[ad_1]

What is the Vendor Reconciliation Process in Accounts Payable

Vendor reconciliation is a critical practice in accounts payable to ensure the completeness and accuracy of vendor payments. Before making payments to vendors, it”s essential to check that the vendor bills the company the correct amount.

Accounts payable teams must reconcile payments regularly to avoid double-processing them. The process involves matching the amounts that your vendors bill and comparing them to the company’s accounts payable documents. By periodically performing vendor reconciliation, accounts payable teams ensure that the amounts recorded by both parties match exactly.

We will walk you through the following in this blog post:

- Why is Vendor Reconciliation so important?

- Steps Involving Vendor Reconciliation

- Example of Vendor Reconciliation

- Challenges with Vendor Reconciliation

- Automated Vendor Reconciliation workflow with Nanonets

Ready to Experience Seamless Reconciliation?

Say goodbye to manual errors, time-consuming tasks, and financial discrepancies. With Nanonets, you can automate your vendor reconciliation workflow, ensuring accuracy, efficiency, and peace of mind.

Why is Vendor Reconciliation so important?

Vendor Reconciliation is a critical practice to ensure the company’s balances are correctly owed to the vendors.

It serves quite a few crucial purposes like:

- Prevents Overpayments: Vendor reconciliation helps detect and deter overpayments to vendors by matching vendor statements with internal payment records, which can save the business thousands of dollars. Vendors might delete paid entries, and the company might process double payments without regular reconciliation.

- Ensures Accuracy: It verifies the balance of vendor accounts at the end of the period, ensuring that all transactions are accurately recorded and accounted for.

- Detects Fraud: This process can help identify fraudulent activities, such as intentional errors in invoices or statements, and prevent financial losses

- Maintains Good Vendor Relationships: Regular vendor reconciliations help maintain good vendor-client relationships by ensuring timely and accurate payments, reducing the need for follow-ups and disputes.

- Provides Better Budgeting: With accurate and up-to-date vendor payment data, businesses can create more informed budgets and make better financial decisions.

Steps Involving Vendor Reconciliation

Accounts Payable teams must adhere to the important features of accurate, regular vendor reconciliation. By doing so, they can maintain good vendor relationships, detect fraud, and support audit trails.

They can do so by following these steps:

Gather All the Documents:

Ensure that all the documents associated with vendor payments have been gathered. This means consolidating paperwork like vendor invoices, payment receipts, and bank statements.

Examine Vendor Invoices:

It is critical to examine each vendor’s invoice details and check for human-made errors. Each invoice can contain mistakes in vendor names, amounts, and invoice numbers. Also, ensure that the invoices are recorded in the accounts payable system.

Match Line Items:

Identify and eliminate line items that match the vendor statement and accounts payable records. Ensure that the vendor invoice correctly aligns with the Accounts Payable system for each item. Errors in logging payments correctly, duplicates, or missing entries may lead to incorrect reporting.

Reconcile Discrepancies:

Spot any differences, such as missing payments or invoices. Identify which items are present on the vendor statements but not in the accounts payable ledgers. These issues typically happen due to timing differences, missing entries, etc. Document the root cause of errors in resolving discrepancies.

Check Bank Statements:

Verify that all purchase transactions are authorized and processed correctly. Ensure that amounts recorded by the Accounts Payable ledger match the bank statement history for the amounts paid.

Allocation of Credit:

Note instances where the supplier extends a credit agreement. In this case, the company needs to ensure all credit notes are associated with the vendor statement.

Check Bank Statements:

Verify that all purchase transactions are authorized and processed correctly. Ensure that amounts recorded by the Accounts Payable ledger match the bank statement history for the amounts paid.

The opening balance of the Accounts Payable Ledger should provide a view of the amount the company has spent on accounts payable according to internal accounting records, which should, in turn, coincide with the vendor invoices. The team needs to ensure that this amount is equal to the bank statement, underlining the actual amount that was processed via the bank.

Because of the complicated three-way matching, disconnected data sources, and consolidation of paperwork, vendor reconciliation proves to be a highly manual, unscalable process prone to human errors.

Example of Vendor Reconciliation

A company, ABC Manufacturing, purchases raw materials from a vendor, XYZ Supplies. At the end of the month, the accounts payable team of ABC Manufacturing undertakes the activity of vendor reconciliation to ensure all transactions are accurately recorded and there are no discrepancies.

Here’s how the team approaches the task manually:

- Gathering All the Documents: The team gathers all the related documents, including purchase orders, delivery receipts, vendor invoices from XYZ Supplies, payment receipts, and bank statements.

- Examine Vendor Invoices: The team reviews each of the vendor invoices and checks for accuracy within the records. They find an invoice of $5000 for a shipment of raw materials.

- Match Line Items: The team compares each line item with the accounts payable ledger or internal recording system after ensuring that the purchase order, delivery receipt, and invoice align correctly.

- Reconcile Discrepancies: During this step, the team identifies a discrepancy: an invoice for $2,000 from XYZ Supplies that is not recorded in their accounts payable system. After investigating, they discovered that the invoice was misplaced and needed to be recorded.

- Check Bank Statements: The team verifies that all payments made to XYZ Supplies are correctly reflected in the bank statements. They ensure that the payments match the amounts recorded in their accounts payable ledger. For instance, they find that the $5,000 payment is correctly recorded in the bank statement, matching the invoice amount.

- Verify Opening Balances: They check the opening balance of the accounts payable ledger to ensure it aligns with the vendor invoices and bank statements. They confirm that the amount the company has spent on raw materials matches the total amount recorded in the bank statements for payments to XYZ Supplies.

Challenges with Vendor Reconciliation

Vendor Reconciliation can be a daunting task faced by Accounts Payable teams due to the following issues:

Volume of Transactions: The manual reconciliation process is inefficient for businesses that have a lot of vendors and invoices to deal with.

Data Entry Errors: Entering data manually could be error-prone and cause inaccurate reconciliation and financial reporting.

Discrepancies in data: Without the provision of proper documentation, accounts payable teams face a time-consuming task in identifying and resolving discrepancies.

Different formats of data: When vendor documents are in different formats, it’s time to templatize them into a given format for effective reconciliation.

Duplicate Payments: Without regular reconciliation activities, there is always a risk associated with processing payments twice. Not having the proper documentation and notes can lead to this issue.

Using software like Nanonets’ AI Reconciliation can help benefit accounts payable teams in the following ways:

Efficient Handling of High Transaction Volumes

Manual reconciliation struggles to keep pace with high transaction volumes, especially for businesses dealing with numerous vendors and invoices. Nanonets’ automated system effortlessly processes large datasets, ensuring that no transaction is overlooked. This efficiency saves time and reduces the risk of errors associated with manual handling.

Quick Resolution of Data Discrepancies

Identifying and resolving discrepancies between company records and vendor statements can be time-consuming. Nanonets uses advanced algorithms to detect and highlight discrepancies instantly. This feature allows finance teams to quickly pinpoint the root causes of discrepancies, facilitating faster and more accurate reconciliation.

Elimination of Duplicate Payments

The risk of duplicate payments is a constant concern in manual reconciliation. Nanonets’ automated system meticulously checks for duplicate entries and flags them for review, significantly reducing the chances of duplicate payments. This accuracy helps maintain financial integrity and avoids unnecessary expenses.

Minimization of Data Entry Errors

Manual data entry is prone to mistakes, leading to inaccurate reconciliation and financial reporting. Nanonets automates data capture and entry, drastically reducing human error. By ensuring data accuracy, businesses can trust their financial reports and make better-informed decisions.

Timely Reconciliation

Delays in vendor reconciliation can affect cash flow management and strain vendor relationships. Nanonets automates the reconciliation process, ensuring that it is completed promptly. Timely reconciliation helps businesses manage cash flow more effectively and maintain healthy relationships with their vendors by ensuring on-time payments.

Optimal Resource Utilization

Many businesses face resource limitations regarding staff, technology, and tools for efficient reconciliation. Nanonets offers a scalable solution that optimizes resource utilization. By automating repetitive tasks, your team can focus on more strategic activities, improving overall productivity without the need for additional staff or expensive tools.

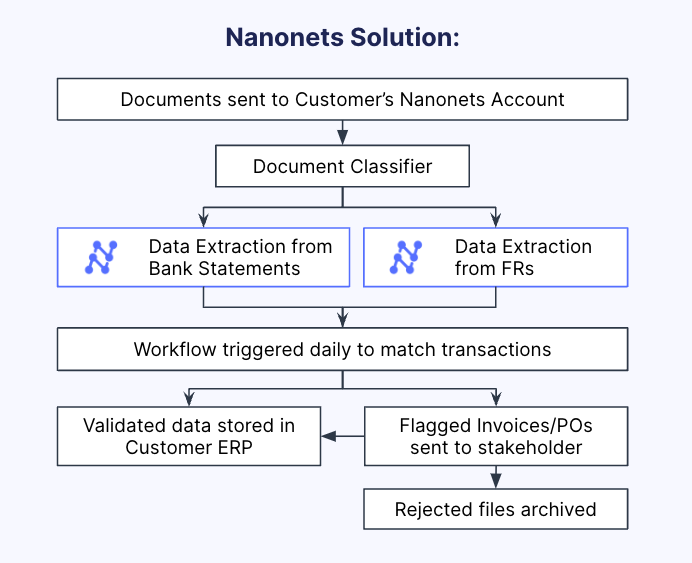

Automated Vendor Reconciliation workflow with Nanonets

Step 1: Gathering Documents

Traditional Approach: Gathering piles of receipts, invoices, and bank statements is time-consuming and prone to errors.

Nanonets Solution: With Nanonets, gathering documents manually is no longer required. All your sources, including bank statements, vendor invoices, and other relevant documents, can be uploaded in any format or integrated directly via accounting tools. This automation eliminates the need for manual document collection and organization.

Step 2: Data Extraction and Standardization

Traditional Approach: Manually verifying and entering data from various documents can lead to inaccuracies and inconsistencies.

Nanonets Solution: Nanonets extract data with high accuracy using Optical Character Recognition (OCR) technology and templatize all vendor statements into a consistent format. This ensures that all data is standardized, making it easier to compare and analyze.

.png)

AI document processing solutions for workflow challenges

| Challenge | Action |

|---|---|

| Data Inaccuracy | Eliminates errors through precise machine learning-driven extraction. |

| High Volumes of Data | Rapidly digests bulk documents, effortlessly scaling with business expansion. |

| Compliance Failure | Automates compliance measures, maintaining strict adherence to regulations. |

| Unstructured Data | Deciphers and accurately extracts data from diverse formats using advanced AI. |

| Existing Systems Integration | Fluidly integrates and syncs data with existing systems, ensuring smooth transitions. |

| Multiple Languages | Breaks language barriers, processing documents in various languages with ease. |

| Limited Visibility | Grants real-time monitoring and control for swift issue identification and resolution. |

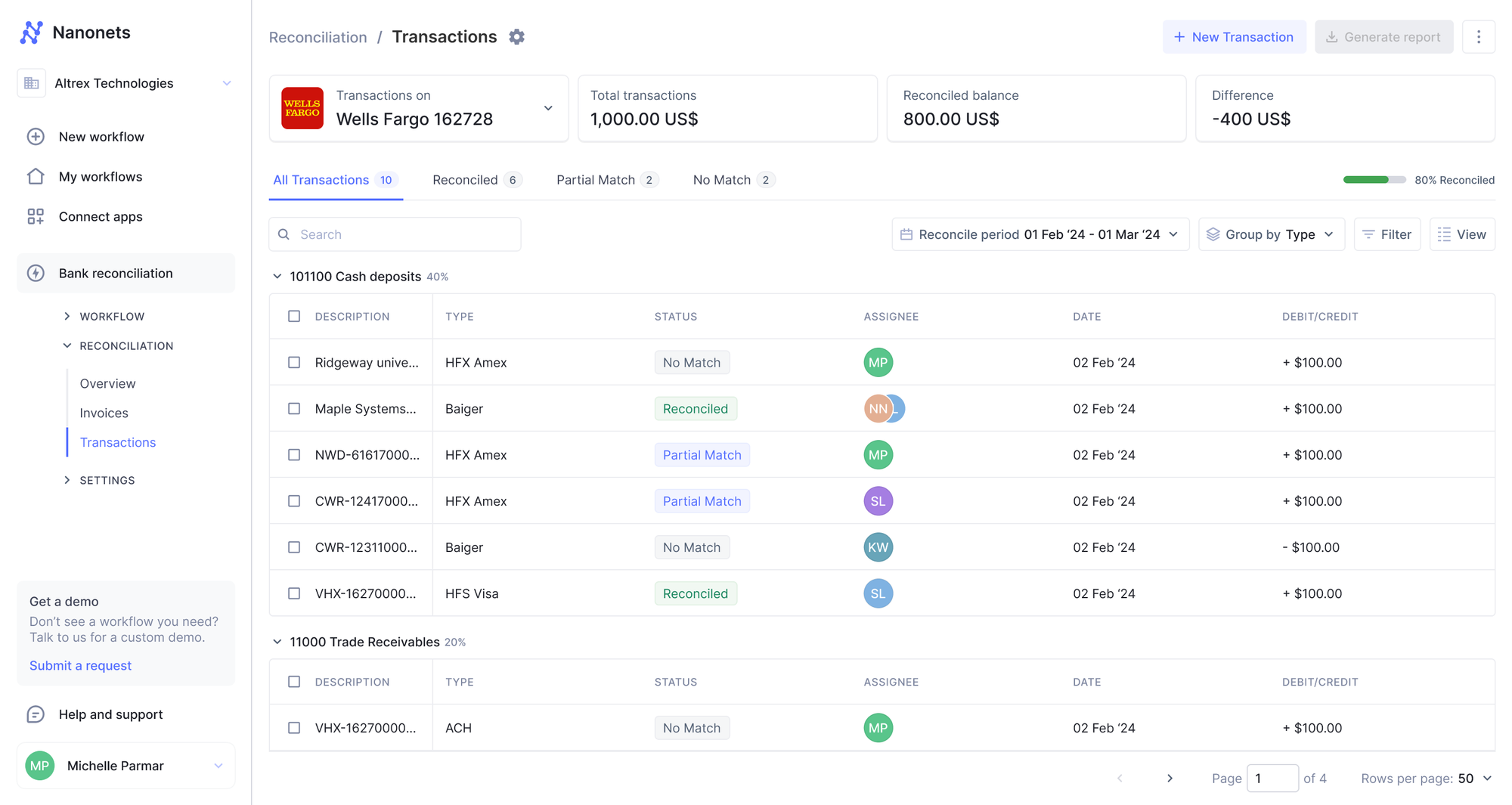

Step 3: Matching Transactions

Traditional Approach: Matching vendor statements with invoices manually is a tedious task, often leading to missed discrepancies and errors.

Nanonets Solution: Nanonets uses Natural Language Processing (NLP) and fuzzy matching techniques to automatically match transactions from vendor invoices to the accounts payable ledger. It continuously checks these against bank statements, flagging any discrepancies for further review. This automated matching ensures high accuracy and saves significant time.

Step 4: Reconciling Inconsistencies

Traditional Approach: Identifying and reconciling inconsistencies requires meticulous attention to detail and can be highly time-consuming.

Nanonets Solution: Nanonets regularly reconciles vendor statements, automatically identifying and highlighting any inconsistencies. The system learns from manual inputs and adjusts its algorithms to improve future reconciliation processes. This ensures that discrepancies are quickly and accurately resolved, reducing the risk of errors and fraud.

Step 5: Preventing Duplicate Payments

Traditional Approach: Preventing duplicate payments requires careful tracking and verification, which is often error-prone.

Nanonets Solution: Nanonets’ automated system continuously monitors for duplicate payments, ensuring that each transaction is unique and correctly processed. This prevents the risk of duplicate payments, maintaining financial integrity and optimizing cash flow management.

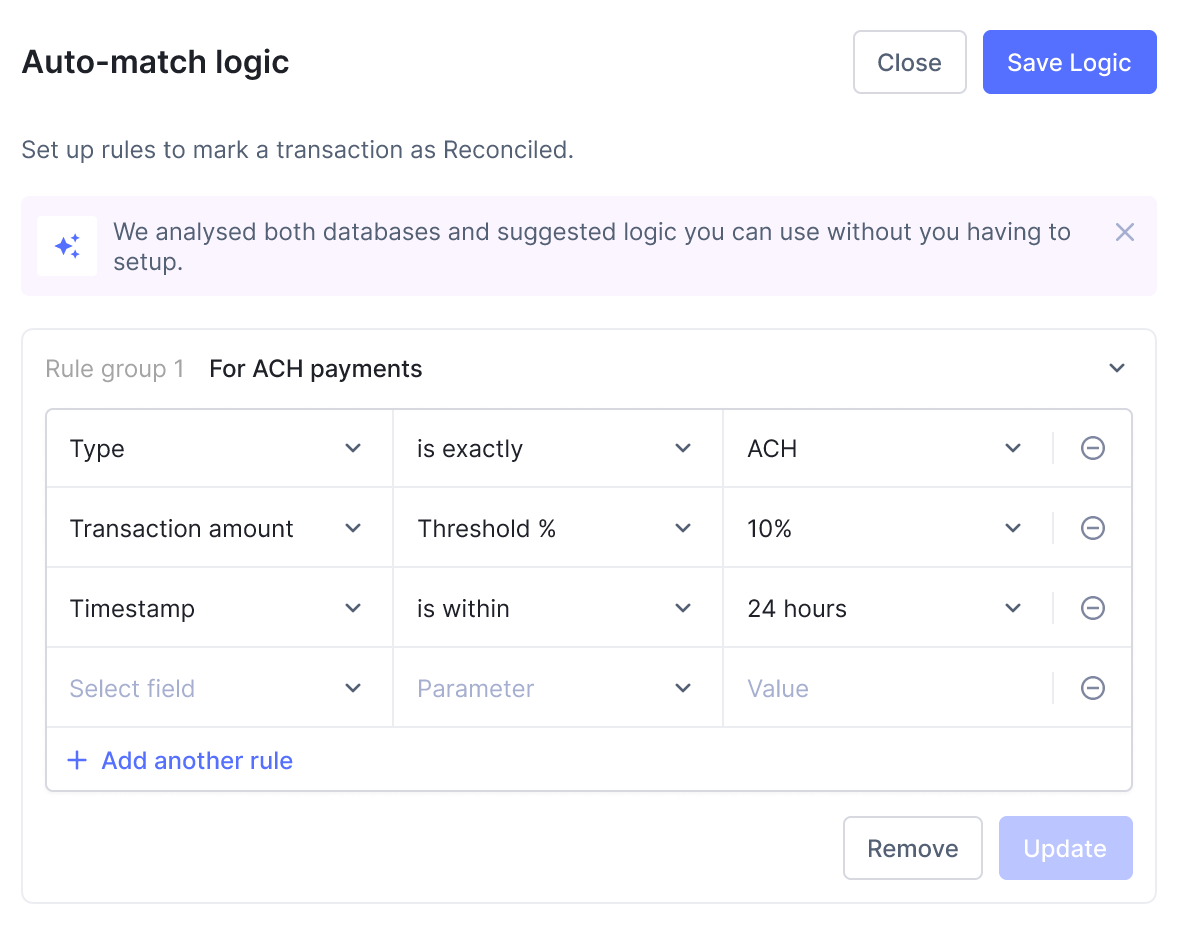

Step 6: Custom and Complex Rule Matching

Traditional Approach: Applying custom rules and handling complex scenarios manually can be challenging and resource-intensive.

Nanonets Solution: Nanonets provide custom and complex rule-matching capabilities. The AI engine constantly learns from manual inputs, adapting to unique business requirements and improving its accuracy over time. This flexibility allows businesses to handle complex reconciliation scenarios effortlessly.

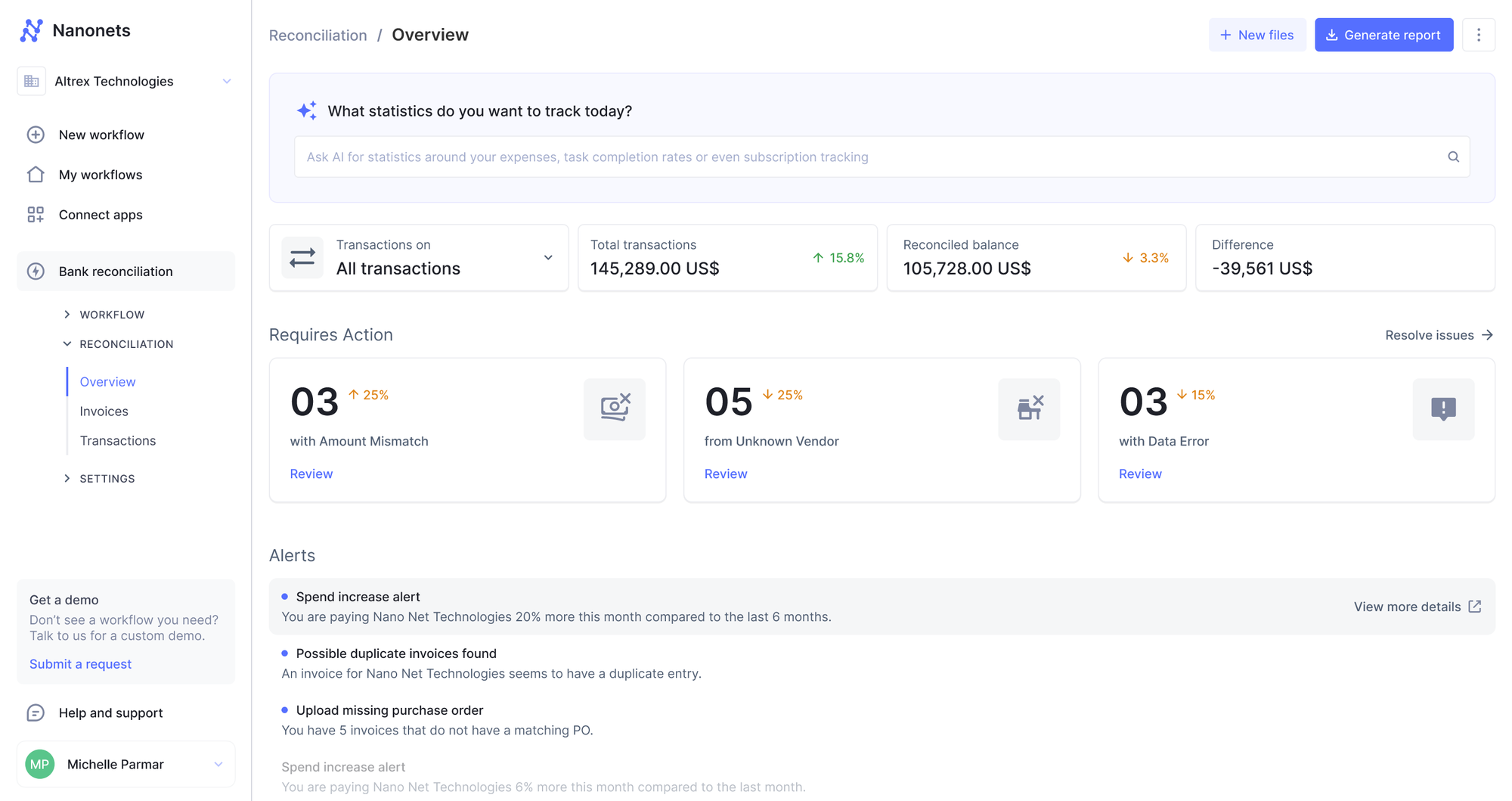

Step 7: Reporting

Traditional Approach: Generating accurate and comprehensive reports manually is a cumbersome process.

Nanonets Solution: At the end of the reconciliation process, Nanonets generates detailed reports, including the opening balance, closing balance, the amount spent according to the accounts payable ledger, and the money issued via the bank, coinciding with vendor invoices. These reports provide a clear and accurate overview of the financial status, helping businesses make informed decisions.

Conclusion

Vendor reconciliation is a critical process across accounts payable teams for accurate financial reporting. It helps in the detection of fraud, overcomes double payment processing, and helps maintain good relationships with vendors. However, the process of manually reconciling vendor statements is error-prone, time-consuming, and not the best use of time for financial teams. Automating the vendor reconciliation process via automated reconciliation software like Nanonets transforms a traditionally complex and error-prone process into a streamlined and efficient operation. By leveraging advanced technologies Nanonets ensures high accuracy, timely reconciliation, and comprehensive reporting.

[ad_2]

Source link