[ad_1]

Introduction to Bank Reconciliation Journal Entries

Bank reconciliation is an important process in accounting that ensures the accuracy and integrity of a company’s financial records. It involves the comparison between the company’s internal financial records and those of the bank. At the heart of this reconciliation lies the creation of journal entries, which serve to align discrepancies between the company’s books and the bank statement. Understanding the intricacies of bank reconciliation journal entries is essential for finance professionals and business owners alike, as it empowers them to identify, address, and prevent errors or discrepancies in financial reporting. In this essay, we will look at the significance of bank reconciliation journal entries, explore common types of entries, and see how Nanonets can help in ensuring accuracy and efficiency in the reconciliation process.

Looking out for a Reconciliation Software?

Check out Nanonets Reconciliation where you can easily integrate Nanonets with your existing tools to instantly match your books and identify discrepancies.

What is Journal Entry in accounting?

A journal entry is a record of a financial transaction that affects the financial statements of a business. It is the first step in the accounting cycle and involves recording the transaction in the general ledger.

Here are the key components of a journal entry:

- Date: The date on which the transaction occurred.

- Accounts: The accounts affected by the transaction. Each journal entry involves at least two accounts: one account to be debited and another account to be credited. Debits and credits are used to record increases and decreases in specific accounts according to the rules of double-entry accounting.

- Debit and Credit Amounts: The amounts to be debited and credited to each account. Debits are recorded on the left side of the journal entry, while credits are recorded on the right side.

- Description/Narration: A brief description or explanation of the transaction, indicating the nature of the transaction and providing context for the entry.

For example, consider a business that receives $1,000 in cash for services provided. The journal entry to record this transaction would typically look like this:

In this journal entry:

- The “Cash” account is debited because the business receives cash, resulting in an increase in cash (an asset account).

- The “Service Revenue” account is credited because the business earns revenue from providing services, resulting in an increase in revenue (an equity account).

The fundamental principle behind journal entries is the double-entry system, which ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced. Every debit must be accompanied by an equal and opposite credit, thereby maintaining the equilibrium of the accounting equation.

Journal Entries in Bank Reconciliation

In the process of bank reconciliation, various transactions require journal entries to ensure accurate alignment between a company’s financial records and its bank statement. Here are examples of such transactions and the corresponding journal entries:

- Bank Service Charges: When the bank imposes service charges, typically shown on the last day of the bank statement, but not yet reflected in the company’s books, a journal entry is necessary. This involves crediting the Cash account and debiting an expense account such as Bank Charges or Miscellaneous Expense.

- Returned Customer Checks (NSF): If checks deposited by customers bounce due to insufficient funds, resulting in reversal of funds in the company’s account, a journal entry is required to adjust the Cash account and reverse the revenue initially recorded

- Bank Fees for Returned Checks: If the bank charges fees for returned checks, a journal entry is made to recognize this expense and reduce the Cash account.

- Collections of Notes Receivable by the Bank: If the bank collects on the company’s behalf for notes receivable, a journal entry is necessary to recognize the increase in cash.

- Interest Earned on Bank Accounts: When the bank pays interest on the company’s account, a journal entry is made to recognize this income.

Some other items that go into the journal are check printing charges, customer checks that were initially deposited but are subsequently returned due to insufficient funds (NSF), bank corrections addressing company errors, loan payments, and electronic deposits and withdrawals.

These journal entries help ensure that the company’s financial records accurately reflect the transactions reported by the bank, facilitating precise financial reporting and robust internal controls.

Purpose of Journal Entries in Bank Reconciliation

The primary purpose of journal entries in bank reconciliation is to align a company’s internal financial records with the transactions reported by the bank. Bank reconciliation ensures the accuracy and integrity of financial data by identifying and addressing discrepancies between the company’s records and the bank statement. Journal entries facilitate adjustments to the company’s books to reflect transactions that have been recorded by the bank but not yet by the company, or vice versa.

Here are some key purposes of journal entries in bank reconciliation:

- Correcting Discrepancies: Journal entries help correct any differences between the company’s records and the bank statement. These differences may arise due to outstanding checks, deposits in transit, bank fees, interest earned, or other transactions that have not been accurately recorded or reflected in both sets of records.

- Ensuring Accuracy: By making necessary adjustments through journal entries, bank reconciliation ensures that the company’s financial records accurately reflect its true financial position. This accuracy is vital for making informed business decisions and meeting regulatory requirements.

- Strengthening Internal Controls: Bank reconciliation, supported by journal entries, serves as an essential internal control mechanism. It helps detect errors, discrepancies, or potential fraud in the company’s financial transactions by comparing records independently maintained by the bank and the company.

- Facilitating Decision-Making: Accurate and up-to-date financial records, achieved through effective bank reconciliation and journal entries, provide management with reliable information for decision-making. Clear and reconciled financial data enable management to assess the company’s performance, manage cash flow effectively, and plan for the future.

- Enhancing Financial Reporting: Properly reconciled financial records, aided by journal entries, contribute to the preparation of accurate financial statements. These statements are essential for stakeholders, including investors, creditors, and regulators, to evaluate the company’s financial health, performance, and compliance with accounting standards.

How to Make Journal Entries in Bank Reconciliation?

Making journal entries in bank reconciliation involves a systematic approach to ensure accuracy and alignment between a company’s records and the bank statement. Here’s a step-by-step guide on how to make journal entries in bank reconciliation:

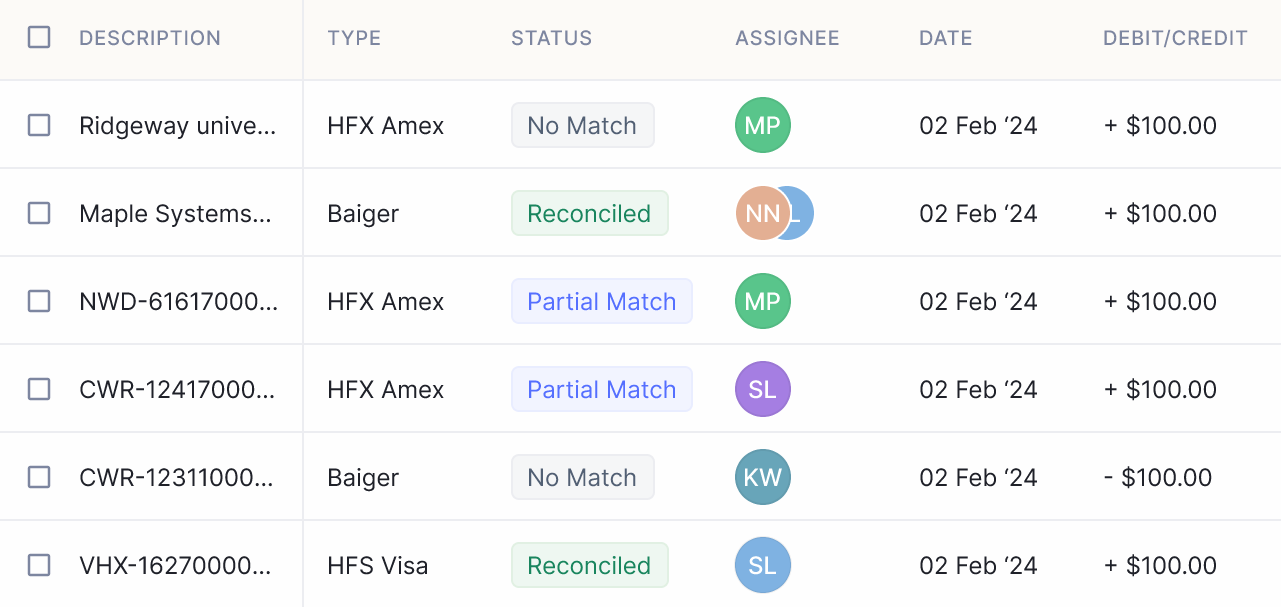

- Identify Discrepancies: Begin by reviewing the bank statement and comparing it with the company’s internal records such as the General Ledger to identify any differences or discrepancies. Common discrepancies include outstanding checks, deposits in transit, bank fees, interest earned, or errors in recording transactions.

- Analyze Transactions: Analyze each identified discrepancy to determine the appropriate adjustment needed in the company’s books. Assess whether each item requires a journal entry and whether it should be debited or credited based on its nature.

- Choose Accounts: Select the accounts to be debited and credited for each journal entry. Debit accounts represent increases in assets or expenses, while credit accounts represent increases in liabilities, equity, or income. Ensure accuracy by choosing the correct accounts for each transaction.

- Determine Amounts: Calculate the amounts to be debited and credited for each journal entry. Verify that the total debits equal the total credits to maintain the balance of the accounting equation. Take care to accurately determine the amounts to reflect the true impact of each transaction.

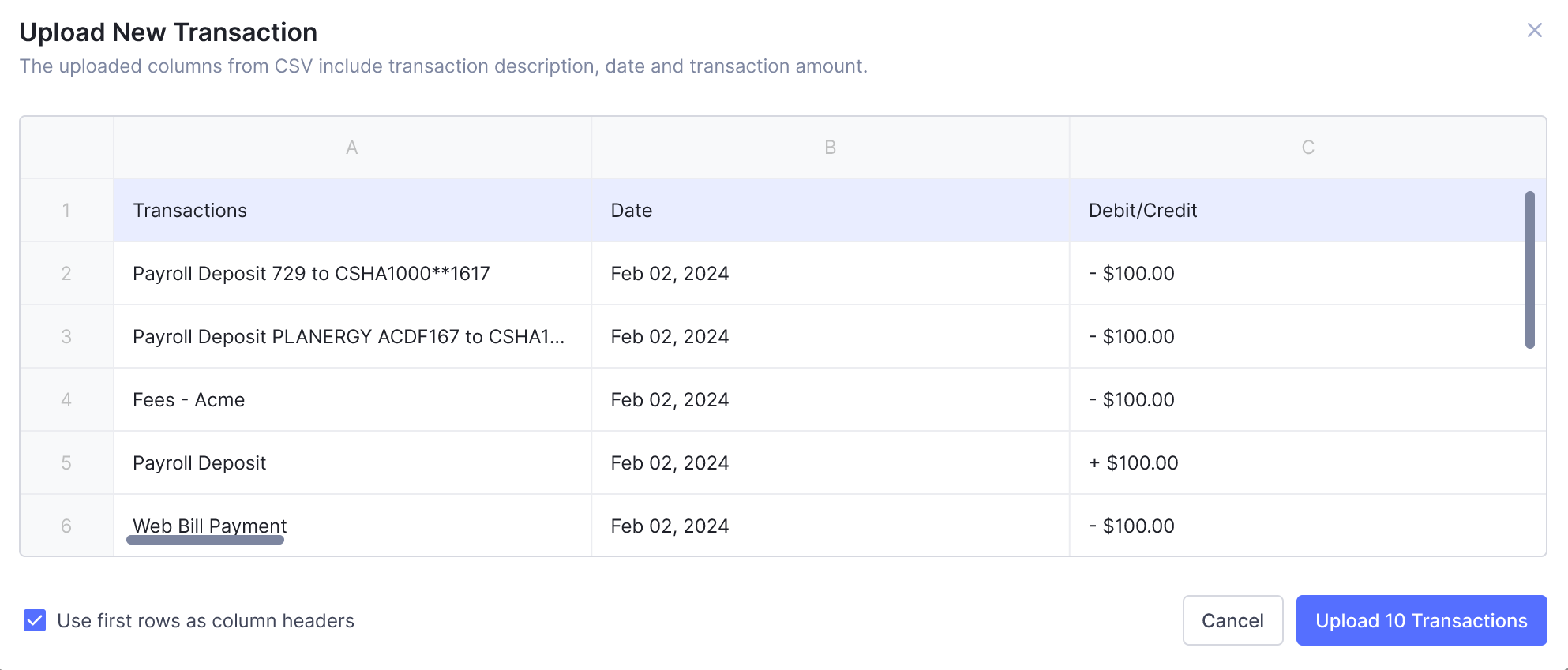

- Prepare Journal Entries: Record the journal entries in the company’s general ledger or accounting software. Include the date of the entry, the accounts debited and credited, and a brief description of the transaction to provide clarity and context. Double-check the accuracy of each entry before proceeding.

- Post Entries: Post the journal entries to the appropriate accounts in the general ledger. Ensure that each entry is posted accurately to reflect the adjustments made in the company’s records. Review the posting to confirm that the balances are updated correctly.

- Reconcile Balances: After completing all journal entries, reconcile the adjusted balances with the bank statement to ensure consistency between the company’s records and the bank’s records. Compare the reconciled balances to identify any remaining discrepancies that may require further investigation or adjustment.

- Review and Confirm: Review the completed bank reconciliation and journal entries to verify accuracy and completeness. Confirm that all discrepancies have been addressed and resolved appropriately. Keep thorough documentation of the reconciliation process for future reference and auditing purposes.

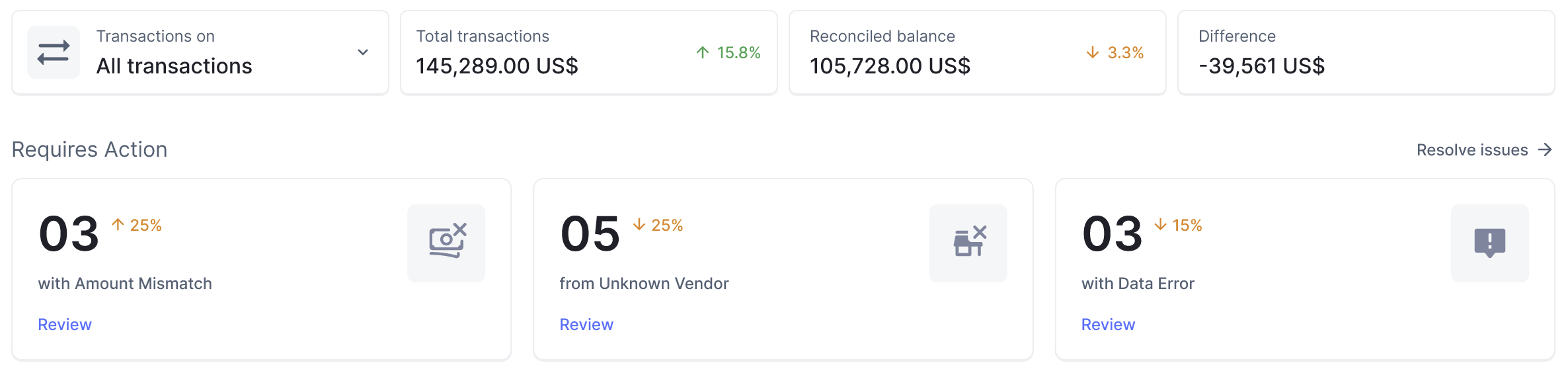

Streamlining Bank Reconciliation with Nanonets Automation

Nanonets can enhance the efficiency and accuracy of the bank reconciliation process by automating the creation of journal entries. Here’s how Nanonets can help.

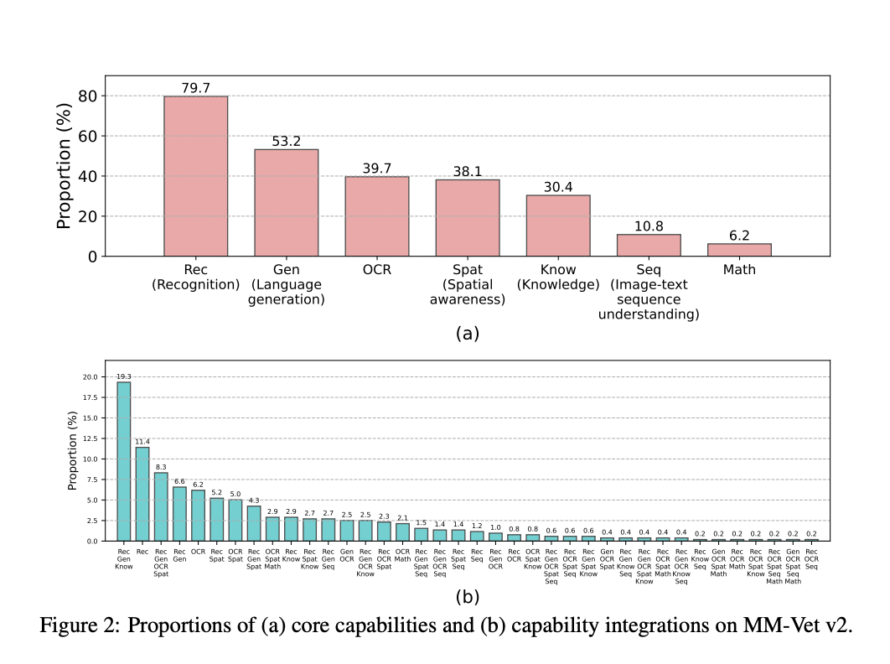

- Data Extraction: Nanonets uses advanced optical character recognition (OCR) technology to extract relevant information from bank statements, including transaction details such as dates, amounts, and transaction types.

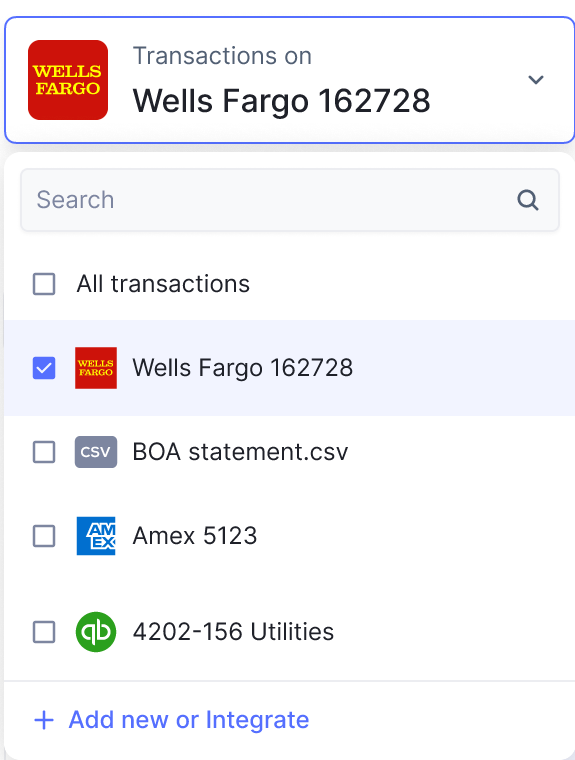

- Integration with Accounting Software: Nanonets seamlessly integrates with popular accounting software systems, such as QuickBooks or Xero. This integration allows extracted data to be automatically transferred into the accounting software, eliminating the need for manual data entry.

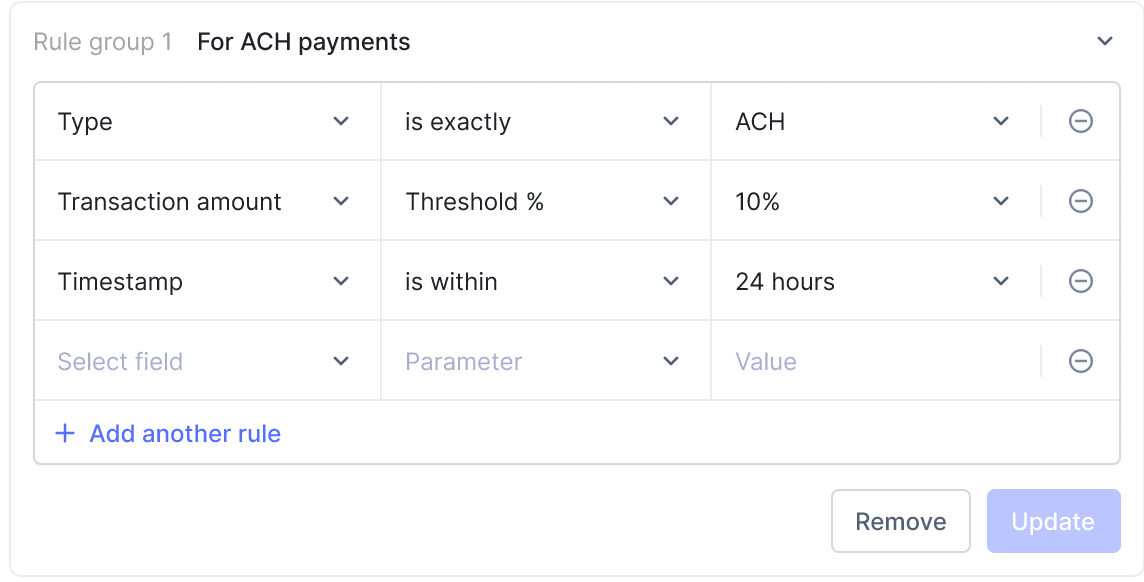

- Rule-based Classification: Nanonets employs machine learning algorithms to classify transactions based on predefined rules. For example, it can distinguish between deposits, withdrawals, bank fees, and interest earned, ensuring accurate categorization of transactions.

- Automated Journal Entry Generation: Once transactions are classified, Nanonets automatically generates journal entries based on predetermined rules and mappings. It debits and credits the appropriate accounts, streamlining the journal entry creation process.

- Customization and Flexibility: Nanonets offers customization options to tailor the automation process to the specific needs of the business. Users can define rules, mappings, and approval workflows according to their accounting practices and preferences.

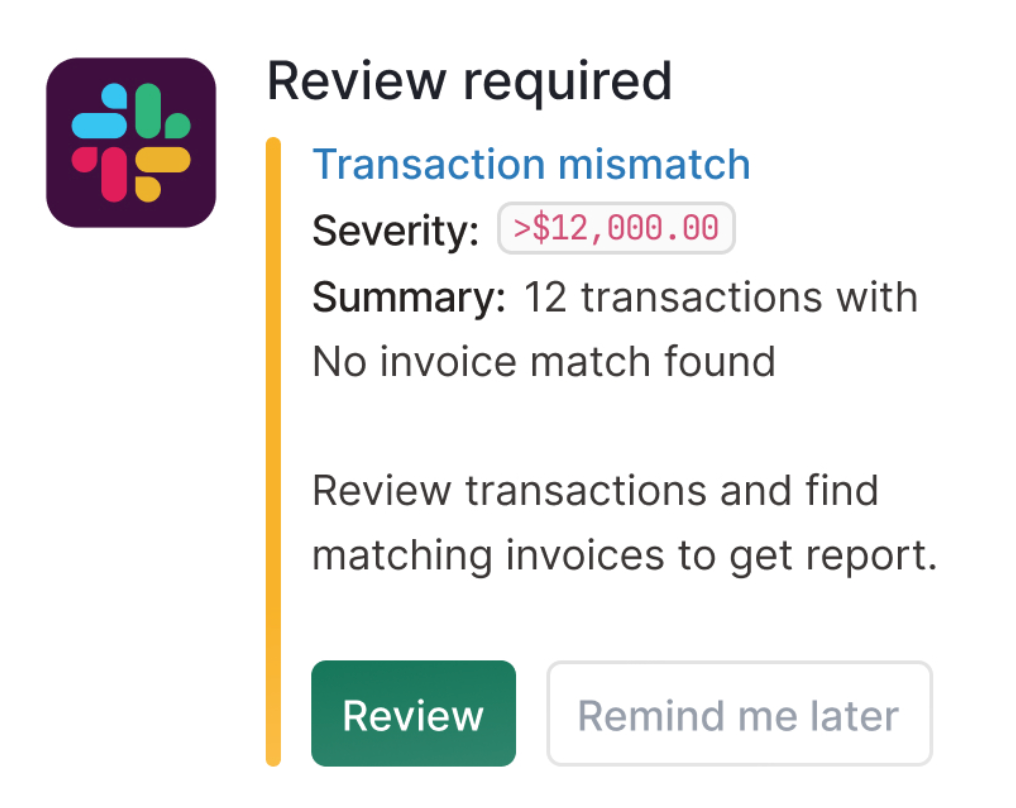

- Real-time Updates and Alerts: Nanonets provides real-time updates and alerts on reconciled transactions, discrepancies, or exceptions. This enables timely resolution of issues and ensures that the reconciliation process remains efficient and up-to-date.

- Audit Trail and Compliance: Nanonets maintains a comprehensive audit trail of all automated journal entries, providing transparency and accountability. This helps businesses comply with regulatory requirements and facilitates audit processes.

- Continuous Improvement: Nanonets leverages machine learning capabilities to continuously learn from user feedback and data patterns, improving accuracy and efficiency over time. This iterative approach ensures that the automation process evolves to meet changing business needs.

Take Away

The bank reconciliation journal helps in maintaining financial integrity. By effectively reconciling company records with bank statements and utilizing tools like Nanonets for automation, businesses can streamline operations, reduce manual effort, and minimize errors. With accurate and up-to-date financial records, companies can make informed decisions, comply with regulatory requirements, and drive sustainable growth.

[ad_2]

Source link