[ad_1]

OCR software has proven to be a game-changer for finance professionals. It allows them to automate the extraction and interpretation of text from images, invoices, receipts, and other documents. This enhances efficiency and reduces the margin for error, allowing finance professionals to focus on strategic decision-making rather than mundane data entry tasks.

In this blog, we explore the top 5 accounting OCR software dominating the financial landscape in 2024. These cutting-edge solutions transform how businesses handle their financial documents and set new standards for accuracy, speed, and overall productivity.

Let’s dive into the future of accounting technology and discover the tools reshaping the financial world as we know it.

Automate manual data entry using Nanonet’s AI-based OCR software. Capture data from documents instantly and automate data workflows. Reduce turn around times and eliminate manual effort.

What is OCR?

OCR, or Optical Character Recognition, is a technology that converts different types of documents, such as scanned paper documents, PDFs, or images captured by a digital camera, into editable and searchable data. It recognizes text within these documents, allowing for the extraction, interpretation, and manipulation of textual information.

In finance, OCR is crucial in automating various processes, reducing manual intervention, and improving overall efficiency. For instance, accounting OCR technology automatically extracts relevant information from invoices, such as vendor details, invoice numbers, dates, and line item details. This significantly accelerates the accounts payable process, reduces errors, and enhances the accuracy of financial data.

Let us now dive into the top 10 accounting OCR software in 2024.

Nanonets

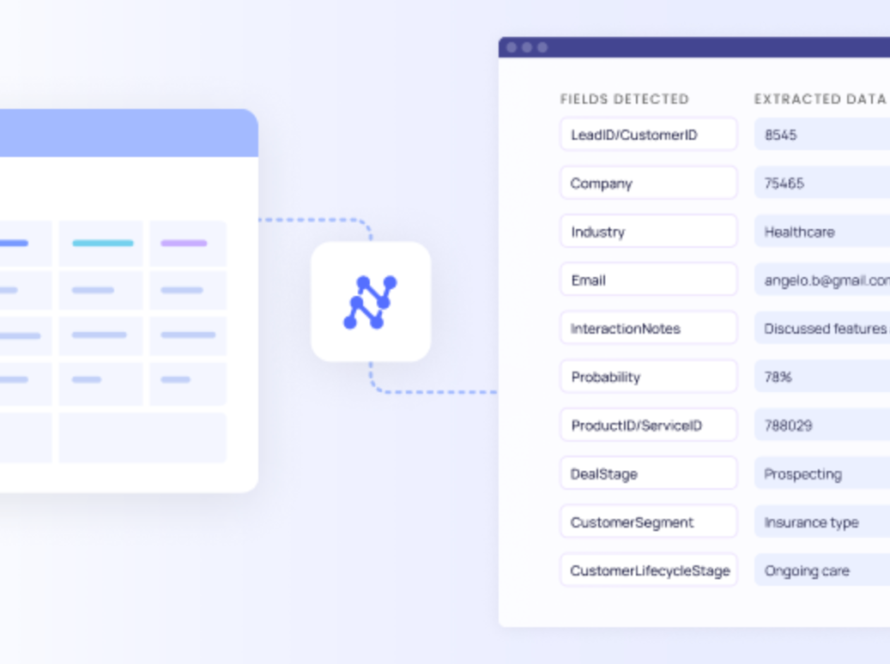

Nanonets is an AI-based OCR software that automates data capture for intelligent document processing of invoices, receipts, ID cards, and more. Nanonets uses advanced OCR, machine learning image processing, and Deep Learning to extract relevant information from unstructured data. It is fast, accurate, easy to use, allows users to build custom OCR models from scratch, and has some neat Zapier integrations.

Customers have seen a 90% reduction in manual data entry and a 5X ROI payback within three months. According to reviews on G2, Nanonets helped a business save almost 300 man-hours a month.

Digitize documents, extract data fields and integrate with your everyday apps via APIs in a simple, intuitive interface.

Nanonets’ accounting OCR solutions can significantly speed up document processing workflows. This is particularly beneficial when large volumes of documents, such as invoices or receipts, must be handled promptly.

Unique Selling Points of Nanonets Accounting OCR Software

- Efficient Data Extraction: Nanonets’ OCR technology can help finance professionals extract data from various documents quickly and accurately. This is particularly useful for tasks like invoice processing, receipt management, and extracting information from financial statements.

- Automation of Repetitive Tasks: By automating data extraction from documents, Nanonets enables finance professionals to save time on repetitive and manual tasks. This automation allows them to focus on more strategic and analytical aspects of financial management.

- Improved Accuracy: Nanonets enhances data extraction accuracy compared to manual entry. This is crucial in finance, where precision is essential for reconciling accounts, processing invoices, and generating financial reports.

- Document Search and Retrieval: The searchable text output from OCR allows finance professionals to easily search for and retrieve specific information from a vast array of documents. This improves document management and facilitates quick access to critical data.

- Integration with Existing Systems: Nanonets OCR solutions can often be integrated with existing financial systems and software. This seamless integration ensures a smooth workflow without major overhauls of existing processes.

- Cost Savings: By automating manual data entry tasks, Nanonets’ OCR technology helps reduce labor costs associated with repetitive document processing. This cost-effectiveness is a significant advantage for finance departments looking to optimize their operations.

- Customization for Specific Use Cases: Nanonets may offer customization options to tailor OCR solutions to specific use cases within finance. This flexibility allows finance professionals to address their unique document processing needs effectively.

- Audit Ready: Nanonets maintains a secure log of all activities for audit requirements. Make a digital archive of your financial documents to create a searchable database. Pull up documents whenever required during audit.

- Simplify Risk Assessment: Use Nanonets workflows for risk assessment with custom rules and a human-in-the loop model. Perform all assessments on autopilot while flagging documents for exceptions and rule failures.

Pricing of Nanonets

- Free Trial: Nanonets offers a free trial for users to test the software before committing to a subscription. The free trial allows users to process up to 500 pages for free.

- Pro Plan: The Pro plan is priced at $499/month and includes 5,000 pages per month. Beyond that, the costs are $0.10 per page. The Pro plan includes features like auto-capture line items (tables), up to 20 fields, annotation services, customization hours, and more.

- Custom Enterprise Plan: Nanonets also offers a custom plan for enterprises with specific needs. The custom plan requires a specific quote from Nanonets to build and price, including premium features like a dedicated account manager, custom data retention, customized client onboarding, and personalized 1:1 team training.

Find out more about Nanonets pricing tiers here

Get started with Nanonets’ pre-trained OCR extractors or build your own custom OCR models. You can also schedule a demo to learn more about our OCR use cases!

Veryfi

Veryfi is an AI-powered data extraction and automation platform that processes unstructured financial documents such as receipts, invoices, and expenses. With advanced artificial intelligence and machine learning algorithms,

Veryfi can extract relevant data from documents quickly and accurately, eliminating the need for manual data entry and streamlining accounting and bookkeeping processes.

Features of Veryfi Accounting OCR Software

- Focus on Financial Documents: Veryfi specializes in processing financial documents like receipts, invoices, and expenses, making it a targeted solution for accounting and bookkeeping tasks.

- Bank Reconciliation: Veryfi assists with bank reconciliation, ensuring that expenses are accurately recorded and accounted.

- Job Costing: Veryfi offers job costing capabilities, allowing businesses to allocate expenses to specific projects or clients.

- Real-Time Data Extraction: The ability to extract data quickly and accurately in real-time can significantly improve business productivity and decision-making processes.

- User-Friendly Interface: Veryfi aims to provide a user-friendly experience, making it accessible to businesses with varying levels of technical expertise.

Pricing

- Free Plan: This plan is entirely free and allows users to process up to 50 documents monthly. However, it only supports receipts and invoices as document types and offers limited features for development. Support is provided through email only.

- Pay As You Go Plan: Recommended for businesses processing less than 25,000 documents per month, this plan requires a minimum monthly payment of $500. It supports all document types, including receipts, invoices, W-2s & W-9s, business cards, and more. Users are billed at $0.08 per receipt and $0.16 per document (for non-receipt types). Support is available via email and Slack, and there are SLA (Service Level Agreement) options.

- Custom Plan: Designed for high-volume users with 25,000 or more documents per month, this plan offers volume discounts and requires contacting the sales team for pricing details. It includes all document types, features, and additional options like Veryfi Lens (offered at custom pricing), available to all customers.

DocParser

DocParser is a document data extraction software that automates extracting data from PDFs and scanned files. Its key features include data extraction automation, customizable rules and templates, integration capabilities, data validation and enrichment, and support for exporting extracted data in multiple formats.

Features of DocParser Accounting OCR

- Users can create and customize parsing templates to match the structure and format of their documents, ensuring accurate data extraction.

- DocParser provides data validation features to ensure the accuracy and integrity of extracted data.

- DocParser allows users to create and customize parsing rules to extract specific data fields from documents, providing flexibility and accuracy.

Pricing

- Starter Plan: Priced at $39 per month (billed yearly), it includes 100 parsing credits per month. Users can create up to 15 different parsers, access premium templates, and parse PDFs, Word, and image files. They can export data to Excel, CSV, JSON, and XML, integrate with Google Sheets, and access numerous other integrations. This plan is designed for individuals tired of manual data extraction.

- Professional Plan: Priced at $74 per month (billed yearly), it includes everything in the Starter plan plus 250 parsing credits per month. Users can create up to 50 different parsers, enable multifactor authentication, and enjoy priority support and parsing access. It is suitable for professionals who are serious about data extraction and workflow automation.

- Business Plan: Priced at $159 per month (billed yearly), it includes everything in the Professional plan plus 1000 parsing credits per month. Users can create up to 500 different parsers, gain priority support and parsing access, and have access to multi-layout parsers and parser version control. This plan is ideal for automating entire business processes with document parsing and cloud integrations.

- Enterprise Plan: The pricing for the Enterprise plan is available on request, allowing users to build a package tailored to their specific parsing requirements. It includes custom parsing credits per month, unlimited parsers, extended document retention, and white labelling license.

DocParser also offers add-on features such as Parsing Assistant for customized parser setup and Extended Retention to keep documents available in the account for longer periods.

Automate manual data entry using Nanonet’s AI-based OCR software. Capture data from documents instantly and automate data workflows. Reduce turn around times and eliminate manual effort.

Datamolino

Datamolino is a cutting-edge automation tool designed to streamline and expedite bookkeeping processes for finance professionals. This platform efficiently extracts and processes data from various financial documents, such as bills, receipts, and bank statements.

Features of Datamolino Accounting OCR

With a user-friendly interface, Datamolino offers a seamless experience for users in just three simple steps.

- Upload: Users can easily upload financial documents via email, web, or the mobile app, with support for multi-page scanning. Email receipts can be forwarded directly to Datamolino.

- Automate: Datamolino leverages machine learning to understand transaction coding, automating the tedious tasks of invoice coding and categorization. This feature ensures accuracy and consistency in data processing.

- Export: Users have the flexibility to review transactions before exporting or set up automatic exports to their preferred accounting software. Datamolino integrates with popular platforms like Xero and offers a quick and efficient export process.

Pricing

- Small Plan:

- 150 documents/month

- Ideal for small businesses & freelance bookkeepers

- Monthly Fee: $47

- Additional Document Cost: $0.33 per document

- Bank Statement Page Cost: $0.70

- Medium Plan:

- 500 documents/month

- Suitable for mid-sized businesses & bookkeeping firms

- Monthly Fee: $140

- Additional Document Cost: $0.33 per document

- Bank Statement Page Cost: $0.65

- Large Plan:

- 1500 documents/month

- Geared towards large companies & accounting firms

- Monthly Fee: $419

- Additional Document Cost: $0.30 per document

- Bank Statement Page Cost: $0.50

- Extra Large Plan:

- 2500 documents/month

- Designed for large corporations & accounting firms

- Monthly Fee: $675

- Additional Document Cost: $0.28 per document

- Bank Statement Page Cost: $0.50

Optional Fees: For PDFs with multiple documents: £0.02 per invoice, £0.05 per bank statement sheet

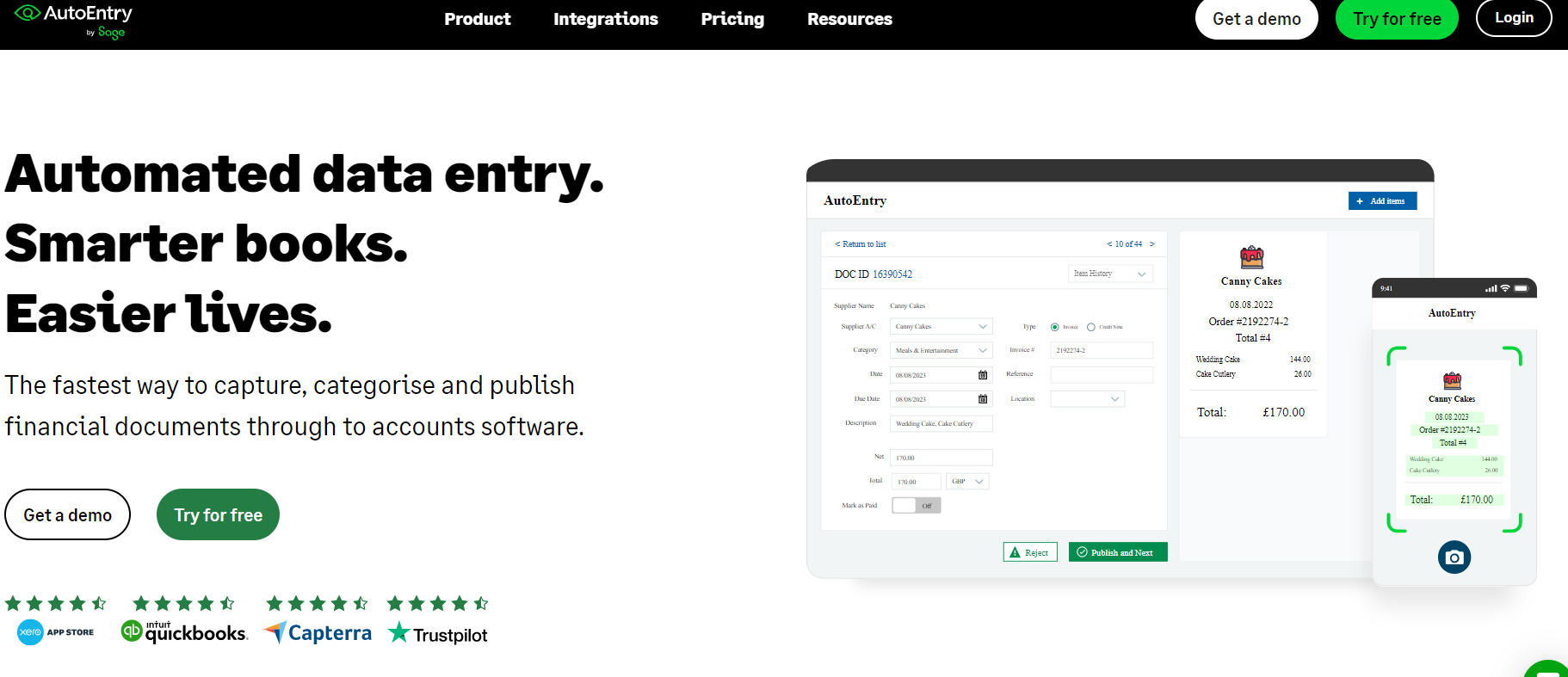

AutoEntry

AutoEntry is a solution for finance professionals seeking to streamline their data entry processes and enhance efficiency in accounting. This tool eliminates manual data entry challenges by automating the capture, categorization, and publication of financial documents directly into accounting software. It also integrates with leading providers such as Sage, QuickBooks, Xero, and FreeAgent to accelerate workflows and accuracy in financial data management.

Features of AutoEntry Accounting OCR

- Eliminates Manual Data Entry: The platform excels in capturing, categorizing, and publishing data from various financial documents, including invoices, receipts, and bank statements. Users can easily categorize and seamlessly publish the captured data to their accounting software or share it with their accountants. This eliminates the manual grind, reducing the time and effort traditionally associated with data entry.

- Multiple Upload Formats: AutoEntry supports versatile input methods, allowing users to submit documents through photographs, scans, or emails.

- Accounting Software Integrations: The platform’s seamless integration with leading accounting software providers such as Sage, QuickBooks, Xero, and FreeAgent ensures a cohesive workflow.

- Easy Setup: Setting up AutoEntry is a hassle-free process, requiring only a few minutes. The platform ensures easy integration with existing accounting software, allowing users to incorporate its features into their workflow quickly.

Pricing

- Bronze: 50 credits at $12 per month

- Silver: 100 credits at $23 per month

- Gold: 200 credits at $44 per month

- Platinum: 500 credits at $98 per month

- Diamond: 1500 credits at $285 per month

- Sapphire: 2500 credits at $450 per month

What is a credit?

- Credits are the currency used when uploading documents to AutoEntry.

- Credits consumed depend on the document type uploaded (e.g., 1 credit per invoice, 2 credits per invoice with line items, etc.).

Start using Nanonets for Automation. Try out the various OCR models or request a demo today. Find out how Nanonets’ use cases can apply to your product.

How does Nanonets stand apart as an Accounting OCR software?

Nanonets OCR software is easy and flexible to set up, requiring just one day. The intelligent automation platform handles unstructured data easily, and the AI also easily handles common data constraints. Information from documents with imperfections & blemishes is extracted quite easily. It handles multi-page invoices and easily identifies multi-line items, something that most legacy and modern OCR tools fail at. Nanonets customizes column headers, allowing it to process complex invoices more efficiently. Nanonets’ AI also ensures high accuracy while processing documents requiring minimal rework or revision.

The benefits of using Nanonets go beyond better accuracy, experience, and scalability. Here are eight reasons that highlight the unique Nanonets advantage:

- Training & working with custom data – Most OCR software out there are quite rigid on the type of data they can work with. Nanonets isn’t bound by such limitations. Nanonets uses your own data to train models that are best suited to meet the particular needs of your business.

- Easy to use & flexible – Adapting Nanonets for your business needs is easy. From creating custom OCR models & retraining them to adding new fields & handling integrations, Nanonets can handle it all.

- Learns & retrains continuously – Businesses often face dynamically changing requirements and needs. Nanonets OCR software allows you to easily re-train your models with new data to overcome potential roadblocks. This allows your OCR model to adapt to unforeseen changes.

- Customize, customize, customize – Nanonets can capture as many fields of text/data as you like and present it in any desired fashion. Captured data can be presented in tables or line items or any other format of your choice with custom validation rules. Always remember that the template of your document does not bind Nanonets!

- Requires almost no post-processingRequires almost no post-processing – While most OCR software grabs and dumps data, Nanonets extracts only the relevant data and automatically sorts them into intelligently structured fields, making it easier to view and understand.

- Handles common data constraints easily – Nanonets leverages deep learning & object detection techniques to overcome common data constraints that greatly affect text recognition and extraction among other OCR software. Nanonets AI can recognize and handle handwritten text, images with low resolution, images with new or cursive fonts and varying sizes, images with shadowy text, tilted text, random unstructured text, image noise, blurred images and more. Traditional OCR software are not equipped to perform under such constraints; they require data at a very high level of fidelity which isn’t the norm in real life scenarios.

- Works with non-English or multiple languages – Since Nanonets focuses on training with custom data, it is uniquely placed to build a single model that could extract text from documents in any language or multiple languages simultaneously.

- Requires no in-house team of developers – No need to worry about hiring developers and acquiring talent to personalize Nanonets API for your business requirements. Nanonets was built for hassle-free integration. You can readily integrate Nanonets with most CRM, ERP, content services, or RPA software.

[ad_2]

Source link