[ad_1]

Tedious paperwork and long wait times are every person’s worst insurance nightmare. But insurance claim automation is paving the way for faster, more accurate, and more customer-friendly experiences.

The drive to enhance claims processing through new technologies has intensified, especially since every dollar saved directly impacts profitability. The pandemic further accelerated this shift, rapidly pushing insurers to adopt digital and virtual claims handling almost overnight.

This article explores the impact of automation on the claims landscape, whether you’re an insurer looking to streamline operations or a policyholder seeking quicker resolutions.

What is claims process automation?

In 2024, 88% of customers expect insurers to offer online self-service portals for claims, driving insurers to invest in user-friendly digital platforms to enhance the claims process.

Claims process automation uses advanced technology to streamline insurance claim management. It involves automating different steps of claim processing workflows, such as claim submission, claims investigation, deep policy review, and decision-making.

This automation process leverages cutting-edge tools such as machine learning (ML), artificial intelligence (AI), and natural language processing (NLP).

With automation, insurers can automate repetitive tasks such as manual data entry and document verification, speed up claim processing to increase efficiency and accuracy and minimize errors and fraud.

Automating claims processing also offers substantial benefits, such as additional cost savings, improved customer service, and strengthened data security.

This transformation enhances operational efficiency and results in significant cost savings and improved customer satisfaction.

Looking to extract data from motor insurance claim forms, warranty claim forms, certificates of liability insurance, employee reports of injury, incident reports, loss or damage claims ? Try Nanonets’ free AI-powered OCR and workflow automation.

How automated insurance claims processing works

Let’s understand the technologies that drive automated insurance claim processing and the steps in the process:

Machine Learning (ML)

By analyzing extensive datasets of historical claims, ML algorithms can identify patterns and trends, enabling insurers to predict outcomes, assess risk levels, and even flag potentially fraudulent claims.

This is essential in automating decision-making processes, reducing manual interventions, and expediting claims settlements.

For e.g., ML models can accurately estimate repair costs in auto insurance claims by comparing them against vast datasets of similar claims.

Artificial Intelligence (AI)

AI is particularly brilliant at handling complex tasks like fraud detection, risk assessment, and claims adjudication.

Advanced AI systems can cross-check claim details against policy data, third-party databases, and historical claim records to detect anomalies and assess the validity of claims. This significantly reduces the likelihood of fraudulent payouts and improves overall claims accuracy.

Natural Language Processing (NLP)

NLP algorithms can extract and interpret information from unstructured data formats, such as handwritten notes, emails, and scanned documents.

This enables automated data entry processes that lead to faster document review, lower processing time, and enhanced customer experience.

Robotic Process Automation (RPA)

RPA automates repetitive, rule-based tasks in claims automation. RPA bots can handle tasks like data entry, verification of claim details, updating status in the claims management system, and even communication with customers.

This frees up significant time for insurance providers to focus on more complex, high-value activities, thus increasing operational efficiency and reducing the likelihood of human error

Optical Character Recognition (OCR)

Accurate OCR is essential for digitizing physical documents and images by converting them into machine-readable text. OCR can swiftly process forms, invoices, and other paper-based documents, extracting critical information like names, dates, and claim numbers.

This automation reduces the time spent on manual data entry and ensures that information is accurately captured for further processing. When combined with AI, advanced OCR systems can also handle variations in document formats and quality, enhancing the reliability of the data extracted.

Looking to automate claims processing? Try Nanonets Claims Processing Automated Workflows for free.

Steps in insurance claims process and how to automate them

Over 50% of global insurers prioritize digital claims processing, driven by the need to tackle challenges like supply chain disruptions that impact 62% of insurers.

Automated claim processing involves several key steps, each enhanced by automation to improve efficiency, accuracy, and speed.

Let’s understand each step and how workflow automation looks like at each step:

Claim submission

The process begins with the policyholder filing a First Notice of Loss (FNOL) through the insurance platform or the broker. The policyholder provides basic information about the claim, such as the date and location of the incident and any supporting documentation or images as evidence.

With automation, the claim submission process has now gotten more efficient and accurate with –

Digital tools include an online insurance platform, mobile apps, and chatbots through which the policyholder can directly submit the claim.

Pre-filled forms that automatically populate data from the existing customer records. This removes the need to fetch documents, reducing errors and the time interval between the loss and claim filing.

Instant acknowledgment provides immediate confirmation receipt and a tracking ID, keeping policyholders informed throughout.

Review and verification

Insurance providers then examine the policy terms and collect further proof and documents. The matter is investigated, and all liable parties are identified.

The insurer uses different methods to assess the claim and the extent of damage to determine whether the policy covers it. This may involve analyzing the policy language, reviewing the reported damages, and consulting with third-party databases to verify the claimant’s identity and prior claims history.

Automation accelerates this process through:

Automated policy analysis: Claim processing automation tools cross-reference claims with policy databases to identify coverage details and exclusions swiftly.

It immediately identifies the terms and conditions and exclusions, eliminating the need for manual review and speeding up the review process.

Document verification: AI and NLP verify the submitted documents with high accuracy, significantly reducing errors that human eyes often miss. For example, AI can easily read and verify receipts and reports against the policy terms.

Fraud detection: Fraudulent claims are one of the insurance industry’s biggest challenges. Advanced algorithms analyze claims data to detect patterns or anomalies that may indicate fraudulent activity.

While humans can’t possibly verify thousands of claims daily, AI reduces this number significantly.

This also helps them prioritize claims that require detailed scrutiny, ensuring that high-risk claims are flagged early in the process. This reduces the likelihood of fraudulent claims being approved, enhancing the integrity of the process.

Integrations: Automation pulls data from multiple sources, databases, third-party tools, etc., thus allowing for seamless verification.

Intelligent document processing: With automated claim processing tools such as OCR technology and NLP, document processing is much faster and more accurate.

Claim validation and decision

If the claim is deemed valid, the insurer will begin validating it by gathering additional information, such as medical records or repair estimates. The claim is either approved or denied based on the policy guidelines. The claimant must bear any additional expense for damages the insurance policy doesn’t cover.

With automation, the claim decision-making is much faster and unbiased, and reduces the errors significantly in human judgment calls:

Pre-set rules: Automating claim processing allows setting pre-set rules and guidelines to evaluate the claim according to the policy coverage.

It helps insurance companies determine if the claim meets the criteria for approval and if further review is necessary, significantly speeding up the decision-making process.

Consistency: With automation, every claim is evaluated consistently, reducing the chances of human bias or oversight. The tool ensures that similar claims receive similar outcomes by following standardized rules, improving fairness and reliability.

While automation does reduce the need for manual intervention, it also flags high-value or high-risk claims that can be sent for human review. This ensures that such cases receive the careful attention they deserve.

Payment disbursement

The insurance provider initiates the digital payment disbursement if the claim is verified.

Automated payment processing: Once a claim is approved, the automated tool calculates the settlement amount based on the applicable policy and triggers the payment process. This ensures quicker and more accurate disbursements and reduces policyholder delays.

Digital payments: The claim processing platform is integrated with digital payment tools such as direct bank transfers or mobile payment systems. This speeds up payment disbursement and provides a clear, traceable record of transactions for dispute resolution.

It also notifies the policyholder of the payment status, leading to increased transparency and improved customer satisfaction.

Benefits of claims automation

Automating claims processing offers numerous advantages that enhance the efficiency and effectiveness of insurance operations. Here’s how:

Increased efficiency and time savings

Automation streamlines the claims process by minimizing manual tasks and automating repetitive processes to slash processing times by up to 60%!

Insurance companies that use RPA and AI can handle up to 10 times more claims in the same period than those using traditional manual processes.

Faster claim settlements

Tasks that usually take weeks, such as claims verification and fraud detection, can now be completed with AI tools in a matter of days. This can reduce the overall claim processing time from weeks to just a few days, allowing for quicker resolution and faster payouts to policyholders.

Improved customer service

Automation can lead to a 15-20% increase in customer satisfaction. This improvement is largely due to faster claims processing, real-time status updates, proactive communication with timely alerts and notifications, and more accurate payouts.

Increased revenue and cost savings

Insurers implementing advanced claim automation have reported revenue increases of up to 20%, driven largely by greater operational efficiency and enhanced customer retention.

By reducing reliance on manual labor, automation also helps companies lower their operational and administrative costs by 30%, leading to overall profitability by reduction in errors and improved financial performance.

Risk mitigation and fraud prevention

Fraud detection technologies have been instrumental in reducing the $40 billion annual cost of fraudulent claims in the U.S. alone.

Advanced automation tools incorporate features for fraud detection by ML algorithms that detect and flag suspicious patterns in claims. They also provide risk assessment and evaluation by identifying and mitigating potential fraudulent activities.

Claim automation improves environmental sustainability by minimizing reliance on paper-based processes and reducing waste. By transitioning to digital documentation, insurance companies can help lower the environmental footprint of claims processing operations.

Challenges involved in claim automation

While automation offers great benefits to insurance providers and policyholders, it also presents several challenges that insurers must navigate:

Complex implementation

If new automated technology and tools are not properly integrated into existing systems, they can quickly become complex and costly.

Legacy systems that use outdated software often face difficulty adapting to new technologies. They require significant investment and need constant upgrades and even frequent replacements.

Data quality and management

Automation machine learning models rely heavily on a large set of accurate and consistent data. Inconsistent or poor-quality data can lead to errors in automated processes and prove ineffective.

Limited flexibility

While many automated tools work well with simple, predictable tasks in claim processing, they often struggle with complex or unique claims that require nuanced decision-making. Human intervention is still necessary in such situations and can slow down the process.

Cybersecurity risks

The insurance claim industry deals with a vast amount of sensitive information and automation tools with access to this information can be easy targets for cyberattacks. Robust cybersecurity measures are crucial to protect against data breaches, malware, and other threats.

Regulatory compliance

Regulatory standards vary by region and change frequently. Claim automation systems must comply with evolving regulations and require monitoring and adjustments.

Adoption

Overhauling your pre-existing system with automation isn’t a one-day job. There is a long learning curve, and employees must adapt to new tools and processes. This can sometimes involve extensive training and a shift in job roles, which can be challenging for employees.

Customer trust

While there is a general consensus on the widespread benefits of automation, some may be wary of automated processes. Such customers prefer human interaction, especially in complex or high-stakes situations. Insurers must balance automation with maintaining a personal touch to ensure customer satisfaction when adopting automation in claim processes.

Addressing these challenges requires careful planning, investment, and a strategic approach to ensure that the benefits of automation are fully realized while minimizing potential drawbacks.

With this, let’s begin understanding how you can begin your automation journey in the insurance industry.

Let’s have a look at some of the best tools that are leveraging advanced AI to automate different steps of claims processing in the insurance industry:

Claims processing

Snapsheet offers a digital claims platform that allows policyholders to submit claims online or through a mobile app.

ClaimVantage by Majesco provides an advanced cloud-based claims management system tailored for life, health, and disability insurance. It offers automated workflows, online claim submission, and tracking capabilities.

Lemonade automates the claims process, from submission to decision-making. Its AI bot, “Jim,” processes claims instantly, assessing eligibility and disbursing payments within minutes for simple claims.

Document verification and validation

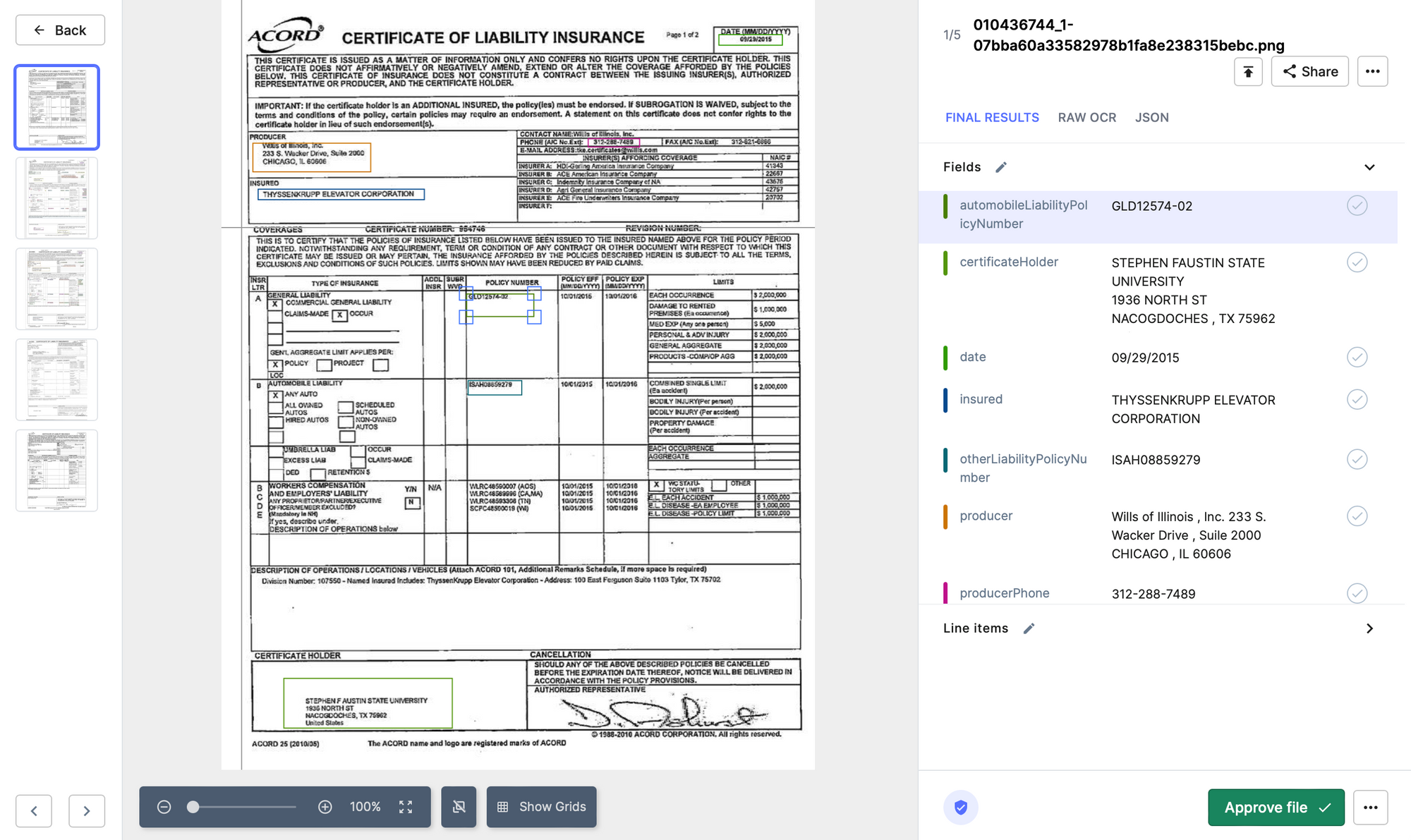

Nanonets OCR technology automates the extraction of key information from claim forms, such as policy numbers, claimant names, and damage descriptions.

By leveraging machine learning algorithms, Nanonets helps insurers quickly validate claims, reducing manual work and improving accuracy. Nanonets is particularly trusted and popular for automating document-heavy processes like claims validation, medical records and forms data extraction, and even handwritten scanned documents.

Tractable uses computer vision and AI to automatically assess vehicle damage and determine the appropriate repair costs. Tractable’s AI can make rapid, data-driven decisions, significantly reducing the time required to settle auto insurance claims

Verisk Analytics: Offers an extensive suite of tools for claims validation, including predictive analytics, property and casualty claims analytics, and medical bill review. This tool is trusted to validate complex claims such as workers’ compensation and property damage.

Customer service

Lemonade is an AI-powered insurance platform that automates the entire claims process, from submission to decision-making. Lemonade’s AI bot “Jim” processes claims instantly, assessing eligibility and disbursing payments within minutes for simple claims.

Underwriting

Octo Telematics uses data to analyze driving behavior and adjust premiums based on risk, leading to more accurate pricing and better risk management.

AI underwriting tools like Nanonets can assist underwriters by automatically analyzing applicant data, identifying risk factors, and suggesting appropriate coverage levels based on historical data and predictive models

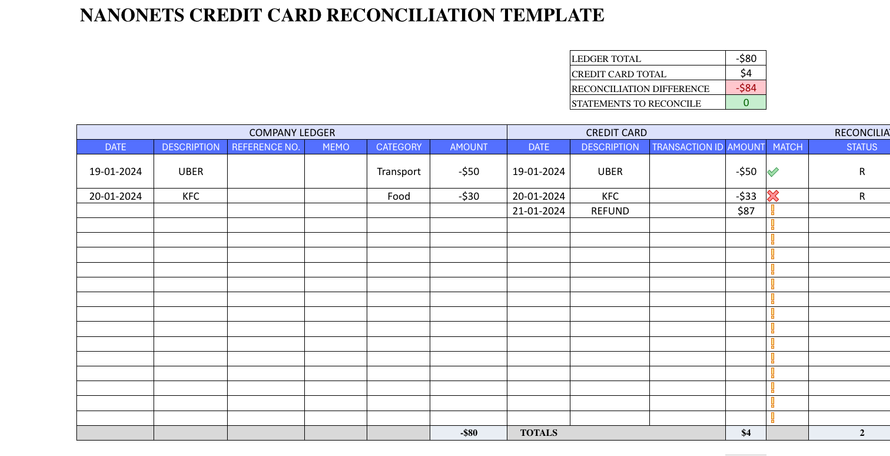

Finance and Accounting

Automation in finance and accounting within insurance involves streamlining claims disbursement, payment reconciliation, and financial reporting.

Checkbook.io offers a digital check platform that allows insurers to issue payments electronically and securely.

One Inc provides a digital payments platform designed specifically for the insurance industry. One Inc. offers secure, real-time payment solutions for claims disbursement via ACH, credit cards, and digital wallets. Its integration with existing claims systems ensures seamless and efficient payment processing.

Claims verification and fraud detection

Shift Technology is popular for its AI-driven fraud detection capabilities. It analyzes claims data to identify potential fraud, errors, and anomalies. Its algorithms are trained on vast datasets, ensuring high accuracy in flagging suspicious claims, thereby reducing the risk of fraudulent payouts.

FRISS is a comprehensive insurance fraud detection platform that uses AI and predictive analytics to monitor and verify claims. It evaluates risk scores in real-time during the claim lifecycle, helping insurers detect and prevent fraud at an early stage.

Consider the following while evaluating an automation tool for claim processing and management:

- End-to-end automation

- AI and ML capabilities

- NLP and OCR integration

- RPA for repetitive tasks

- System compatibility

- API integration

- Security and compliance

- Data migration

- Training and support

- Cost and ROI

- Pricing and plans

- Post-implementation monitoring

- Long-term cost and benefit analysis

Try Nanonets to extract important data from 70+ insurance claim documents.

Getting started with claims process automation with Nanonets

Nanonets is an AI-powered document processing platform that enables companies across different industries to extract information from unstructured documents.

Features of Nanonets AI that make it lucrative for insurance companies:

- Automated document processing

- OCR technology for handwritten forms, scanned PDFs and images.

- Multi-language support

- Intelligent data extraction

- Achieve 99% accuracy in data extraction

- Pre-built custom machine learning models

- Automated data validation

- Pattern recognition to spot anomalies

- Assign risk scores to claims

- Seamless integration and rule-based approval setup

- Automated notifications and timely alerts

To start processing your insurance claims on Nanonets for free,

Step 1: Sign up on the Nanonets app

Step 2: Upload your claim or any document

Step 3: Wait as the AI and OCR processes the claim and extracts all fields

Step 4: Verify all the fields. Train the model to locate other fields, if missed

Step 5: Download the data in a CSV, XML, or any format you prefer

Step 6: Process your claim further by integrating your existing system

While claims processing is one challenge in the insurance industry, Nanonets has also automated the underwriting process, policy issuance, renewals management, and premium calculation for many healthcare and insurance companies worldwide.

[ad_2]

Source link