[ad_1]

Introduction

Accounts Payable (AP) are short-term obligations that a company owes to its creditors or suppliers, but company has not yet paid for them. On a company’s balance sheet, payables are recorded as a current liability.

Understanding Accounts Payable: Is it a debit or a credit?

To better understand AP, we must first know the basic concept of debits and credits.

What are debits and credits?

Debit and credit are the two essential accounting terms you must know to understand the double-entry accounting system. A double-entry accounting system records each transaction as a debit or a credit. This ensures that the books are always balanced.

In simple words, debits are amounts owed to someone and credits are amounts someone owes you.

Debit and credit are terms used in finance to indicate changes in account balances. Debiting an account involves recording an amount owed or subtracted, which decreases the account balance.

Conversely, crediting an account involves recording an amount added or deposited, which increases the account balance. In essence, debiting reduces the balance while crediting increases it.

Journal Entries for Debits and Credits

Journal entries are created in accounting systems to record financial transactions. Debits and credits must be recorded in a certain order in an accounting journal entry. Debits and credits in an accounting journal will always appear in columns next to one another. As usual, debits will be shown on the left and credits on the right. When recording a transaction, it is always important to put data in the proper column.

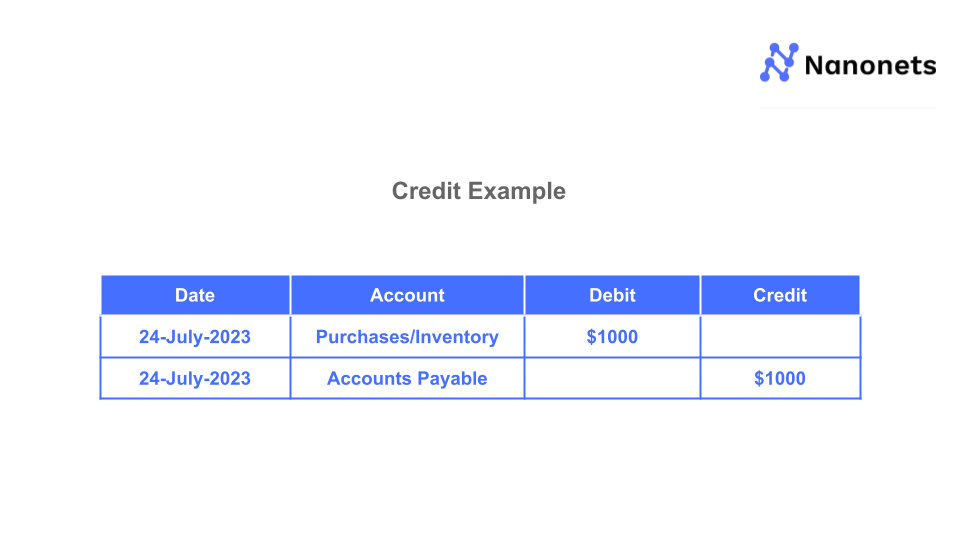

Credit Example:

If the company buys a laptop for its employees for $1000, following is how it will be recorded:

1. Purchases or Inventory account will be debited by $1000

2. Accounts Payable will be credited with $1000

Here is the double entry for buying anything on credit:

Companies often refer to the name of the vendor from whom they have made purchases rather than the “Account payable” account when recording financial transactions. Instead of keeping all the balances under a single account, it enables them to manage their Accounts Payable balances more efficiently.

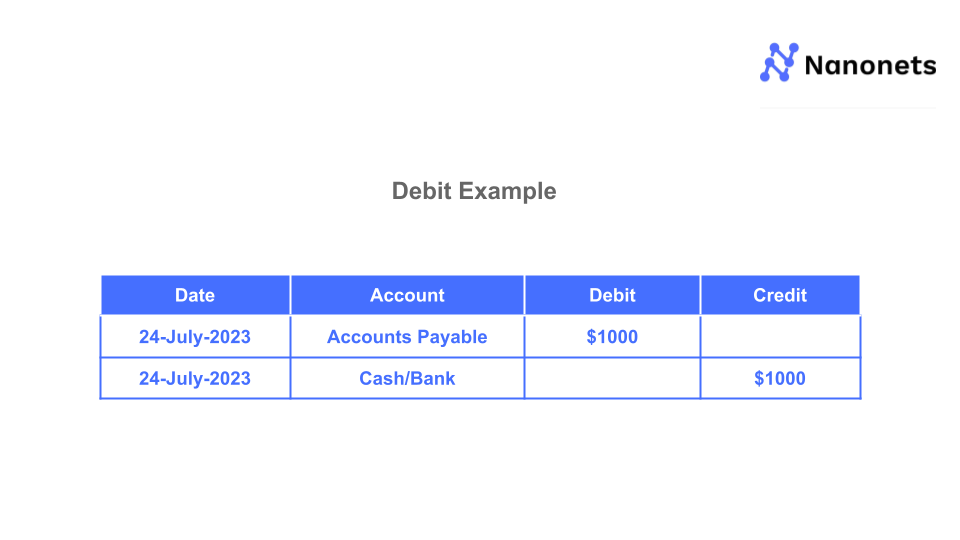

Debit Example:

After the business has settled its debt of $1000 to the vendor, it is required to record the transaction as follows:

1. Accounts Payable account will be debited by $1000

- Cash or bank transfers are the two most common methods that businesses use to make a debit to Accounts Payable. That account will be credited with $1000

Consequently, the double entry for the payback of Accounts Payable should look like this.

What is Account Payable?

Simply put, A company’s Accounts Payable includes any outstanding bills for purchase of goods or services from its vendors. Accounts Payable is a liability since it is a debt.

A credit balance in a payable account means that the company owes money, while a debit balance indicates that the company has settled its debts to a particular vendor. Therefore, the normal balance of Accounts Payable is negative.

Is Accounts Payable debit or credit?

To answer the question, Accounts Payable are considered to be a type of liability account. This means that when money is owed to someone, it is considered to be credit. On the other hand, when someone owes you money, it is considered to be a debit. In this case, Accounts Payable would be classified as a debit.

Depending on the nature of the transaction, Accounts Payable may be recorded as a debit or a credit. Accounts Payable is a liability; hence any growth in that number is typically credited. Accounts Payable are often credited when an entity receives payment but debited when the company is released from its legal obligation to pay the debt.

Accounts Payable are a type of liability, meaning they are a debt your company owes. Liabilities are usually recorded as a credit on your balance sheet. However, Accounts Payable can also be considered a debit, depending on how you structure your chart of accounts.

Credit purchases are the most frequent source of credit in AP. When a business uses credit to buy supplies, the transaction is recorded in Accounts Payable.

Conversely, a debit in Accounts Payable often results from cash being refunded to suppliers, reducing liabilities. Debits in Accounts Payable might also result from discounts or product returns.

Accounts Payable are considered a liability, which means they are typically recorded as a debit on a company’s balance sheet. However, the account may be recorded as a credit if a company makes early payments or pays more than is owed.

Automate data capture, build workflows and streamline the Accounts Payable process in seconds. No code is required. Book a 30-min live demo now. Automate invoice payments with AI.

Recording Account Payable – Examples

The following examples should make it clearer how the entries in the journal are to be made for the Account Payable.

Example 1:

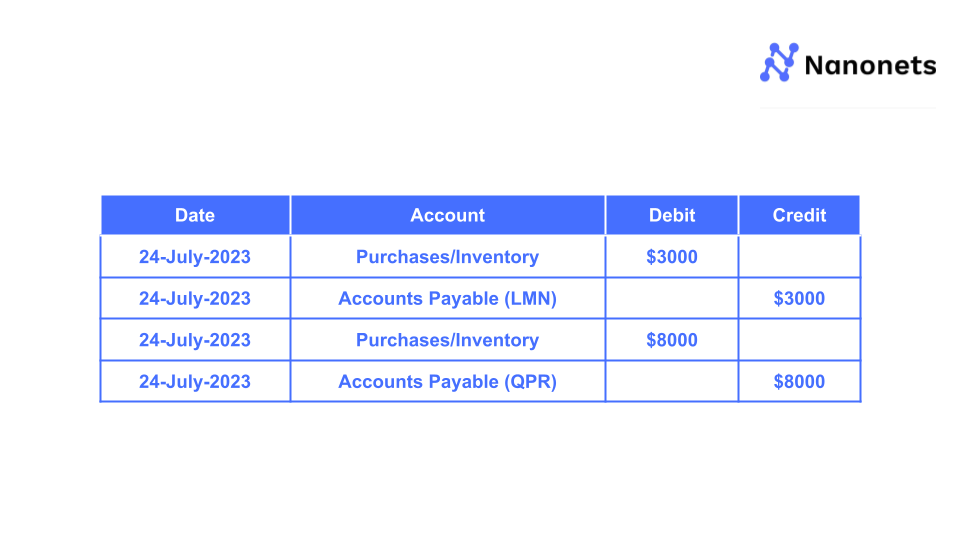

One business, XYZ Company, purchases from another company, LMN Co., for a total of $3000 worth of products. Additionally, it purchases from a different supplier, QPR Co., totalling $8,000 worth of items. These two purchases are being made using credit for one month. The following are the double entries that need to be completed for the purchase that was made from LMN and QPR Company:

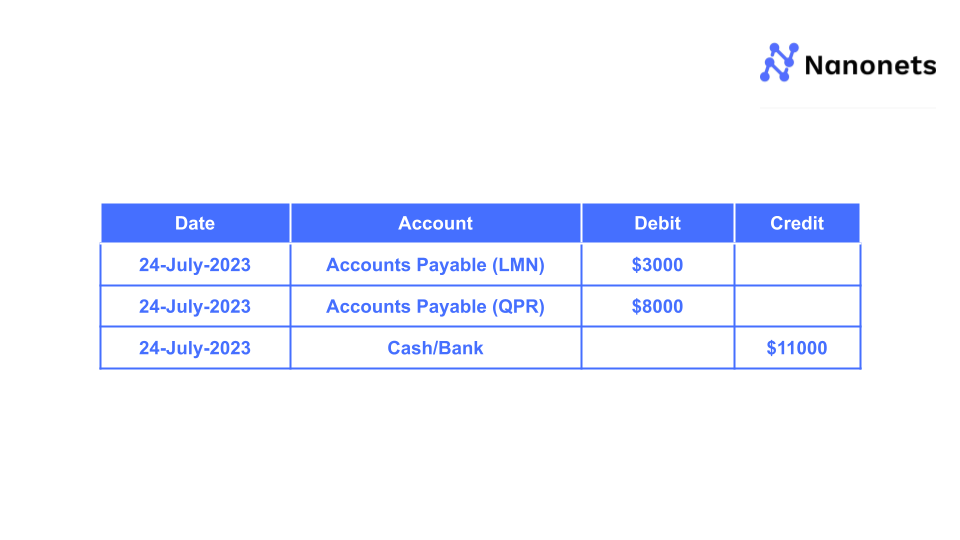

After a month has passed, XYZ Company makes a repayment to LMN and QPR Companies for the purchase made above. The bank or cash source of XYZ Company is used to make a debit to Accounts Payable. The following is the compound accounting entry that should be made to both Accounts Payable ledgers.

This entry nullifies the balance in suppliers’ ledgers, i.e., Accounts Payable (LMN) and Accounts Payable (QPR). The closing balance at the end of the financial year will be zero per these two transactions.

When you pay your rent, you debit your account with the money you owe. So, when tracking transactions in a double-entry accounting system, think of debits as money flowing out of an account and credits as money flowing into an account. This might initially seem confusing, but it will become clear once you start working with examples. Let’s take a closer look at what these terms mean and how they work together in the accounting system.

Example 2:

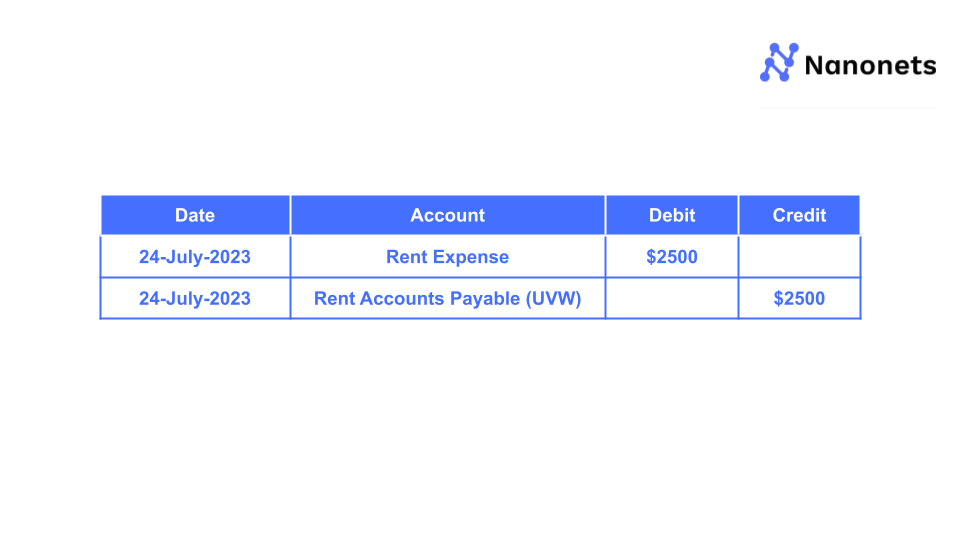

XYZ firm has moved its day-to-day business activities into a location rented from UVW company at the cost of $2,500 per month for the space. XYZ Company is paying rent to UVW Company.

On an accrual basis, the payment of the overdue amount takes place after the rental service has been completed. This implies that first, the service is enjoyed, and then the payment for it is made after it has been provided for a month.

The following is how the double entry for the rental service appears for the company that was bought from UVW:

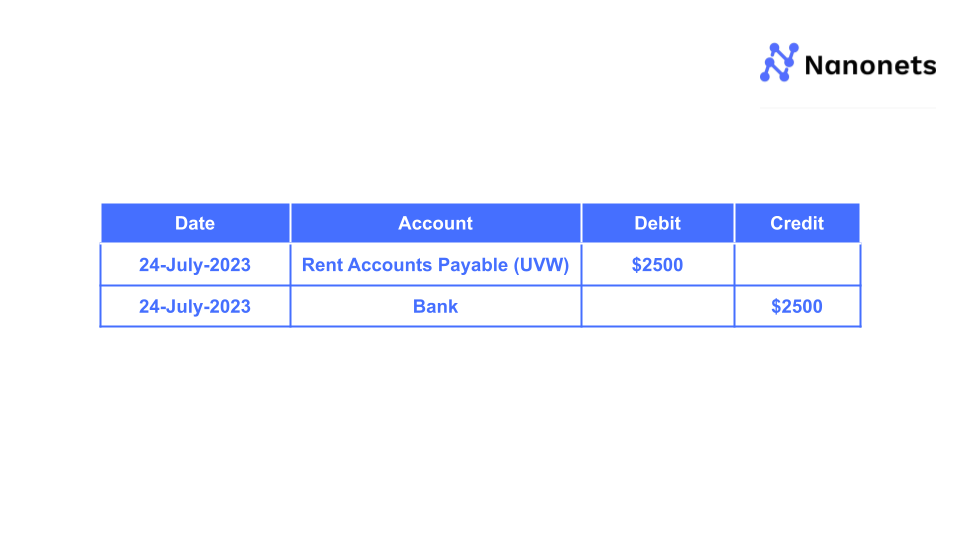

After a month, UVW will receive the overdue sum of $2,500 in payment. The submission must be made in the following format:

What is meant by a “Turnover Ratio” for Accounts Payable?

A company’s short-term liquidity may be evaluated by calculating a ratio known as Accounts Payable turnover. This ratio represents the average pace at which a business pays back its suppliers. The Accounts Payable turnover ratio is a statistic businesses use to gauge how well they are clearing off their short-term debt.

The following is the formula that should be used to calculate the Accounts Payable turnover ratio:

AP Turnover Ratio = Net Credit Purchases/Average Accounts Payable

In certain calculations, the numerator will not include net credit purchases; rather, it will utilise the cost of goods sold. The total Accounts Payable at the beginning of an accounting period and Accounts Payable after the period are added together and then divided by 2.

How to gauge the financial health based on Turnover Ratio?

Creditors can gauge the company’s short-term liquidity and, by extension, its creditworthiness based on the Accounts Payable turnover ratio. If the percentage is high, buyers pay their credit card vendors on time. Suppliers may be pushing for faster payments, or the firm may be trying to take advantage of early payment incentives or raise its creditworthiness if the figure is high.

A low percentage suggests a pattern of late or nonpayment to vendors for credit transactions. This might be because of good lending conditions or an indication of cash flow issues and a deteriorating financial situation. Although a falling ratio could suggest financial trouble, that is not always the case. The business may have negotiated more favourable payment conditions that will enable it to delay payments without incurring any additional fees.

Suppliers’ credit terms often determine a company’s Accounts Payable turnover ratio. Companies that can negotiate more favourable lending arrangements often report a lower ratio. Large companies’ Accounts Payable turnover ratios would be lower because they are better positioned to negotiate favourable credit terms (source).

Companies should use the credit terms extended by suppliers to their advantage to receive discounts on purchases, even though a high Accounts Payable turnover ratio is generally desirable to creditors as signaling creditworthiness.

When analyzing a company’s turnover ratio, it is important to do so in the context of its peers in the same industry. If, for instance, the majority of a company’s rivals have a payables turnover ratio of at least four-figure, the two-figure figure for the hypothetical company becomes more worrisome.

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

Automating the Accounts Payable process

Automating the Accounts Payable process can be a great way to save time and reduce errors. By automating the process, businesses can avoid manually inputting data and ensure that all invoices are paid on time. Additionally, AP automation can help businesses keep track of spending, as all transactions will be recorded in one place.

As a business owner, you know that one of the most important — and time-consuming — task is paying your bills on time. But what if there were a way to automate this process?

Enter Nanonets. Nanonets is an AI-powered Accounts Payable solution that makes it easy to automate your invoicing and payments. With Nanonets, you can take a photo of your bill and have it automatically processed — from extraction of critical data to scheduling payments and updating your accounting software — meaning you can spend less time on paperwork and more time running your business.

Nanonets online OCR & OCR API have many interesting use cases that could optimize your business performance, save costs and boost growth. Find out how Nanonets’ use cases can apply to your product.

[ad_2]

Source link