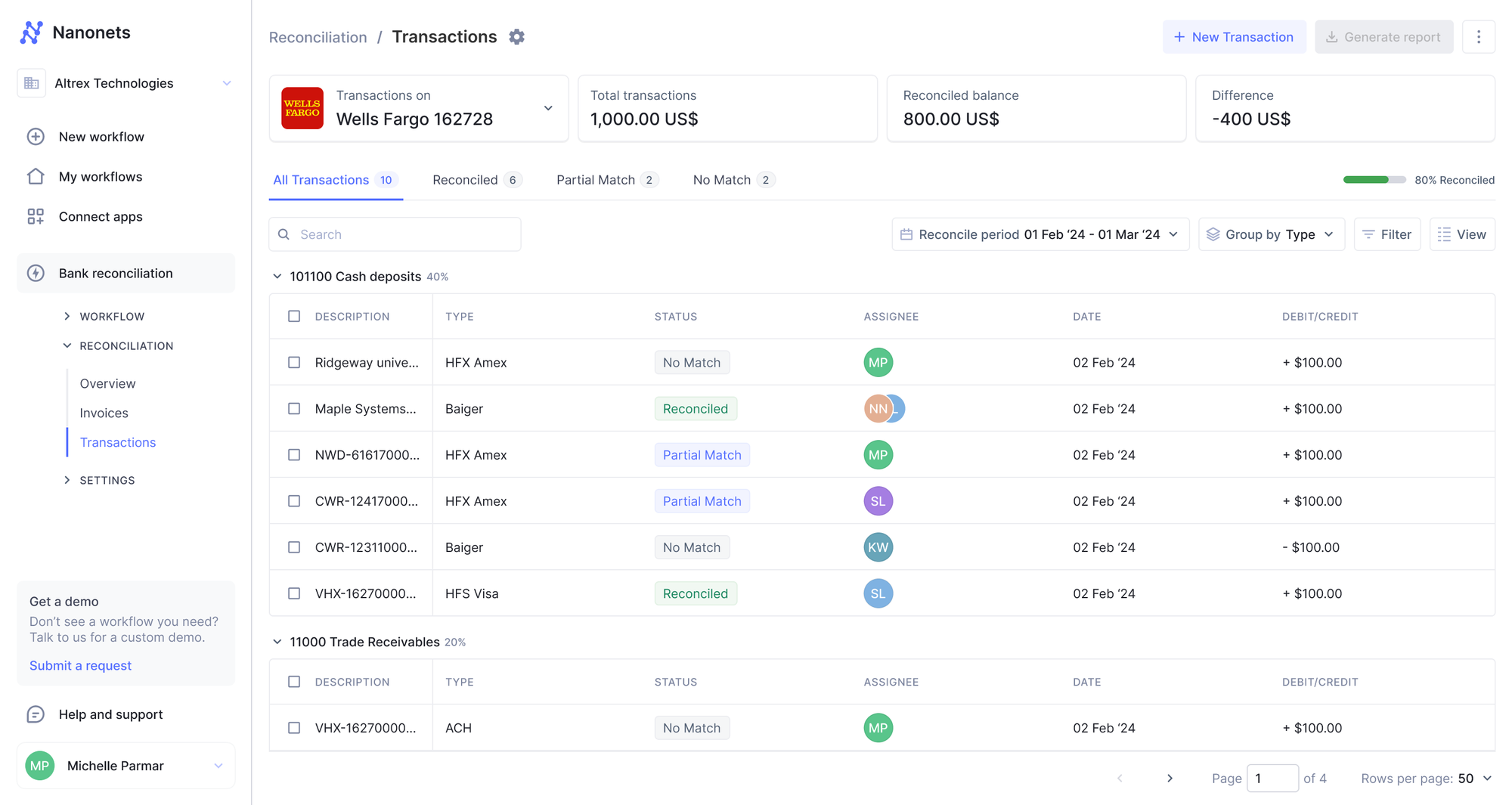

Streamlined Workflows

Since Nanonets is a workflow automation platform, repetitive tasks are automated and accounting tools are integrated cohesively within the Nanonets platform. This solves the issues of disconnected data sources and time wasted manual tasks.

By automating the reconciliation process end-to-end, automated reconciliation software like Nanonets improves accuracy, reduces errors, and provides valuable insights into a company’s financial health

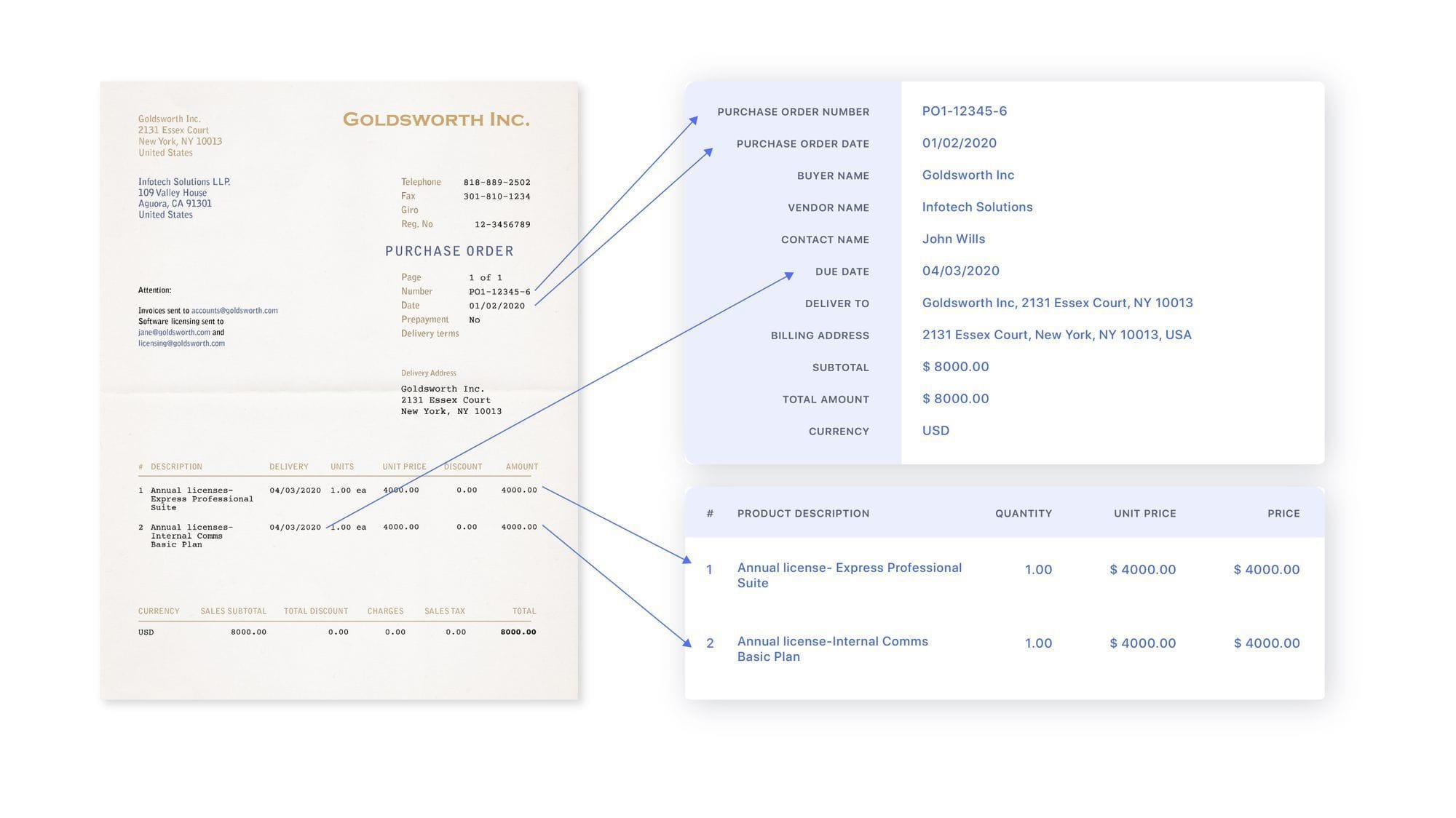

Automated Transaction Matching

Nanonets’ Intelligent Document Processing is trained on 1M+ documents to leverage automated matching of transaction entries. This mean those transactions are identified as the best match based on column names, date, amount etc ensuring 95% accuracy. When these algorithms fail Nanonets tries to make a match using fuzzy matching capabilities as a failsafe.

Enhanced Visibility and Control

Solving the problem of keeping track between multiple spreadsheets, Nanonets’ platform provides a consolidated report of all your account reconciliation statements in one place. This means one report to summary multiple financial documents like ERP’s, bank statements, vendor invoices and sub ledger entries.

In summary, automated reconciliation software like Nanonets enhances the efficiency, accuracy, and overall effectiveness of the balance sheet reconciliation process, providing significant advantages over manual methods.

FAQs

Why Do We Only Reconcile Balance Sheet Accounts?

Balance sheet accounts are reconciled more frequently because they are considered permanent (or continuous) accounts, meaning they carry balances over from one accounting period to the next.

How Often Should We Reconcile Balance Sheet Accounts?

Balance sheet accounts are usually reconciled on a timeline that coincides with either the month-end close or less frequent financial close. This means they can be done as often as monthly but are usually done quarterly or yearly

What Is the Role of Balance Sheet Reconciliation in the Financial Close Process?

Balance sheet reconciliation is an essential part of closing the books because it ensures that the Office of the CFO is working with accurate data. Otherwise, you might finalize your financial statements without accounting for important errors that could skew the results significantly

[ad_2]

Source link