[ad_1]

People buy insurance policies with the hope that in the event of an unfortunate loss or damage to the insured assets, their deprivation will be suitably compensated by the insurance provider at the earliest.

Once loss or damage occurs, the compensation payment process is initiated by sending the First Notice of Loss (FNOL). The insurance provider immediately investigates the loss or damage and settles the loss or damage with the insured person. In order to get the compensation settled quickly, it is necessary that the claims services FNOL is comprehensive, containing all the details required by the insurance provider, and accurate about the incident and the loss or damage.

In this blog, we’ll talk about what FNOL is in insurance and how automation can help streamline the process.

What is a First Notice of Loss (FNOL)?

First Notice of Loss is the first report made to an insurance provider about loss, damage, or theft of an insured asset. The details contained in the FNOL for insurance claims assist the insurance provider in handling the claim, determining insurance coverage, assessing the extent of damage or loss, and settling the claim on the basis of the terms and conditions of the insurance policy.

How Does a First Notice of Loss (FNOL) Work?

The process of an insurance claim and its settlement starts with filing FNOL for an insurance claim and ends with the settlement of the claim. Under their laws, most states require the insurer to initiate a claim within a specific deadline after receipt of the FNOL. In those states, the FNOL triggers legal deadlines. The FNOL for insurance claims sets the process of an insurance claim and its settlement in motion.

If the FNOL and the supporting documents contain all the information required by the insurance provider, then the process will be taken to the next level, i.e., investigation and assessment of loss or damage. If the FNOL for an insurance claim is incomplete, the settlement process will be delayed.

What are the Components of an Effective FNOL?

The FNOL for insurance claims contains important information for the insurance provider to determine the claim. Generally, the insurance providers require that the FNOL process should include policy details, location where the loss or damage occurred, details of the incident of loss, damage or theft and description of the loss or damage. The insurer may also require supporting documents like driving license, registration certificate of the vehicle and First Information Report of the accident submitted to the police.

Telematics technology is an important technology, and the information generated by this technology is treated as FNOL for insurance claims. This technology, which has built-in GPS technology, records accidents and disseminates the information relating to the accident. Telematics box installed in motor vehicles sends messages about details of accidents such as date, time, and location of the accident.

Who Uses Information from the FNOL?

Insurance and related industry professionals use the information in the FNOL for insurance claims. They are:

- Insurance agents

- Insurance brokers

- Claims Adjusters

- Underwriters

- Lawyers

- Investigators who investigate insurance fraud

Why Do Businesses Need to Streamline the FNOL?

Many insurance companies still follow manual handling of FNOL and the supporting documents, which results in manually segmenting claims that lead to multiple file transfers that result in inordinate delays in settling claims. They are the least automated, which results in customer dissatisfaction, whereas present-day customers want transparent and automatic delivery of services and products, which needs automation of areas like FNOL handling.

Incomplete FNOL for insurance claims and inadequate supporting documents result in processing delays, leading to customer dissatisfaction. For insurers, the FNOL process is very important as customer satisfaction is linked to how quickly and effectively they carry out the process. Studies have indicated that if the customer is unsatisfied with the insurer for not handling the claims process satisfactorily, he switches to another insurer.

Benefits of FNOL Automation

First Notice of Loss (FNOL) automation refers to the process of automating the initial reporting of an insurance claim when a loss or incident occurs. Implementing FNOL automation can offer several benefits for insurance companies, policyholders, and other stakeholders.

The accuracy and efficacy in settling the claims by the automated FNOL save precious time and resources for the insurer and the insured resulting in a win-win situation for both the insurer and the insured.

Faster Claims Processing: Automation reduces the time it takes to report and process a claim. This speed is crucial in the insurance industry, as it allows for quicker assessment and resolution of claims.

Improved Customer Experience: Quick and efficient FNOL processes improve policyholders’ overall experience. Automation allows customers to report claims at their convenience, 24/7, without having to wait for business hours.

Reduced Human Error: Automation minimizes the chances of errors in data entry or information gathering. This helps in ensuring that accurate and consistent information is captured during the initial stages of a claim.

Enhanced Data Accuracy: Automation ensures that information is entered and processed consistently, reducing the likelihood of inaccuracies. This accurate data is crucial for claims assessment and analytics.

Cost Savings: By automating the FNOL process, insurance companies can reduce the need for manual intervention and paperwork, leading to cost savings in terms of labor and operational expenses.

Advanced Analytics and Reporting: Automated FNOL systems generate data that can be analyzed to identify patterns, trends, and potential areas for improvement. This data-driven approach helps insurers make informed decisions and enhance their overall claims management strategies.

Fraud Detection: Automation allows for the integration of advanced analytics and fraud detection algorithms. This helps in identifying potentially fraudulent claims early in the process, preventing financial losses for insurance companies.

Streamlined Communication: Automated FNOL systems often include features for real-time communication between insurers, adjusters, and policyholders. This streamlines the entire claims process and ensures everyone involved can access improve policyholders’ overall experience with up-to-date information.

Compliance and Documentation: Automated FNOL systems can help meet the necessary documentation and compliance requirements. This is crucial for regulatory purposes and can also simplify the audit process.

Scalability: Automation provides scalability, allowing insurance companies to handle a larger volume of claims efficiently without the need for a proportional increase in resources.

The supporting documents of FNOL for insurance claims to be relied upon by the insurer include reports made to and made by investigating agencies like police, fire department, and other agencies. Sometimes contractors and witnesses may have to submit their evidence in prescribed forms, which also constitute FNOL documents for insurance claims.

These documents may not be in a structured format and sometimes may even be handwritten. Processing and analyzing these documents are time-consuming, which will result in delays in settling claims.

Legacy Systems Compatibility

Many insurance companies may still rely on legacy systems that are not easily compatible with modern automation technologies. Integrating FNOL automation with existing systems may require significant effort and investment.

Unstructured Data

FNOL data can come in various formats, including text descriptions, images, and documents. Extracting relevant information from unstructured data sources can be challenging and may require advanced natural language processing and image recognition capabilities.

Inconsistent Data Formats

The information provided during the FNOL process may be inconsistent in terms of format and structure. Standardizing and normalizing data formats from different sources can be a challenge.

Privacy and Security Concerns

FNOL data often contains sensitive information about individuals and incidents. Ensuring the privacy and security of this data throughout the extraction process is critical to comply with regulations and protect customer information.

Scalability Issues

As the volume of claims increases, scalability becomes a concern. The FNOL system should be able to handle a growing number of claims without compromising performance or data accuracy.

The Rise of FNOL Automation

A growing number of insureds use digital channels to file FNOL claims. Similarly, a number of insurance companies have developed websites or mobile apps to enable their customers to file FNOL claims digitally.

Optical character recognition (OCR) is an AI-based technology that recognizes handwritten texts. Since some of the FNOL documents, such as police reports, are handwritten, OCR technology can be used successfully to capture the handwritten FNOL documents. Telematics technology can be used by the customer to file FNOL and verify the date, time, and location of the accident by the insurer.

How to Automate Claims from an FNOL?

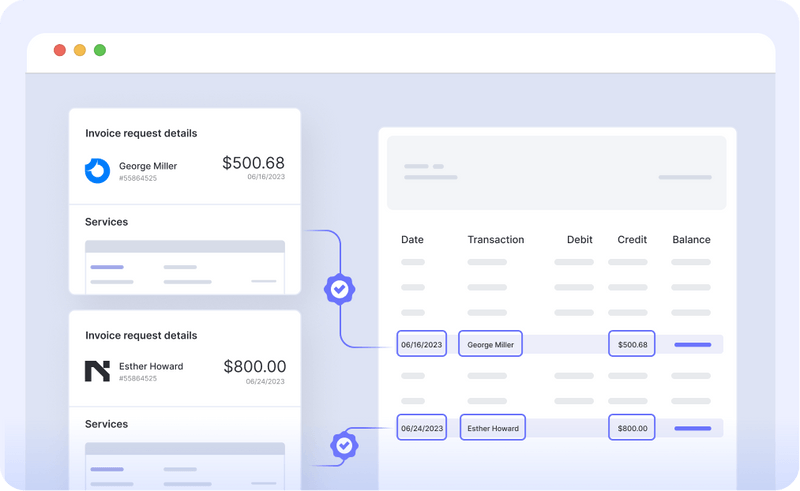

The software, computer programs, AI, and machine learning tools quickly process the FNOL, and the supporting documents structure the FNOL and the supporting documents, which can be easily understood, analyzed, and stored. The unstructured data is processed automatically, which will ensure the following:

- Identification of the insured.

- Extraction of the details of the parties.

- A claims adjuster form is generated by extracting the data from the unstructured documents.

- Damage is identified and assessed, enabling early settlement of the claim.

[ad_2]

Source link